April 08, 2022

On March 24, 2022, the Civic Federation released its annual analysis and recommendations for the Governor’s proposed State of Illinois FY2023 Operating and Capital Budgets. The proposed budget noted that since the enactment of the FY2022 State Budget, revenue collections have continuously exceeded expectations. This strong performance has prompted both the Governor’s Office of Management and Budget (GOMB) and the Commission on Government Forecasting and Accountability (COGFA), the fiscal analysis unit of the Illinois State Legislature, to make several significant upward revisions to both FY2022 and FY2023 revenue projections.

On March 8, 2022, COGFA released its updated economic forecast and revenue estimates, which included an additional month of data than was available at the time of the release of the Governor’s budget proposal. The COGFA forecast predicts even higher FY2023 revenues due to the incorporation of stronger-than-expected economic performance in January 2022 for the State’s largest revenue sources (GOMB’s projection only included data through December 2021).

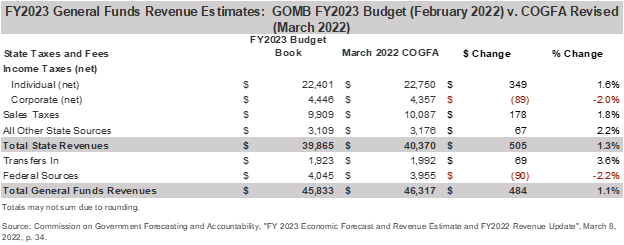

The following chart compares the most recent GOMB and COGFA forecasts for General Funds revenue, which supports the regular operating and administrative expenses of most State agencies and are the funds over which the State has the most control. General trends are largely consistent with those released in the FY2023 budget, as both the entities rely on many of the same economic sources when formulating their predictions.

Overall, COGFA predicts $484 million in higher revenue compared to the February GOMB estimates, largely stemming from net individual income taxes and sales taxes.

Income Taxes

Individual and corporate income taxes represent, respectively, the largest and third-largest individual revenue sources and account combined for more than half of all General Funds revenue. Since 2017, the individual income tax rate has been established at 4.95% and the corporate rate at 7.0%.[1]

COGFA predicts an additional $349 million in net individual income tax revenue than was included in the Governor’s proposed budget for FY2023. This largely stems from a higher FY2022 estimate of base revenues, rather than growth expectations.[2] Overall, COGFA anticipates somewhat lower baseline growth expectations for FY2023, including:

- A 1.7% increase in State GDP, compared to the 2.7% growth predicted by GOMB;

- A 0.6% increase in total employment, as opposed to a 1.8% increase predicted by GOMB;

- An average unemployment rate of 3.9%, slightly below the GOMB estimate of 4%; and

- A 4.3% increase in personal income, exceeding GOMB’s projection of 4.1%.

Both GOMB and COGFA project a decline in net corporate income taxes, with a more conservative COGFA prediction $89 million below those released by GOMB in February. Both agencies attribute some of the decline to reduced corporate profits to the waning effects of the federal pandemic stimulus and a return to more normal consumer spending. GOMB also projects diminishing impacts from changes to the Illinois Income Tax Act (IITA) enacted in the FY2022 budget, and a shift of revenues to FY2022 from FY2021 that will not recur. COGFA additionally cites the impact of rising inflation and higher input costs as reasons for the decrease.[3]

Sales Taxes

Sales taxes remained strong throughout the pandemic, as personal disposable income increased with the infusion of federal stimulus dollars and expanded unemployment benefits. The pandemic also brought about changes in consumption patterns to goods, which are taxed by the State, from services, which largely are not.[4] With decreasing COVID infection rates and subsequent pandemic restrictions, consumption patterns are likely to begin a shift back to normalcy. COGFA’s net sales tax revenue predictions from March exceed those of GOMB by $178 million, or 1.8%.

Transfers In

Revenue estimates also include transfers from other funds such as lottery, gaming, and adult-use cannabis into the General Fund based on received revenues or incurred costs in a given budget year.[5] The most recent COGFA estimates increased $69 million, or 3.6%, from the GOMB estimates the month prior.

Federal Sources

Federal revenue sources consist mainly of reimbursements for State Medicaid spending and fluctuate from year to year depending on the level of Medicaid spending. Projected federal revenues decreased $90 million, or 2.2%, from GOMB’s February projections. COGFA attributes this decline to the assumed cancellation of the enhanced federal matching rate before FY2023.[6]

Looking Forward

While COGFA’s analysis of the State’s March 2022 revenue numbers—released in April 2022—showed continued strong growth, several events subsequent to COGFA’s March projections could impact revenues going forward. Shortly before the release of the March COGFA report, Russia launched an invasion into neighboring Ukraine, leading to massive economic sanctions and significant economic uncertainty. Additionally, on March 16, 2022, the Federal Reserve approved its first interest rate hike since 2018, increasing the target for short-term interest rates by 0.25% in order to curb inflation. The Fed, on average, expects interest rates to increase to approximately 1.9% by the end of 2022. Additionally, the Fed reduced its forecast for economic growth in 2022 to 2.8% from the 4.0% projected in December 2021.[7]

The Civic Federation will release its analysis of the State of Illinois’ enacted budget after its expected passage this week and will continue to monitor other economic developments.

Related Links:

Civic Federation State of Illinois FY2023 Budget Analysis and Recommendations

Civic Federation FY2023 State Budget Blog

FY2023 Economic Forecast and Revenue Estimate and FY2022 Revenue Update (COGFA)

[1] Public Act 100-0022, enacted over the Governor’s veto on July 6, 2017. Corporations also pay a personal property replacement tax (PPRT) of 2.5% on net income.

[2] Illinois State FY2023 Budget, p. 145; Commission on Government Forecasting and Accountability, "FY 2023 Economic Forecast and Revenue Estimate and FY2022 Revenue Update", March 8, 2022, p. 34.

[3] Illinois State FY2023 Budget, p. 151; Commission on Government Forecasting and Accountability, "FY 2023 Economic Forecast and Revenue Estimate and FY2022 Revenue Update", March 8, 2022, p. 32.

[4] State of Illinois FY2023 Budget, p. 152.

[5] Illinois State FY2023 Budget, p. 18.

[6] Commission on Government Forecasting and Accountability, "FY 2023 Economic Forecast and Revenue Estimate and FY2022 Revenue Update", March 8, 2022, p. 35.

[7] Scott Horsely, “The Federal Reserve raises interest rates for the first time since 2018, March 16, 2022. https://www.npr.org/2022/03/16/1086484178/the-federal-reserve-interest-rates-inflation