July 12, 2019

A Commission created to analyze an annual five-year forecast of Cook County revenues held its first meeting in early July. The Cook County Board of Commissioners approved an ordinance establishing an Independent Revenue Forecasting Commission on October 17, 2018. The Commission is intended to help the Board of Commissioners make informed budgetary decisions by evaluating long-term revenue estimates.

The Commission is chaired by the Cook County Chief Financial Officer and consists of three members who were approved by the Cook County Board of Commissioners this spring: two economists associated with universities in Cook County and one member of the public with expertise in public finance. Dr. Paula Worthington from the University of Chicago Harris School of Public Policy and Dr. David Merriman from the University of Illinois at Chicago College of Urban Planning and Public Affairs were appointed as the academic members. Karen Walker, an investment banker and former Chief Financial Officer of the Chicago Transit Authority and Director of Financial Services at the Illinois Finance Authority, was appointed as the member of the public with financial expertise.

The first meeting of the Independent Revenue Forecasting Commission, held on July 2, 2019, provided an overview of the scope and responsibilities of the Commission and a presentation explaining the assumptions and projections for the County’s major tax revenue sources over the next five years.

As explained during the presentation, the focus of the Commission is to analyze Cook County home rule taxes that generate over $30 million annually. As a home rule unit of government, Cook County is authorized to impose taxes not otherwise prohibited by State law. Home rule taxes make up about 80% of the $1.9 billion General Fund budget. The scope of the Commission’s work excludes analyzing other sources of revenue such as fees and licenses generated by separate County agencies such as the County Clerk, Clerk of the Circuit Court, Treasurer and Recorder of Deeds, as well as grants and governmental reimbursements. It also excludes the County’s Health System, which is a $2.7 billion operation as of FY2019. Fee-generating agencies and departments including separately elected officials and the Health System are responsible for estimating their own fee and license revenues.

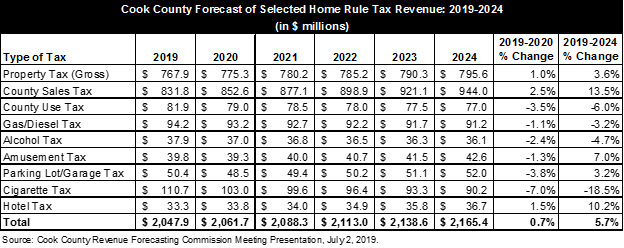

The table below summarizes the forecast of home rule tax revenues from 2019 through 2024 presented by the Cook County Bureau of Finance. The methodology for forecasting each revenue source involves looking at historical and economic trends (including the use of compounded annual growth rates and linear regression analysis), industry estimates, regulatory or legislative changes and internal management initiatives such as compliance or collections enforcement.

Some revenue projections such as the sales tax and property tax are based on GDP growth estimates from the Federal Reserve. While sales tax revenue is projected to grow by 13.5% over the next five years, property tax revenue is only projected to grow by 3.6% because growth is based only on new property and new construction. The County Board of Commissioners has kept the base property tax levy flat since 2001.

The County’s use tax is a 1% tax on the purchase of titled property (mainly vehicles). Projections for this tax rely in part on industry estimates from the Center for Automotive Research that estimate a decline in future car sales.

Gas tax estimates are projected to decrease by 3.2% over the next five years in line with an overall declining trend due to more fuel efficient cars. The State of Illinois enacted a 19 cent increase in the gas tax that went into effect July 1, 2019, but Bureau of Finance staff do not expect that this will have much of an impact on the County’s gas tax revenue because demand for fuel is fairly inelastic. Likewise, the State enacted a new parking tax of 6% daily and 9% weekly/monthly, but the County does not expect this to have a significant impact on its parking tax revenue.

Cigarette tax revenue is projected to decrease by 18.5%, a $20.5 million drop from $110.7 million in 2019 to $90.2 million in 2024. The projected decrease is due to a combination of factors including natural declines in tobacco sales, an increase in the State cigarette tax and an increase in the purchasing age from 18 to 21.

Projections for first-year revenue were also discussed for two newly legalized tax sources enabled by the State of Illinois: cannabis and sports gambling. These tax sources are expected to bring in $3.3 million and $3.2 million in 2019 respectively, but not enough data is available yet to make five-year projections.

Bureau of Finance staff discussed some of the compliance challenges associated with certain tax collections such as the alcohol tax and parking lot tax because of hard-to-find businesses such as emerging microbreweries and temporary parking lots. Cigarette tax compliance is also an ongoing issue because of cigarette smuggling across state borders.

The Commission will analyze the County’s five-year projections and their underlying assumptions and methodology, and will provide feedback to the Chief Financial Officer before agreeing upon a final five-year revenue forecast in August.

The Civic Federation commends Cook County for establishing the Independent Revenue Forecasting Commission and making the Commission’s meetings and activities open to the public. The Commission serves as a valuable asset to the Board of Commissioners by providing an independent review of the County’s tax revenue projections and increases the openness and transparency of the County’s financial information.

While the initiative is a positive step, the Civic Federation encourages the Cook County Board of Commissioners and President’s Office to eventually expand the scope of the Commission to examine the County’s budget as a whole—including all revenue sources and expenditures. Rising expenditures due to personnel costs for employee salaries and healthcare benefits are a main driver of annual budget deficits. Therefore, it is critical that the County Board look for ways to control or decrease annual expenditures in combination with projecting revenues.

Related Links:

Cook County Establishes Independent Revenue Forecasting Commission

Civic Federation Analysis of the Cook County FY2019 Executive Budget Recommendation