October 03, 2018

Consumers of liquid nicotine in the City of Chicago will now pay more for liquid nicotine following the passage of Ordinance 2018-7371. Liquid nicotine products are used in e-cigarettes, also referred to as vaping.

On September 20, 2018 Chicago Mayor Rahm Emanuel introduced Ordinance 2018-7371 to the City Council Finance Committee where it was passed by the Committee and within hours sent to and approved by the City Council. The ordinance increases the City of Chicago tax on liquid nicotine to $1.20 per milliliter from $0.55 per milliliter and increases the per product unit tax from $0.80 to $1.50, effective September 20, 2018.

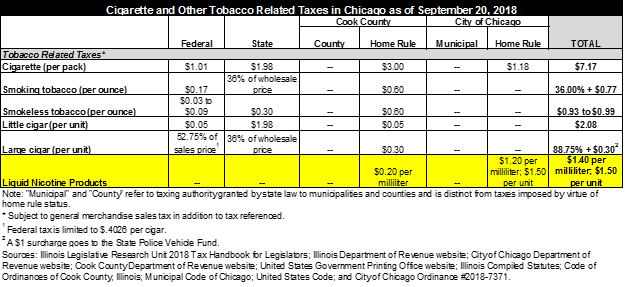

When including the $0.20 milliliter Cook County imposes in addition to the City of Chicago tax, consumers of these products pay $1.40 per milliliter of liquid nicotine and $1.50 per unit within the City of Chicago.

A consumer of cigarettes and other tobacco products in the City of Chicago is subject to tax rates imposed by the federal government, State of Illinois, Cook County and City of Chicago. Currently only the City of Chicago and Cook County impose a tax on liquid nicotine products. Below is a chart that compiles the composite tax rate for cigarettes and other tobacco products a consumer in Chicago may encounter. State and local laws specify tax per cigarette, but per pack (20 cigarettes) is used here for simplicity.

The City of Chicago first began taxing liquid nicotine products in 2016 at a rate of $0.80 per product unit and $0.55 per fluid milliliter. The tax on liquid nicotine products went into effect January 1, 2016 and generated $1.04 million that fiscal year.[1] In 2017 it generated $772,000 in revenue to help fund school-based health services.

The Civic Federation will continue to monitor this ordinance and other revenue and/or expenditure reduction proposals as Mayor Emanuel introduces his proposed FY2019 budget in the coming weeks.

The Civic Federation will also be releasing its annual Selected Consumer Tax Rates Report in early 2019, which will include special analysis of the new tax on liquid nicotine products and other new or revised taxes imposed on consumers.

Related Links:

Selected Consumer Taxes in the City of Chicago – 2018

City of Chicago Passes Additional 2.0% Tax on Home Sharing

Chicago and Cook County Impose Tax on Electronic Cigarettes

[1] City of Chicago, Annual Financial Analysis, 2017, Corporate Fund Revenues, https://chicago.github.io/afa-2017/Revenue-History/Corporate/ (last accessed October 2, 2018).