October 25, 2012

Last week, the Civic Federation’s Institute for Illinois’ Fiscal Sustainability published a blog on the State of Illinois’ Personal Property Replacement Tax (PPRT) and why the State will be distributing $182 million less to local governments in FY2013. This blog builds on that one to show the impact of the drop in PPRT revenues on the City of Chicago’s FY2013 budget.

The PPRT is a revenue source for local governments that was created by the General Assembly in 1979 to replace a tax on the personal property of businesses that was abolished pursuant to the 1970 Illinois Constitution Article IX Section 5. A portion of PPRT revenues are deposited into the State’s Tax Refund Fund to pay income tax refunds and the rest are deposited into a special fund, the PPRT Fund, and distributed to local governments. Because the State paid all required PPRT refunds to business taxpayers in FY2012 which led to an excess of payments over replacement tax receipts, money must then be transferred from the PPRT Fund to the Refund Fund, resulting in a smaller pool of money to be distributed to local governments in FY2013. The State’s allocation of PPRT to the City of Chicago is received in the City’s Corporate Fund to be appropriated for operating expenses and in the City’s four pension funds to pay for pension obligations.

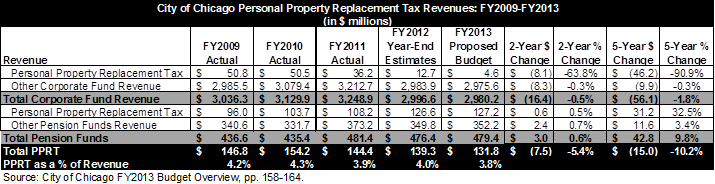

The City of Chicago released its FY2013 Proposed Budget on October 10, 2012 and the City Council will be voting on it on October 31, 2012. The City estimates its FY2013 Corporate Fund revenues to be $2.98 billion, a decrease of $16.4 million, or 0.5%, from FY2012 year-end estimates. The FY2013 revenue estimate is a decrease of $56.1 million, or 1.8%, from FY2009. Included in the City’s Corporate Fund revenues are various taxes and fees, proceeds and transfers in such as interest generated on long-term asset lease reserves, licenses, permits, fines and intergovernmental revenue such as State income tax and PPRT.

The decline in overall revenue in part reflects the decrease in PPRT revenues received from the State of Illinois: the FY2013 estimate of $131.8 million in total PPRT revenue, including PPRT for the pension funds, is a $7.5 million, or 5.4%, drop from FY2012 year-end estimates. Since FY2009, PPRT revenues have declined by $15.0 million, or 10.2%. What the City uses PPRT revenue for has also changed over the five-year period ending in FY2013. As pension expenses have grown, the City has had to use more PPRT revenues for the City’s pension funds, an increase of $31.2 million, or 32.5%. PPRT revenue for the Corporate Fund has declined accordingly by $46.2 million, or 90.9%. In its Budget Overview, the City notes that PPRT revenues are also projected to decline due to the State diverting PPRT revenue away from local governments to pay its obligations (under Public Act 97-0732, the State paid regional Superintendents with PPRT funds), the timing of PPRT refunds by the State as well as the growing portion of PPRT that must be used to fund pension obligations.

The drop in PPRT funding for the City of Chicago may not have a significant impact on the City’s budget in the immediate future, due to the size of the government and diversity of its resources. However, over time, the steady decline in State revenues may become a larger burden on the City’s finances. Overall, PPRT revenues account for approximately 3.8% of the City’s FY2013 Corporate Fund and Pension Funds resources, which is down from 4.3% in FY2010. As discussed in the IIFS’ blog from last week, the impact may be more significant for smaller municipalities such as Peoria, Illinois. In FY2013 the City of Peoria is expected to receive a PPRT allocation of $5.6 million, a reduction of $1.0 million, or 15.2%, from the prior year.