October 28, 2025

By Lily Padula

Each fall, the Governor’s Office of Management and Budget (GOMB) issues its Illinois Economic and Fiscal Policy report, which serves as the State of Illinois’ (Illinois or the ‘State’) primary long-term fiscal planning document and an early indicator of whether Illinois is structurally balanced heading into the next budget year. The 2025 edition of the report, released on October 9, 2025, about a month earlier than required by statute, signals an increasingly strained fiscal environment due to new federal policy changes, slowing economic conditions, and rising cost pressures from statutorily mandated spending.

After several years of relative fiscal stability, GOMB’s new projections show emerging fiscal gaps beginning in FY2026 and widening through FY2031, driven by federal tax code changes and restrictions/cuts to federal programs like Medicaid and food assistance. The report provides updated revenue and expenditure estimates for the current 2026 fiscal year, which began on July 1, 2025, and a five-year projection through FY2031. The projections are based on current assumptions, demonstrating what would happen if no policy actions were taken to adjust for revenue declines.

Three key federal impacts from H.R. 1, passed by Congress in July 2025 as the Budget Reconciliation Bill, will create an increasingly worse fiscal situation for the State of Illinois:

1. Changes to the federal tax code will expand business expensing provisions and modify several corporate and individual deductions, reducing Illinois’ taxable base and lowering State revenues beginning in FY2026.

2. Beginning October 1, 2026, Illinois’ share of SNAP administrative costs will increase to 75%, and cost-sharing provisions tied to SNAP payment error rates will also go into effect on October 1, 2027. Absent material improvement in Illinois’s payment error rates, GOMB estimates the State will face an additional $705 million annually.

3. On the Medicaid front, new federal limits on provider taxes will begin phasing in during FY2028, reducing State revenues by an estimated $304 million in the first year and leading to total combined losses (state and federal revenues) of approximately $4.5 billion by FY2031.

The following summarizes GOMB’s key projections and analysis from its 2025 report.

Fiscal Outlook: Key Findings from GOMB’s Report

GOMB’s analysis shows that budget gaps in the current FY2026 year and over the course of the next five years are largely, though not solely, driven by federal tax code changes and cuts to programs.

