June 07, 2019

In a flurry of activity at the end of its spring session, the Illinois General Assembly passed a $40 billion operating budget, approved significant tax increases and authorized the State’s first major construction program in a decade, financed partly by an expansion of gambling.

With so many issues on the table, the legislative session went on two days longer than its originally scheduled adjournment date of May 31. Governor J.B. Pritzker, who took office in January, promptly signed the principal budget-related bills on June 5.

Passing an annual budget is usually the General Assembly’s main job. However, the financial plan for the fiscal year that starts on July 1, 2019 took a back seat to the new Governor’s longer-range agenda, which includes the capital program, moving the State to a graduated income tax rate structure by 2021 and legalizing and taxing recreational cannabis.

The only major controversy surrounding the FY2020 operating budget was the Governor’s proposal to save money by skimping on State pension contributions, but that plan was canceled after an income tax windfall in April led to higher revenue projections for the upcoming year. To win last-minute votes from Republican legislators, the Democratic Governor agreed to include pro-business measures, including new tax credits and the phase-out of the franchise tax, a capital-based corporate tax, and to drop a proposal to end tax credits for private school scholarships.

Despite bipartisan support for both the operating budget and the capital program, the Civic Federation remains concerned about the State’s severe financial challenges, including overwhelming pension costs and a lingering backlog of unpaid bills. The $45 billion capital program shows no evidence of comprehensive planning to prioritize projects and depends on unreliable and untested revenues to pay for non-transportation construction.

The budget process itself also left much to be desired. The major bills were introduced on the last scheduled day of the session, leaving no time for most legislators—let alone the public—to evaluate more than 4,000 pages of content. As a result, the following analysis should be regarded as preliminary. Numbers are likely to change as more information becomes available.

FY2020 Operating Budget

The operating budget consists of appropriation and revenue legislation, as well as legislation with various provisions required for budget implementation. Another bill, which has not yet been signed by the Governor, authorizes the issuance of bonds for capital and operating purposes.

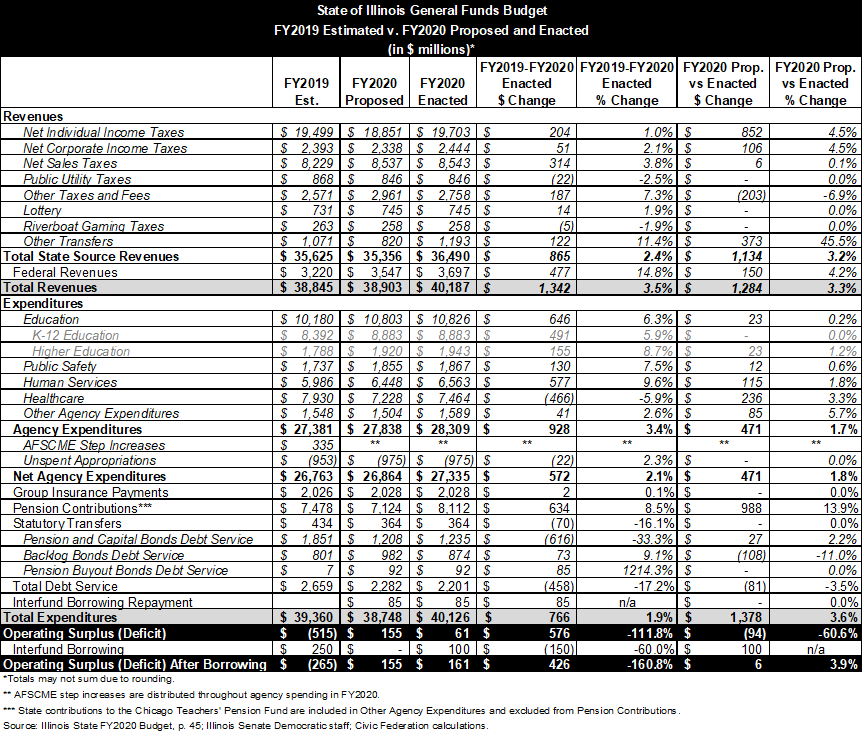

The enacted FY2020 General Funds operating budget has revenues of $40.2 billion and expenditures of $40.1 billion. After interfund borrowing of $100 million, the budget results in an operating surplus of $161 million. Without the $100 million of interfund borrowing, the operating surplus would have been $61 million—below the $155 million surplus in the Governor’s proposed budget.

The surplus will be used to pay down the bill backlog, which currently stands at about $6.6 billion. In addition, the General Assembly approved the sale of $1.2 billion of bonds to further pay down the backlog and reduce the steep interest penalties paid by the State on overdue bills. The Governor’s budget proposed $1.5 billion in backlog borrowing.

