August 01, 2014

This week the City of Chicago released its Annual Financial Analysis for 2014. According to an executive order issued by Mayor Rahm Emanuel on May 20, 2011, the Office of Budget and Management is mandated to produce a financial analysis of the City budget by July 31st of each year. The report includes:

- A financial condition analysis that covers the previous ten years, including a discussion of key factors impacting the performance of the City’s revenue streams;

- A three-year baseline forecast that describes key assumptions as well as alternative forecasts to show positive and negative variances;

- A reserve analysis that includes the corporate fund reserves and asset lease reserves;

- An analysis of the City’s capital improvement program; and

- An analysis of general debt obligations and long-term liabilities, including pensions.

The analysis includes year-end estimates for FY2014 and projections for FY2015, FY2016 and FY2017. The City’s fiscal year runs from January 1 to December 31; therefore, year-end estimates are based upon the first six months of the fiscal year.

Projected FY2015 Budget Gap of $297.3 Million

The 2014 Annual Financial Analysis projects a $297.3 million preliminary budget gap for FY2015. This is the gap the FY2015 budget will need to close through some combination of efficiencies, cuts and revenue increases. The FY2014 year-end estimates show a balanced budget with a surplus of approximately $0.3 million.

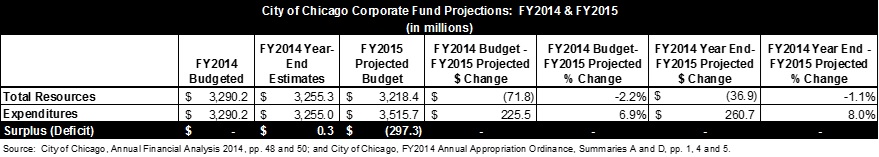

The table below compares the FY2014 adopted budget and the FY2014 year-end estimates with the FY2015 projected budget. Corporate Fund total resources are expected to decline by $71.8 million, or 2.2%, between the FY2014 adopted budget and the FY2015 projected budget. Corporate fund expenditures are expected to increase by $225.5 million or 6.9% between the FY2014 budget and FY2015 projected budget. Based on current estimates, the City anticipates a decrease in total resources of $36.9 million or 1.1% and an increase of $260.7 million, or 8.0%, in expenditures between the FY2014 year-end estimates and the FY2015 projected budget. According to the City’s analysis, the projected growth in expenditures can largely be attributed to personnel costs.[1]

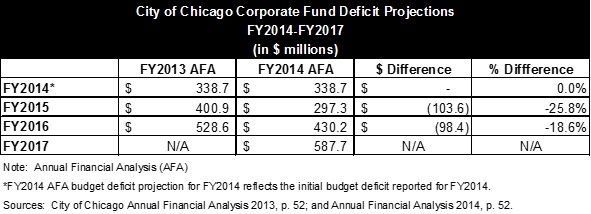

The next table compares the corporate fund deficit projections presented in the 2013 and 2014 annual financial analyses. The Corporate Fund budget gap for FY2015 is projected to be $297.3 million. This is a decrease of $103.6 million, or 25.8%, from the projected FY2015 deficit of $400.9 million, presented in the 2013 Annual Financial Analysis. Similarly, the projection for the Corporate Fund budget gap for FY2016 has also declined from last year’s estimates, from $528.6 million in the 2013 report to $430.2 million in the 2014 report. The projected budget gap for FY2017 is $587.7 million.

Although the budget deficit projections for FY2015 through FY2017 have decreased from last year’s estimates, the projected budget gaps in either report do not take into account the increase in statutorily required payments to the Police and Fire pension funds – which would increase the projected deficits by more than $500.0 million in each of the coming years. However, the projected budget gaps for the Corporate Fund in FY2016 and FY2017 do account for an increase of $50.0 million and $75.0 million, respectively, to the contributions to the City’s Municipal and Laborer’s pension funds required under the pension reform law passed by the Illinois General Assembly this year, Public Act 98-0641.[2] These increases are partially offset by the proceeds of an increase to the 911 surcharge, which was recently passed by the Chicago City Council.

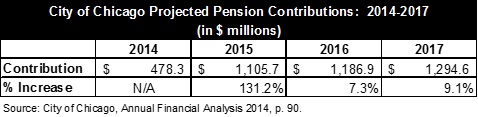

Projected Pension Contributions Increase by 131.2% In 2015, But Will Not Be Paid Until 2016

The City of Chicago contributes to four defined benefit pension plans. The four pension plans include the Municipal Employees Fund, Laborers’ and Retirement Board Employees’ Fund, Policemen’s Fund and Firemen’s Fund. The City of Chicago anticipates that it will contribute a total of $478.3 million to its pension funds in tax levy year 2014. In the 2015 tax levy year, the City projects that its total pension contribution will increase to $1.1 billion or 131.2%. In tax levy years 2016 and 2017, the City projects that its contribution will increase to $1.2 billion and $1.3 billion, respectively. Between 2014 and 2017, the City’s pension contributions will increase by more than 170%. In Cook County, the levy for the current tax year is not collected until following year. Without pension reform for the City’s police and fire pension funds, the increased pension contributions will continue to place a significant burden on the City’s budget to cover basic city services.