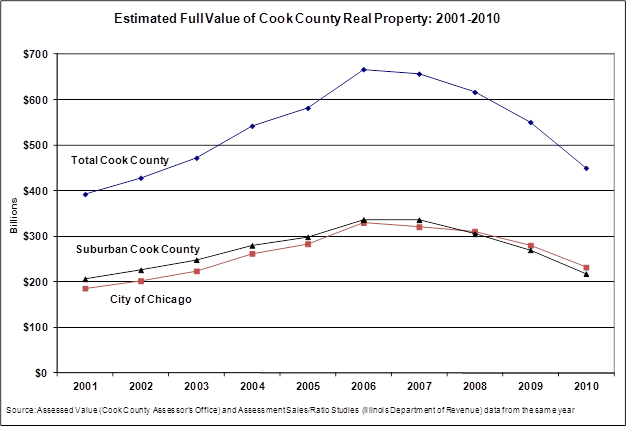

CHICAGO – The full market value of real estate in Cook County was approximately $449.8 billion in tax assessment year 2010 according to an annual estimate released today by the Civic Federation. The 2010 total value estimate represents a decline of $100.3 billion, or 18.2%, from the 2009 estimated full value. Tax year 2010 is the most recent year for which data are available. The 2010 estimated decline is the fourth in a row for the whole County, with full value declining by 32.5% since the 2006 peak.

“The estimated full value of real estate in Cook County peaked at $666.2 billion in 2006 and by 2010 had fallen to below 2003 values,” said Civic Federation President Laurence Msall. Prior to 2007, the estimated full value of real estate in the City of Chicago and suburbs grew every year going back to 1995.

In the City of Chicago the estimated full market value of real estate fell by 17.2% in 2010 from 2009 levels. It fell by 18.5% in the southwest Cook County suburbs and by 19.8% in the northwest suburbs. Between 2001 and 2006 the estimated full value in Chicago had increased by 77.4% from $185.9 billion to $329.8 billion. Between 2006 and 2010 it declined by 29.7% to $232.0 billion.

The Civic Federation estimates the full market value of taxable Cook County real estate using two data sources: the total assessed value of property as reported by the Cook County Assessor’s Office and the median level of assessment reported by the Illinois Department of Revenue. The Illinois Department of Revenue collects data on property sales and calculates the ratio of assessed values to sales values. That data is used to compute the mean assessment-to-sales ratio, or the median level of assessment.

The Civic Federation estimates the full value of property by dividing the median level of assessment into the total assessed value of each class of property in Cook County. For those classes for which the Department of Revenue does not calculate a median level of assessment, the level set by County ordinance is used. The estimate does not include railroad properties or properties that are exempt from real estate taxes.

Trends between tax years 2009 and 2010 for the residential, commercial and industrial classifications of Cook County property vary from the overall fall in estimated full value of 18.2% identified for the County as a whole. The estimated full value of residential property in Cook County fell by 14.4% in 2010 below 2009 levels while commercial property fell by 41.5% and industrial property fell by 11.9%. The sharp fall in the estimate of commercial property value is attributed to a significant rise in the median level of assessment calculated for tax year 2010 above 2009 values. The rise in the median level of assessment for commercial properties in Cook County is likely due to decreases in the selling price of the 169 commercial properties included in the 2010 Assessment/Sales Ratio Study that were larger than the decrease in their assessed values.

The full value estimate including ten-year trend data, charts and a discussion of the 2010 Assessment/Sales Ratio Study is available at civicfed.org.