The following table, which compares the enacted FY2020 budget with the estimated FY2019 budget and the Governor’s proposed FY2020 budget, is based on information compiled by the Illinois Senate Democratic staff. The Governor’s Office has not yet provided a similar table but issued a fact sheet on budget highlights that accompanied a press release on the June 5 bill-signing ceremony. The numbers in the Governor’s fact sheet differ slightly from those in the Senate Democratic staff analysis; for example, the fact sheet puts the operating surplus at $150 million rather than $161 million.

In the table, the estimated operating deficit of $265 million in FY2019 reflects increased revenues due to the influx of $4.1 billion in income tax receipts in April—$1.5 billion above the forecasted amount. Before revenue estimates were revised in May, the projected FY2019 deficit was $1.6 billion. The estimated FY2019 budget includes about $335 million in supplemental appropriations for labor union step increases that were withheld by the prior administration, resulting in a court battle that was decided in favor of the American Federation of State, County and Municipal Employees (AFSCME).

The dispute arose after then-Governor Bruce Rauner’s administration stopped paying the automatic raises to early-career workers after AFSCME’s contract expired at the end of FY2015. Nearly four years later, the Pritzker administration and the union announced on May 31 that they had reached a tentative agreement on a new contract. The terms will not be released until union members have a chance to vote on the contract. Additional appropriations are not needed to cover the new contract in the FY2020 budget, which already provided for step increases of about $185 million, according to the Governor’s Office of Management and Budget (GOMB). However, the financial impact of the new contract in subsequent years remains unclear.

FY2020 Operating Revenues

Total FY2020 General Funds operating revenues are projected to increase by $1.3 billion, or 3.3%, to $40.2 billion (before interfund borrowing) in the enacted budget from $38.9 billion in the Governor’s proposed budget, which was issued in February 2019. The revised income tax projection due to April collections added about $850 million to the revenue total.

Total FY2020 revenues also reflect two tax changes proposed by the Governor: decoupling from federal tax changes that allow corporations to deduct foreign-derived intangible income, which is expected to increase corporate income tax revenue by $94 million; and a delinquent tax incentive program that is projected to generate $175 million that would have been collected over several years. The incentive is included in Other Taxes and Fees in the table.

New revenue sources, not included in the Governor’s budget proposal, include additional sales taxes of $80 million from requiring so-called marketplace facilitators such as Amazon and Etsy to collect and remit sales taxes from third-party online retailers. Transfers in to General Funds increase from the Governor’s proposed budget due to additional balances in the Income Tax Refund Fund and a sweep of the Tourism Promotion Fund. The table does not reflect additional income taxes due to a new requirement involving enhanced reporting for payment transactions processed by credit card companies.

Other revenues proposed by the Governor are not included in the enacted budget, including $6 million from phasing out the income tax credit for private school scholarships and a new tax on plastic bags that was intended to generate as much as $23 million. Revenues from sports betting are now directed to the capital program. Revenues from legalizing the recreational use of cannabis are not included in the table. Cannabis legislation sponsors have said the program could add $57 million to General Funds revenues in FY2020, but the actual amount will depend on regulatory expenses and other costs. In the Governor’s proposed budget, cannabis revenues of $170 million and most of the sports gambling revenues of $212 million were one-time sources because they came from the upfront sale of licenses, with the license costs deducted from tax bills in future years.

As part of the agreement with Republican leaders, the Governor’s proposal to cap the retailer’s discount—the portion of sales taxes retained by retailers as a processing fee—was not included in the enacted budget. The cap was projected to increase State revenues by $75 million and provide $58 million for local governments. Other components of the agreement, including the restoration of a sales tax exemption known as the manufacturer’s purchase credit exemption, are expected to reduce revenues but are not included in the table because the financial impact is still being calculated.

The share of State income taxes and sales taxes distributed to local governments and transit districts continues to be reduced by 5% from the pre-FY2018 formula, as it was in FY2019. However, local governments are expected to benefit from the budget legislation relating to online sales, which specifically requires that market facilitators and out-of-state retailers collect and remit local sales taxes starting in FY2021.

FY2020 Operating Expenditures

The enacted FY2020 budget has General Funds operating expenditures of $40.1 billion, an increase of $1.4 billion, or 3.6%, from $38.7 billion in the Governor’s proposed budget. The increase stems mainly from Governor Pritzker’s decision to cancel a plan to reduce contributions to the State’s five retirement systems to $7.1 billion from $8.1 billion and instead to make full statutorily required payments.

The Governor’s budget had proposed a General Funds contribution reduction of $878 million based on extending the State’s deadline for reaching its 90% pension funding target for seven years, from 2045 to 2052. The retirement systems had a combined funded ratio of 40.1% at the end of FY2018. Another $125 million contribution reduction in the Governor’s proposed budget was related to making permanent two voluntary pension buyout plans that were set to expire in FY2021.