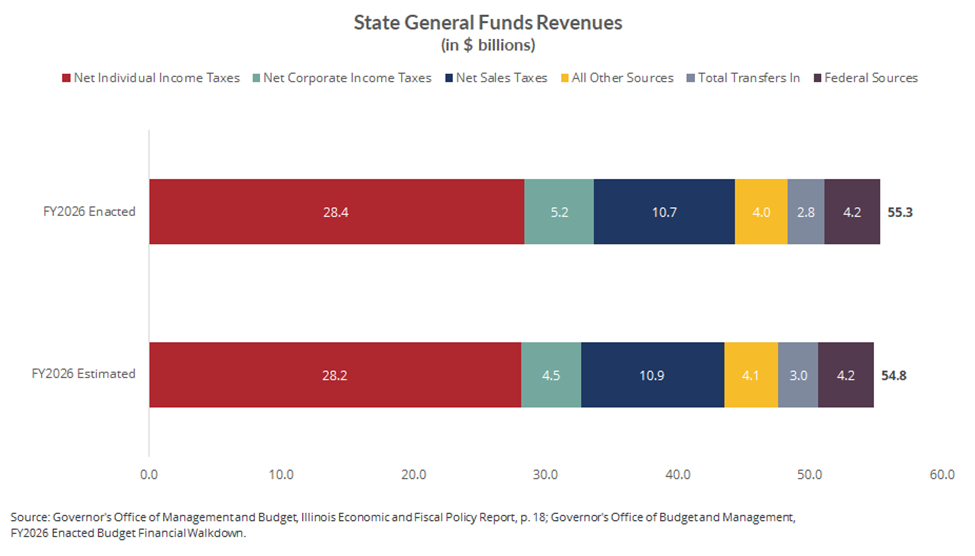

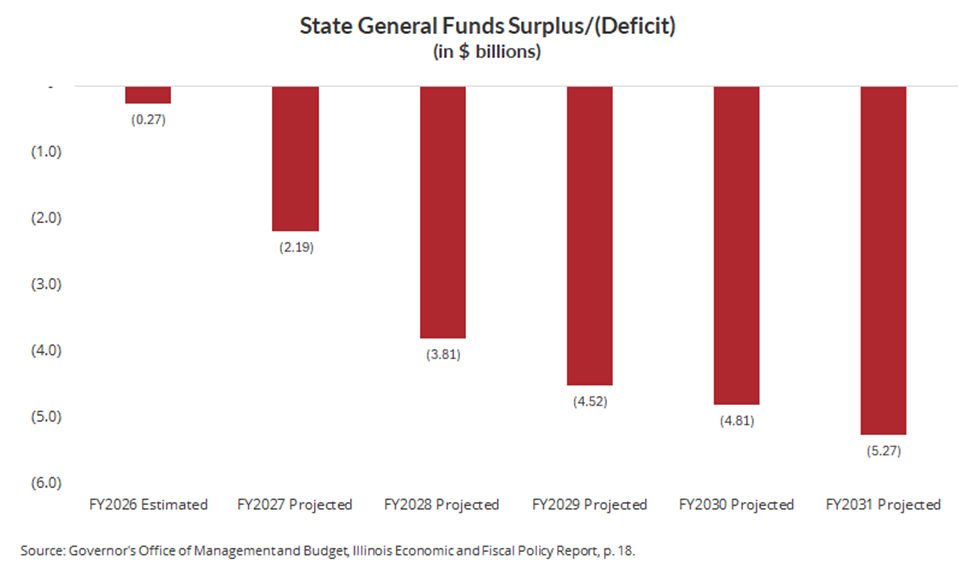

Emerging Deficit in FY2026: After enacting an FY2026 budget this spring reflecting an estimated $221 million surplus, Illinois now faces a modest but material general funds deficit of $267 million in the current fiscal year. Higher-than-expected expenditures on pensions and debt service contribute slightly to the gap, but revised revenue projections are the principal contributing factor, with better-than-expected sales tax revenues outweighed by weaker individual and corporate income taxes. The income tax shortfall is due in part to a slowing economy but primarily to a reduction in corporate income tax receipts resulting from federal tax code changes under H.R. 1, which broaden expensing provisions and lower taxable business income.

Widening Structural Gap: In FY2027, the projected gap expands significantly to $2.2 billion and continues to grow to $5.3 billion in FY2031. Federal tax changes will reduce Illinois’ income tax collections by more than $830 million in FY2026, along with significant future cost shifts in major programs such as the Supplemental Nutrition Assistance Program (SNAP) and Medicaid.

Federal Cost Shifts to States: Beginning in FY2027, Illinois will face higher SNAP administrative cost-sharing and potential financial penalties tied to payment error rates. In addition, federal limitations on healthcare provider taxes used to fund Medicaid will begin phasing in during FY2028 and are projected to reduce Medicaid revenues to Illinois by $4.5 billion by FY2031.

Reserves and Recommended Actions: Despite these pressures, GOMB notes that the State’s Budget Stabilization Fund (i.e., rainy day reserve fund) remains at historically high levels, totaling approximately $2.4 billion, with an additional deposit of $161 million planned for FY2026. However, this fund balance still represents fewer than 15 days of operating expenditures. To mitigate the emerging imbalance between recurring revenues and expenditures over the forecast horizon, GOMB recommends selective decoupling from certain federal tax provisions, continued restraint in agency spending, and preservation of reserves.

FY2026: Feeling the Heat from H.R. 1

GOMB reports that Illinois ended FY2025 in a strong position, supported by healthy year-end revenue performance and moderate spending growth. GOMB’s FY2026 and future forecasts are based on assumptions of slowing real GDP growth, moderating inflation, and a stable if softening labor market. In other words, the start of FY2026 was promising.

However, early FY2026 general funds revenues show signs of weakness, particularly among corporate and pass-through income-tax sources affected by H.R. 1’s tax changes, especially those related to “expensing” of certain business investments, meaning businesses can deduct up to 100% of investment costs upfront, temporarily reducing Illinois’ taxable income base. The decline in business-tax receipts, combined with slower overall economic expansion, has reduced expected general funds resources to $54.8 billion, down nearly $450 million, or 0.8%, from levels expected and reflected in the balanced budget passed earlier this year.

On the spending side, current estimates for general funds expenditures of $55.1 billion are little changed from those in the enacted budget, with spending expected to increase modestly over FY2025 levels due to high pension contributions, K-12 education funding, and debt service obligations.

Together, these factors produce a projected gap of $267 million for FY2026—only a few months after the enactment of a balanced general funds budget.

A significant portion of the State’s fiscal challenges stems from H.R. 1: tax-related provisions, including those related to expensing and the treatment of multinational corporations, have reduced Illinois’ expected income tax revenues by more than $830 million in FY2026 alone. This immediate and sizeable impact is driven by a “double whammy” effect:

- Corporations may reduce their September 2025 estimated payments or April 2026 final payments in anticipation of decreased tax year (calendar year) 2025 obligations; and

- Those same corporations may decrease their estimated payments through the spring of 2026 to reflect their expected lower tax liabilities for tax year (calendar year) 2026.

