July 11, 2013

On March 8, 2013, Governor Quinn signed HB5547, which gave home-rule municipalities and counties with populations over 2,000,000 (essentially Chicago and Cook County) the ability to tax parking garages by percentage rather than by a flat tax. Soon after, Chicago’s City Council approved changes to the City’s parking garage tax system accordingly. Cook County is in the process of making similar changes.

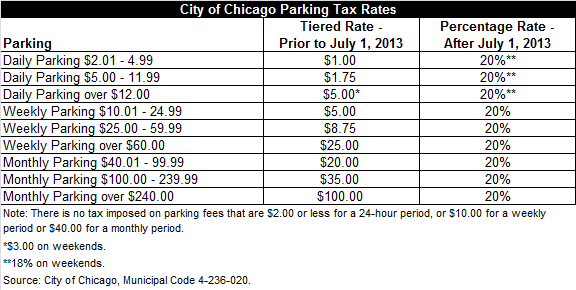

On April 8th, the Finance Committee of the City Council approved an ordinance changing the City’s current tiered parking tax rates for daily parking to a percentage-based tax rate of 18% on weekends and 20% on weekdays effective July 1, 2013. For weekly and monthly parking, the percentage-based tax rates are 20%. The following chart shows the parking tax system before and after the change in tax code.

According to the testimony of City Budget Director Alexandra Holt, the parking garage industry pushed for the changes at the State level, which in turn allowed the City to implement its changes, in order to simplify the tax code.

The City’s budget department has said it structured the new tax rate to be revenue neutral, using relatively conservative revenue estimates and including factors such as rising gas prices, which negatively affect parking revenues. The new 18-20% parking tax rate is comparable to other large cities: in New York City, the parking tax rate is 18.4%, San Francisco’s is 25% and Philadelphia’s is 20%.

Although the overall revenue generated from the new rates is designed to be roughly equal to that generated from the previous system, some consumers will experience significant differences. Taxes on premium parking – such as overnight parking at hotels and O’Hare Airport – will increase from $5.00 to $10.00. Consumers of economy parking such as early bird specials will likely experience lower taxes.

At the Finance Committee hearing, some aldermen expressed concerns that economy parking garage operators will increase their parking rates to take what would have been savings to the consumer. Other aldermen expressed concern for students and hospital visitors. Ms. Holt explained that universities set their own subsidies for student parking while hospital-owned and operated garages are exempt from the City’s parking tax.

The ordinance was approved by the City Council with a vote of 40 to 5 on April 10, 2013.

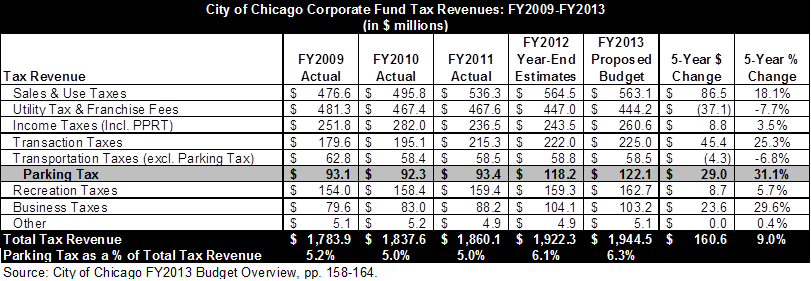

The following chart shows the City of Chicago’s tax revenues from FY2009 to FY2013 as well as the percentage that parking taxes contribute to the City’s total tax revenue. The City budget projected $122.1 million in parking tax revenue for FY2013, which is approximately 6.3% of the City’s total tax revenue. The estimated increase in FY2012 and projected increase in FY2013 were in line with an expected increase in tourist and visitor traffic downtown.[1] The last increase to the parking tax rate occurred with the approval of the FY2012 budget, which added $2 to the average tax rate for downtown weekday parking. The proposed tax increase was referred to as a congestion premium with the intent of encouraging drivers to take public transportation.[2]

For more information on the City’s parking tax and all other consumer taxes, see the Civic Federation’s report on Selected Consumer Taxes in the City of Chicago.

[1] City of Chicago, FY2013 Budget Overview, p. 13.

[2] City of Chicago, FY2012 Budget Overview, p. 5.