May 25, 2023

The City of Chicago has received a number of upgrades from credit rating agencies over the past year, for both the City’s long-term general obligation debt and other debt. City debt primarily consists of general obligation debt secured by a full faith and credit pledge of revenues, revenue debt secured by earmarked taxes and fees, Sales Tax Securitization Corporation debt, and tax increment financing debt paid for by taxes on incremental value increases of property values in TIF districts. The rating changes were primarily due to the City’s improved economic and revenue conditions as it emerged from the depths of the COVID-19 pandemic. The upgrades also reflect the City’s efforts to reduce liabilities by making additional payments for its pension funds.

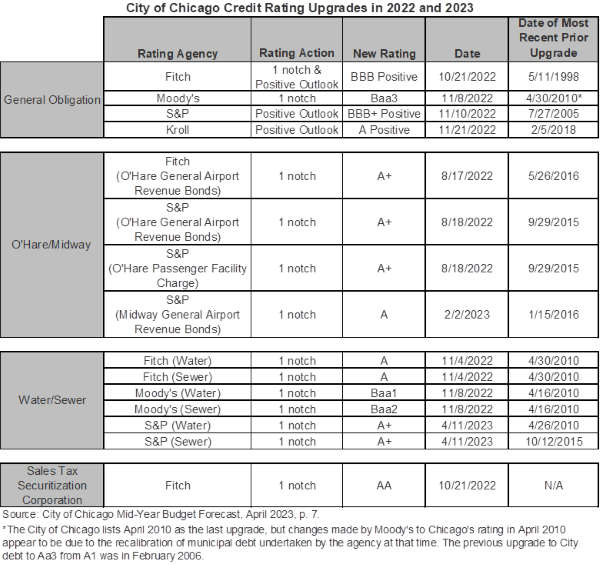

Several of the rating upgrades were the first in well over a decade. The last time Fitch had upgraded the City’s general obligation debt was 25 years ago. The chart below summarizes these recent credit actions occurring in 2022 and so far into 2023.

The credit rating increases are significant not only because they signal improved financial stability, but also because they save the City money over time. According to the City, every credit rating upgrade represents $100 million in interest cost savings on each $1 billion in bonds issued.

Chicago had $6.3 billion in long-term tax supported debt outstanding in FY2021, according to the City’s most recent audited financial report, plus another $16.3 billion in outstanding revenue bonds for water/sewer and O’Hare and Midway airports. Debt service appropriations in FY2023 are projected to be 20.2% of total local fund net appropriations, or $2.4 billion out of expenditures equaling $11.8 billion. More detailed information about the City’s liabilities, including long-term debt, can be found in the Civic Federation's analysis of the City's FY2023 budget proposal.

Summary of Chicago Credit Upgrades in 2022 and 2023

The following are brief summaries of recent credit upgrades from Fitch, Standard and Poor’s, Moody’s and Kroll for Chicago’s long-term general obligation and revenue debt in 2022 and 2023, to date.

Fitch Rating Changes

On November 4, 2022, Fitch upgraded the City’s $1.5 billion in outstanding second lien sewer revenue bonds one notch from A- to A+ with a positive outlook. The rating agency based its decision on an assessment that the system’s operating costs were low, it had moderate life cycle needs and the sewer system’s finances were stable. On the same day, Fitch also upgraded the City’s $1.8 billion in outstanding second lien water revenue bonds one notch from A- to A with a positive outlook. Fitch found that Chicago’s water system provided an essential service with very low operating costs and moderate life cycle needs, and that it possessed a strong financial profile.

On October 21, 2022, Fitch Ratings upgraded the City of Chicago’s general obligation bonds from BBB- to BBB. This was Fitch’s first upgrade of Chicago general obligation bonds in 25 years due to the City’s improved financial condition, rather than a change in the rating agency’s methodology. Fitch also upgraded Chicago Sales Tax Securitization Corporation's bonds from AA- to AA. Both issues received a positive outlook. The reason for the upgrade was the City’s commitment to improving its pension funding, maintaining strong reserves and implementing structural budget measures that have improved its ability to respond to future cyclical economic changes.

In August 2022, Fitch Ratings upgraded the rating on $8.5 billion of outstanding general revenue airport bonds to from A to A+. The credit upgrade was based on O’Hare Airport’s improved financial performance and stable debt service coverage levels as well as progress that had been made on the airport’s expansion and improvement plans.