In other words, the State’s current fiscal year (FY2026) may absorb impacts from both tax years (calendar years) 2025 and 2026, and as taxpayers adjust estimated and ultimately final payments to reflect H.R. 1-driven changes in their tax liabilities, the state’s FY2026 will be “doubly” affected.

Given the $267 million deficit now estimated for FY2026, GOMB has directed agencies to maintain four percent spending reserves and proceed cautiously with hiring and contracting. Furthermore, GOMB recommends immediate and targeted “decoupling” of the state’s tax code from the most impactful aspects of the federal tax code, such as bonus depreciation, along with updating the state’s income tax code to reflect the transition from Global Intangible Low-Taxed Income (GILTI) to Net Controlled Tested Income (NCTI) for multinational corporations. Taking these steps alone would prevent estimated revenue losses of $234 million—nearly enough to close the $267 million deficit this year.

FY2027 Forecast: Widening Structural Deficit

Looking ahead to FY2027, the report forecasts general funds revenues of $54.8 billion and expenditures of $57.0 billion, resulting in a deficit of $2.2 billion. Persistent growth in education, Medicaid, and pension obligations continues to outpace baseline revenue growth, creating an expanding structural gap.

Fixed costs—primarily pensions, Medicaid, and debt service—now consume approximately 40% of General Funds expenditures, leaving limited flexibility to adjust without affecting core services. Even under baseline economic assumptions, the structural imbalance reemerges, reflecting the long-term gap between the State’s recurring revenues and its mandated expenditures.

Absent policy adjustments, the imbalance is expected to deepen over the next several years as revenue growth remains constrained while fixed and mandated costs continue to rise.

Five-Year Fiscal Projections: FY2026-FY2031

GOMB’s five-year outlook projects that—again, absent policy adjustments—Illinois’ fiscal position will weaken gradually over time as revenue growth fails to keep pace with expenditure demands. The projected imbalance of revenues and expenditures will continue to expand in subsequent years, reaching $3.8 billion in FY2028, $4.5 billion in FY2029, $4.8 billion in FY2030, and $5.3 billion by FY2031.

Over the five-year period, revenues are expected to grow at an annualized growth rate of 2.1%. In contrast, expenditures are projected to increase at an annualized growth rate of 3.7% per year, driven by ongoing growth in pension contributions, healthcare spending, and education funding, as well as the federal pressures described above.

Looking Ahead

Finally, the report notes that despite the State’s progress in building reserves, Illinois’ long-term fiscal position remains constrained by structural factors.

- The Budget Stabilization Fund’s $2.4 billion balance provides a valuable cushion for short-term volatility but is insufficient to address multi-year imbalances—and GOMB advises that the fund should be preserved and strengthened as a contingency measure rather than used to fund ongoing operations.

- Fixed obligations—including pensions, debt service, Medicaid, consent-decree programs, and education—account for approximately 64% of projected General Funds Expenditures in FY2027, leaving little room for discretionary adjustments. Given these constraints, broad, across-the-board spending cuts would be difficult.

With federal income tax changes and programmatic changes in SNAP and Medicaid certain to affect the state’s fiscal condition going forward, the state must pursue strategies that balance near-term stability with long-term structural correction.

Illinois’ fiscal outlook is shifting from a period of recovery and relative stability to one of significant fiscal uncertainty. After several consecutive years of balanced budgets and growing reserves, the State now faces renewed pressures from federal tax changes, slowing revenue growth, and escalating fixed costs. At the same time, Illinois remains only modestly prepared for a potential economic downturn, with reserves and structural flexibility insufficient to absorb a major shock. As national economic conditions soften and federal policy changes further constrain revenues, the State’s long-term fiscal position is becoming more vulnerable, and without timely policy action, the State’s structural deficit is projected to widen significantly through FY2031.

While Illinois’ reserves provide minimal short-term protection, they cannot substitute for sustainable balance between revenues and expenditures. Maintaining fiscal discipline, modernizing the tax base, and managing cost growth proactively will be essential to preventing a return to chronic deficits and ensuring long-term fiscal stability in the State.

In the weeks ahead, the Civic Federation will share several targeted reports on specific elements of the state’s budget and challenges—including changes to the tax code, SNAP, and Medicaid—aiming to educate and prepare policymakers and all stakeholders for the difficult budget decisions that lie ahead.