December 08, 2017

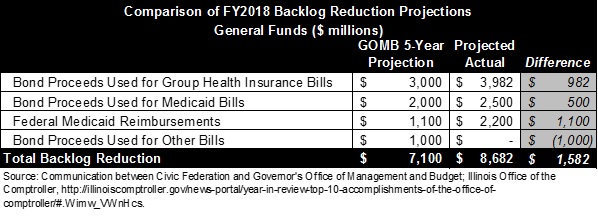

The State of Illinois’ sale of $6 billion of bonds in October was expected to help reduce its massive backlog of bills by about $7.1 billion. Instead, officials are now claiming a reduction of nearly $8.7 billion. What accounts for the difference?

The State has thus far outperformed expectations in two ways. First, the renewed appetite for Illinois bonds allowed Illinois to price its borrowing to repay backlog bills at a premium, netting the state $482 million in addition to the planned $6 billion of proceeds.

Second, while the $7.1 billion estimate in the Governor’s Economic and Fiscal Policy Report released in October included only $1.1 billion of federal Medicaid reimbursements to the State as a result of paid Medicaid bills, the Comptroller’s Office has reported receiving $2.2 billion in Medicaid reimbursements. In total, the $482 million premium combined with the additional $1.1 billion of Medicaid funds increased the bond-related proceeds by almost $1.6 billion.

With projected bond proceeds of $6 billion, the Governor’s Office had assumed that $3 billion would be used to pay down employee group health insurance bills, $2 billion would be spent on Medicaid bills and the remainder would go for other bills. As noted above, federal reimbursements for the Medicaid spending were estimated at $1.1 billion.

The Comptroller’s Office received $6.48 billion, of which $3.9 billion was used to pay for group health bills. The remaining $2.58 billion was spent on Medicaid bills, generating federal matching funds of $2.2 billion.

As discussed here, Illinois completed the sale of $6 billion in General Obligation bonds on October 25 with a negotiated sale of $4.5 billion following the competitive sale of $1.5 billion on October 17. The spreads between the bond yields and market benchmark rates were significantly lower for the new issuances than they were a year ago, due in part to renewed investor confidence in Illinois after the end of the two-year budget impasse.

Credit rating companies saw the issuance as a credit positive because the proceeds would be used to repay backlogged bills bearing interest rates between 9% and 12%. Because the majority of the bonds sold at a premium, the Comptroller was able to apply an additional $482 million in proceeds toward the repayment of outstanding vouchers.

In addition, the Comptroller’s Office used more of the bond proceeds than expected to pay down Medicaid bills, resulting in additional federal reimbursements. State spending on Medicaid is generally matched by the federal government at a rate that varies by state from 50.0% to 75.65%. Illinois’ current federal reimbursement rate is 50.74%, which means that every $1 of Medicaid spending by the State is matched by $1.03 of federal reimbursements.

Federal dollars spent on Medicaid generate more federal reimbursements, in a cycle of State spending and federal matching payments known as churning. The more rounds of State Medicaid spending and federal reimbursements, the greater the amount of federal dollars. After initial reimbursements from the bond proceeds, the Comptroller continued to use additional federal matching funds to pay more Medicaid bills. The Medicaid bill backlog at the Comptroller’s Office was about $5 billion before the bond proceeds were received on November 8. It now stands at about $1 billion.

Officials at the Governor’s Office of Management and Budget (GOMB) said the administration planned to use more of the bond proceeds to pay off bills for agencies’ day-to-day expenses, instead of on Medicaid bills, because the General Assembly did not budget enough to cover agency costs in FY2017. The Comptroller’s decision to allocate additional bond-related funds to Medicaid bills may not affect the backlog in the long run, they said.

The following table compares the Governor’s Office forecast and the actual results of the bond sales and Medicaid reimbursements.

In addition to bond-related funds, the GOMB plan includes about $1.8 billion in other resources to reduce the backlog of bills. Those consist of $850 million in borrowing and transfers from accounts outside the General Funds and $990 million in other fund balances. In all, the Governor’s plan would have reduced the backlog from $14.7 billion at the end of FY2017 to roughly $7.5 billion at the end of FY2018, after accounting for an expected operating deficit of $1.5 billion.

Despite the $8.7 billion backlog reduction due to borrowing, the total reduction by the end of FY2018 is still unclear. There remains the risk that the operating deficit could be higher than $1.5 billion. The Economic and Fiscal Policy Report notes that the General Assembly has yet to appropriate for $445 million in FY2017 Medicaid liabilities to be deposited into the Healthcare Provider Relief Fund.

Additionally the Governor’s projections assume $300 million in revenues from the planned sale of the James R. Thompson Center. While the General Assembly approved legislation authorizing the sale in May, the bill still has not been transmitted to the Governor for signature.