The enacted budget has two new pension changes. One provision increases State pension costs by repealing a law passed last year that lowered the cap on pensionable salary increases borne by the State. That change meant that additional pension costs due to salary increases above 3%—rather than 6%—would be paid for by local school districts, universities and community colleges and not by the State. The cap was restored to 6% in the newly enacted budget legislation. Another change, which extends the pension buyouts through FY2024, is expected to lower State costs. The table does not reflect the financial impact of these provisions, which are expected to be offsetting, according to Illinois Senate Democratic staff.

General Funds appropriations for Medicaid (shown as Healthcare in the table) decline by $466 million from FY2019 due to a new tax on health insurers that has expanded since it was proposed in the Governor’s budget. The total amount of the tax has not been disclosed, but it will be deposited into a special Medicaid account. In the enacted budget, about $500 million of the total taxes paid by managed care organizations (MCOs) will be used in place of General Funds revenues, compared with $390 million in the Governor’s proposed budget. The remainder of the MCO tax receipts will be used to pull in more federal Medicaid reimbursements at no cost to the State. Due to federal requirements, the tax covers MCOs that participate in the Medicaid program as well as those that do not serve Medicaid beneficiaries. However, the tax rate based on enrollment is much higher for Medicaid MCOs and Medicaid MCOs are fully reimbursed for their tax payments through higher monthly payments from the State for providing Medicaid services.

Human services spending increases by $115 million in the enacted budget compared with the Governor’s proposal, including additional funding for mental health services, private agencies that contract with the Department of Children and Family Services and community caregivers for the elderly and disabled. As in the Governor’s proposed budget, $375 million is appropriated for the evidence-based public school funding formula, an increase of $25 million from the statutory target; public universities and community colleges receive increases of about 5%; and funding for the Monetary Award Program, which provides college tuition grants for low income college students, increases by $50 million. Funding for early childhood education increases by $50 million, which is half of the amount proposed in the Governor’s proposal.

Capital Plan

The sweeping Rebuild Illinois capital program is a massive endeavor encompassing both transportation-related (“horizontal”) projects and other (“vertical”) projects involving State facilities, educational institutions and State conservation areas and parks. Neither the General Assembly nor the Governor’s Office has published a summary table of expected revenues or appropriations, making the following analysis even more tentative than the review of the operating budget.

Lack of Comprehensive Planning

The State’s last major capital program, Illinois Jobs Now!, was passed in 2009 under Governor Quinn with $31 billion in appropriations. The program suffered from two major flaws. The first was that the program consisted of a hastily-put-together list of projects with no strategic planning. The second was that the program relied on a collection of untested revenue sources, such as video gambling, many of which failed to deliver the projected amounts. The result was a decline in the condition of Illinois’ infrastructure over the last decade due to inadequate planning and revenues failing to keep pace with rising costs.

Despite calls by the Civic Federation and others, most of the $45 billion Rebuild Illinois program may be repeating the same mistakes as its predecessor. The final appropriations bill approved by the General Assembly removed language that included in earlier drafts that would have required the Illinois Department of Transportation and the Regional Transportation Authority to adopt asset management plans and use performance-based planning.

Instead, the approved legislation contains a large list of appropriated spending and offers no justification for the allocation. Commentators have pointed to the grab-bag style of the bill, including $2.5 to $6 billion in projects for each member of the General Assembly, many of which are unspecified in the bill text.

Also tucked into the 1,091 page Budget Implementation bill is authorization for the Governor’s Office to negotiate a $3.8 billion public-private partnership to redevelop an area next to Solider Field in Chicago. The private developer of this project, known as One Central, would pay the upfront cost for a mass transit hub and be reimbursed by the State no sooner than FY2024.

Nearly half ($20.6 billion) of the Rebuild Illinois program will be bond-financed, with approximately $18 billion in General Obligation bonds and $2 billion in Build Illinois bonds. Of the remainder, $10.7 billion will be pay-as-you-go and approximately $10 billion is expected to come from federal revenues. While the General Assembly has not published a grid of appropriations, testimony during hearings indicates that transportation projects will receive $33.2 billion in funding, nearly three-quarters of the total. Of the remaining appropriations, $4.5 billion is for State facilities, $3.5 billion is for education facilities, $1.9 billion is for economic and community development and $1.2 billion is for environmental and conservation projects.

Non-Transportation Funding

The General Assembly passed two bills to fund Rebuild Illinois. One consists of revenues derived from transportation-related sources that are constitutionally restricted to fund transportation projects. The other bill raises revenue for the “vertical” projects. Unfortunately, the latter bill is largely dependent on sources that historically have been unreliable.