Standard & Poor's Rating Changes

On November 10, 2022, Standard and Poor’s affirmed Chicago's general obligation bond rating of BBB+ and revised the rating outlook from Stable to Positive. The outlook change was based on S&P’s evaluation that the City had significantly improved its financial stability in recent years, including its commitment to increase pension funding.

In April 2023, S&P upgraded City of Chicago water second lien revenue bonds and sewer second lien revenue bonds. Both issuances were raised one notch to A+ from A. The rating agency cited as reasons for the upgrade the City’s improved financial situation as well as its transition to using the American Water Works Association’s cost-of-service rate methodology for suburban customers rather than a uniform rate structure.

S&P upgraded Chicago Midway Airport revenue bonds to A from A- with a stable outlook in February 2023. The upgrade reflected S&P’s assessment that activity at Midway Airport had recovered to a large extent from the effects of the COVID 19 pandemic and their expectation that the airport would continue to have stable and adequate financial performance.

In August 2022, S&P raised its rating for Chicago’s outstanding senior lien general O’Hare International Airport revenue bonds from A to A+. It also increased the rating on O’Hare’s outstanding standalone passenger facility charge revenue bonds to from A to A+. The upgrades were based on increased passenger traffic and improved enterprise operations, according to an S & P Global Ratings summary on Chicago O’Hare International Airport dated August 18, 2022.

In June 2022, S&P revised the outlook to positive from stable for Chicago’s customer facility senior lien Series 2013 bonds and affirmed its BBB long term and underlying ratings for these bonds. The action was based on improved rental car activity as the City recovered from the COVID 19 pandemic.

S&P revised the outlook from stable to positive in January 2022 for the City of Chicago’s first lien and second lien general airport revenue bonds issued for Midway International Airport. At the same time, it affirmed its A- rating on these bonds. The outlook change was based on the improved economic situation at Midway Airport as air traffic activity reached 87% of September 2019 levels.

Moody's Rating Changes

Moody’s Investors Service upgraded Chicago’s general obligation unlimited tax bonds one notch, from Ba1 to Baa3, in November 2022. The upgrade was based on the City’s substantial increase in pension funding; its improved budgetary management, including a willingness to raise revenue to address the City’s ongoing structural deficit; and the elimination of budget gimmicks and pension cost deferrals. At the same time, Moody’s also upgraded its rating on Chicago’s water revenue bonds from Baa2 to Baa1, the rating on senior lien sewer revenue bonds from Baa2 to Baa1 and the rating on the junior lien sewer revenue bonds from Baa3 to Baa2. All ratings have a stable outlook.

Kroll Rating Changes

Kroll Bond Rating Agency changed the outlook of Chicago’s outstanding general obligation bonds from stable to positive in November 2022 and affirmed its A rating of those bonds. The reasons for the positive outlook included the City’s COVID-19 management strategies, improved revenues, enhanced financial stability, reduction of debt and increased pension funding. At the same time, Kroll assigned an A rating with a positive outlook to the City’s Series 2023A and Series 2023B general obligation bonds.

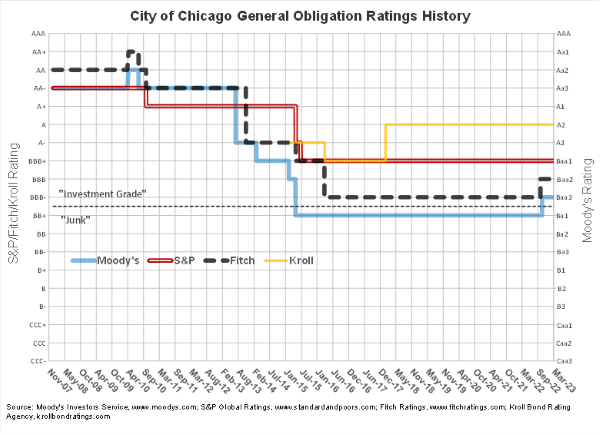

Longer Term Rating History

The following chart shows the longer-term context of the recent changes to the City of Chicago’s general obligation bond ratings. The City’s GO bond ratings between 2008 and 2023 are depicted below. Note that the change in the rating of Chicago GO debt in early 2010 from AA to AA+ by Fitch, and from Aa3 to Aa2 by Moody’s, was due to a recalibration.