August 15, 2013

On June 27, 2013, Cook County Board President Toni Preckwinkle released a report on preliminary budget estimates for fiscal year 2014, which begins on December 1, 2013 and ends November 30, 2014. The report provides an overview of mid-year FY2013 revenues and expenditures, expected year-end estimates for FY2013 and projected revenues and expenditures for FY2014.

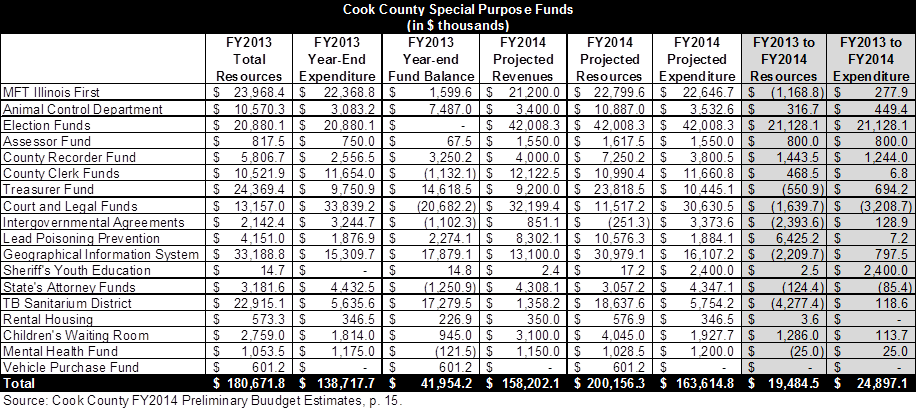

The Civic Federation previously blogged about overall revenue and expenditure estimates for FY2013 and FY2014. This blog will take a closer look at the County’s Special Revenue Funds, which are estimated to provide the County with $180.7 million of resources in FY2013. These resources are in addition to the County’s $2.3 billion of General Funds revenues in FY2013. The General Funds are made up of the Corporate (the County’s general operating fund), Public Safety and Health and Hospitals System sub-funds.

Unlike a general operating fund, which is funded by property and sales taxes and pays for regular government services, a special revenue fund is established by a government to collect specific monies to be used for specific projects. For example, the County established Special Revenue Fund MFT Illinois First to collect Motor Fuel Tax funds from the State of Illinois to pay for construction and improvements of roads and bridges in Cook County. Expenditures within each special purpose fund are restricted by law to be used for a specific purpose. Each fund is considered self-balancing as long as its dedicated resource remains in existence.

Below is an exhibit that compiles all of Cook County’s Special Revenue Funds. Together, the funds provided $180.7 million in resources for the County in FY2013. Estimated year-end expenditures for the funds totaled $138.7 million, leaving nearly $42.0 million in estimated fund balance by FY2013 year-end. The County has forecast over $158.2 million in revenue to be added to these funds in FY2014. Expenditures in FY2014 have been projected to total $163.6 million, a $24.9 million increase from FY2013.

Between FY2013 and FY2014, expenditures in the Election Funds will increase by $21.1 million, due to the fact that 2014 is an election year that covers the primary and general elections for United States Senator, Governor and other federal, State and County elected officials. Because the election funds are financed by property taxes, the County will have to allocate fewer property tax revenues to the General Funds in FY2014.[1]

Court and Legal Funds include a number of funds dedicated to the Circuit Court’s automated systems, legal resources and legal support services and are financed by various fees. The County has projected a negative fund balance for many of these funds, including the Cook County Law Library Fund and Juvenile Probation Fund, and is working to stabilize them. When compiled, expenditures for these funds are decreasing by $3.2 million in FY2014 from FY2013 year-end estimates. However, with $11.5 million of projected FY2014 resources and $30.6 million of projected expenditures, it is likely negative fund balances will remain.[2]

The Geographical Information System (GIS) Funds and the Tuberculosis Sanitarium District Fund are estimated to have fund balances of over $17.0 million by FY2013 year-end. The GIS funds provide maintenance and access to the County’s GIS mapping system. The TB Sanitarium District Fund aims to prevent and treat County residents with tuberculosis. The high fund balance in the TB fund is due to surplus real estate tax from the State of Illinois. The State requires these resources to be used exclusively for the fund.[3]