The largest component of the vertical revenue bill is a massive expansion of gambling. The total number of gambling positions in the State will nearly double. Six new casinos, including one in Chicago, are authorized. Capacity at existing casinos will be expanded. Horse racetracks will be authorized to host casino operations, and one new horse track will be created in Cook County. Video gambling facilities can expand (including to O’Hare and Midway Airports) and allow customers to place higher bets. Finally, sports wagering will be authorized at gambling facilities and stadiums. After 18 months, online-only providers will be allowed to offer sports wagering on mobile phones anywhere in the State.

According to a handout in a General Assembly hearing, full implementation of gambling expansion could raise up to $2.7 billion in one-time revenues and $470 million in recurring annual revenues. However, there is some concern that the planned revenues may not materialize as expected. The magnitude of the gambling expansion may saturate the market and compete with itself for customers. When the Illinois Jobs Now! plan authorized video gambling, it took seven years for annual revenues to meet the initial projections.

In addition to gambling, the vertical revenues bill contains a handful of other tax measures. Cigarette taxes will be raised by $1.00 per pack from the current $1.98. Electcronic cigarettes will be taxed 15%. These hikes are estimated to bring in $156 million annually. A statewide parking tax of 6% of an hourly or daily pass and 9% of a monthly pass are projected to produce $30 million in FY2020 and $60 million thereafter. The bill will also cap an existing sales tax exemption on vehicle purchases to the first $10,000 of an automobile’s trade-in value, which could produce $90 million annually.

Transportation Funding

In contrast to the uncertainty of the revenues for vertical projects, the transportation component of Rebuild Illinois relies on more traditional sources. The State broke its 29.5-year streak in maintaining its per-gallon motor fuel tax, doubling the rate from $0.19 per gallon to $0.38 beginning July 1, 2019. Diesel fuel will be assessed an additional $0.05 per gallon. Moreover, both of these taxes will be indexed to inflation beginning in FY2021. Finally, in FY2022 the State will begin shifting the sales tax collected on gasoline from General Funds to the Road Fund. All of these measures should help prevent the erosion of transportation funding that Illinois has experienced in the last three decades.

In addition to the motor fuel tax, the bill raises vehicle registration and certificate of title fees. All of these revenues will be restricted to transportation projects by the constitutional lockbox amendment approved by voters in 2016.

An important step forward in transportation funding is the creation of a fund to provide mass transit with annual pay-as-you-go funding for the first time. Of the $33.2 billion in total transportation funding, approximately 80% is allocated to roads, highways, bridges and aviation and about 20% is allocated to transit and rail. Pedestrian and bike initiatives will receive $50 million.

Graduated Income Tax

The centerpiece of Governor Pritzker’s plan to stabilize the State’s finances is a shift from the current flat individual income tax rate of 4.95% to a graduated income tax structure. On March 7, the Governor unveiled his proposed graduated rate structure, which was designed to generate $3.4 billion while increasing effective tax rates on fewer than 3% of tax filers. A modified version of the Governor’s proposal was passed by the Senate on May 1 and by the House on May 30 and signed by the Governor on June 5, along with the budget legislation.

The approved rates start at 4.75% and increase to a maximum of 7.99% for single filers with taxable incomes over $750,000 and joint filers with taxable incomes over $1 million. Above those income levels the graduated tax structure is no longer applied—all taxable income is assessed at the highest rate. The legislation would also increase the corporate income tax rate form 7.0% to 7.99%.

Instituting a graduated tax also requires an amendment to the Illinois Constitution, which currently mandates that all income be taxed at a single rate. In May each chamber of the General Assembly adopted a resolution to put the amendment on the ballot by more than the required three-fifths margin. The measure cannot be presented to voters until the next general election in November 2020.

However, the bipartisan support for the FY2020 budget and capital program does not extend to the graduated tax plan. Neither the proposed constitutional amendment nor the graduated rate structure legislation received any Republican votes, and no Republican legislators attended the June 5 bill-signing event. That day House Minority Leader Jim Durkin issued a statement reiterating his caucus’ opposition to the graduated tax plan.

Major Budget, Tax and Capital Legislation:

- SB262 (Public Act 101-0007): FY2020 appropriations and FY2019 supplemental appropriations

- SB687 (Public Act 101-0008): Graduated income tax rate structure

- SB689 (Public Act 101-0009): FY2020 revenue changes

- SB1814 (Public Act 101-0010): Budget implementation bill

- HB62 (Public Act 101-0029): Capital appropriations

- HB142 (Public Act 101-0030): Bond authorization

- SB690 (Public Act 101-0031): Capital revenues for non-transportation projects

- SB1939 (Public Act 101-0032): Capital revenues for transportation projects