July 13, 2018

Cook County Clerk David Orr’s office released the 2017 Cook County Tax Rates report on June 20, 2018 and shortly after, Cook County Treasurer Maria Pappas mailed the second installment of the 2017 tax bills.

The calculation of the tax rates for the 1,400 taxing agencies in Cook County is the final step before property tax bills can be issued. The second installment of the 2017 property tax bills are due August 1, 2018.

How are tax rates calculated?

According to the Cook County Clerk’s website:[1]

- The Cook County Asssessor establishes property valuations;[2]

- Taxing districts file their levy requests with the Cook County Clerk;

- The Cook County Clerk uses the taxing districts’ levy requests to determine the amount to be extended against all properties within the boundaries of the taxing district; and

- The Cook County Clerk then determines the rate needed per $100 of taxable value to generate the requested revenue, based on the value of all taxable property within the taxing district’s boundaries.

Will my property taxes go up or down?

It is impossible to predict with precision what will happen to individual tax bills because of the complexity of the tax system. However, there are two major factors that affect year-to-year changes in a property owner’s tax bill:

- change in the property’s equalized assessed value (EAV) as a percentage of the total EAV of each taxing district with jurisdiction over it; and

- change in the taxing districts’ tax extensions as a percentage of the EAV under their jurisdiction.

Changes in EAV are a product of changes in assessed value (AV), the multiplier and homeowner exemptions. The Civic Federation’s primer on the assessment process describes these three elements and their interaction. Change in an individual parcel’s EAV in relationship to the total EAV of a tax code is driven primarily by changes to AV and to changes to homeowner exemptions, which reduce EAV.

Countywide, the total tax extensions (levies), or the amount requested by all of the taxing agencies combined, increased by 5.0%, from $13.7 billion in tax year 2016 to $14.4 billion in tax year 2017. According to the Clerk’s Tax Rates report, the average residential taxpayer in the City of Chicago and the North Suburbs will see approximately a 3.0% increase in their tax bills while the average residential taxpayer in the South Suburbs will see a 5.0% increase in their tax bill. The change in governments’ tax extensions means that increases or decreases in individual taxpayers’ bills will generally reflect both tax burden shifts among taxpayers as well as changes in tax revenue for governments.

Part of the complexity of the property tax system in Cook County is that properties are reassessed on a triannual basis rather than annually. The County is divided into three triads for reassessment purposes. The South Suburbs were reassessed in 2017 and are seeing the impact of the reassessment on their second installment 2017 tax year bills that were recently issued. The City of Chicago is currently being reassessed and will see the reassessed value incorporated into their second installment 2018 tax year bills in 2019. The North Suburbs will be reassessed in 2019.

Which Municipality Has the Highest Composite Tax Rate in Cook County?

Taxpayers in Ford Heights have the highest composite tax rate at 33.996%. The second highest rate is in Park Forest at 33.619%, and third highest is in Riverdale at 23.760%.

Which Municipality Has the Lowest Composite Tax Rate in Cook County?

The Village of Hinsdale has the lowest tax rate at 6.583%. The second lowest is 6.807% in the Village of Burr Ridge, and third lowest is 7.260% in the Village of Barrington. The City of Chicago’s tax rate is 7.266%.

Does a high tax rate cause a high tax bill?

While the tax rate matters in calculating a tax bill, the overall assessed value in a taxing district, the state equalization factor and the tax district’s extension all have an impact on the total property taxes paid. For example, a residential property with a high tax rate but a low taxable value may result in a lower bill than a property with a high taxable value and a low tax rate.

What effect do exemptions have on my property tax bill?

Homeowners in Cook County who live in their primary residence may qualify for a number of exemptions that reduce their home’s equalized assessed value (EAV). Homeowner and Senior Exemptions both recently increased by $3,000 and the Senior Freeze Exemption expanded the eligibility criteria by increasing the limit on household income by $10,000 from $55,000 to $65,000 per year following the passage of Public Act 100-401.

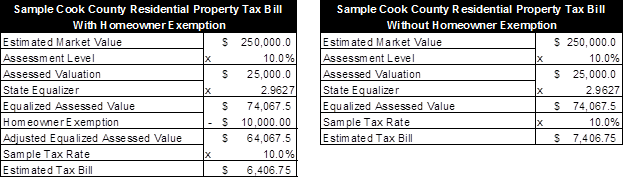

The two exhibits below display how a property tax bill is calculated and the impact a homeowner exemption has on a taxpayer’s total property tax liability.

However, property taxes in Cook County are a zero-sum game, meaning that tax relief provided to one property owner must be paid for by all other owners because it affects both the total EAV upon which the rate is based and the proportion of total EAV for each property.[3] This zero-sum effect arises because the vast majority of non-home rule districts in Cook County are effectively limited by tax caps, not by fund rate limits, so changes in EAV affect the tax rate and not the local government’s property tax extension (levy).

Helpful Links

Civic Federation Property Tax Primers

The Final 2017 Cook County Equalization Factor is 2.9627

Estimated Full Value of Real Property in Cook County: 2007-2016

Estimated Effective Property Tax Rates 2006-2005: Selected Municipalities in Northeastern Illinois

[1] Cook County Clerk’s Office website, Tax Extension and Rates, https://www.cookcountyclerk.com/service/tax-extension-and-rates (last visited July 13, 2018).

[2] The valuations are then subject to appeal at the Cook County Assessor’s Office and the Cook County Board of Review.

[3] The exception to this rule is property tax refunds that are granted after taxes have already been extended. These appeals are described in the Civic Federation’s Cook County Property Tax Appeals: A Primer on the Appeals Process with Comparative Data from 2000-2008 at http://www.civicfed.org/civic-federation/publications/cook-county-property-tax-appeals-primer-appeals-process-comparative-da.