December 13, 2012

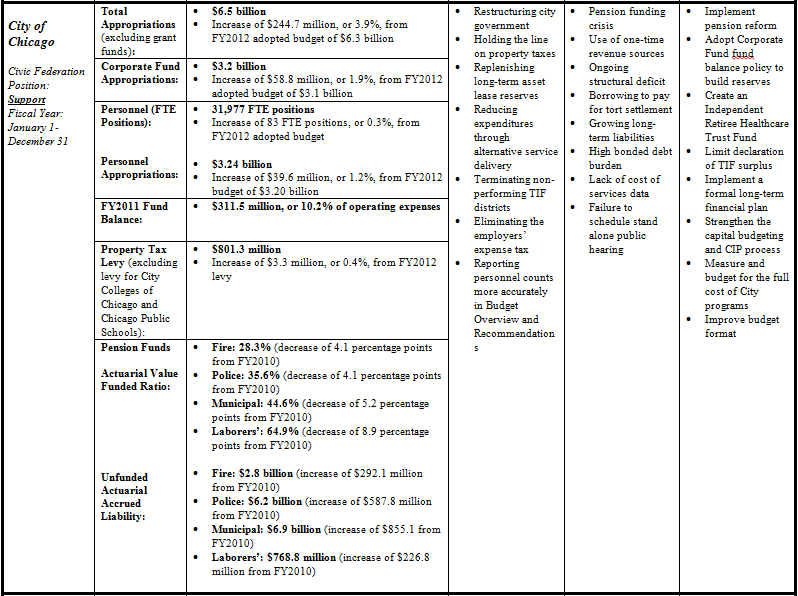

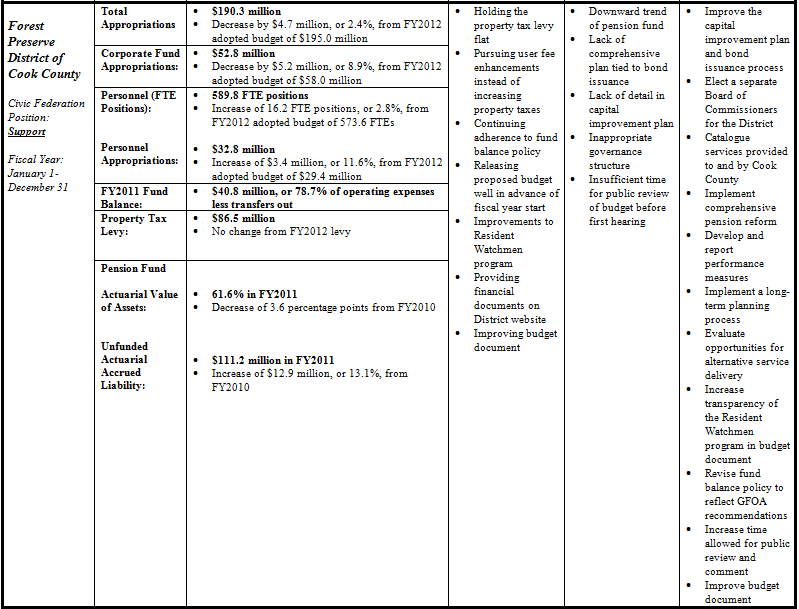

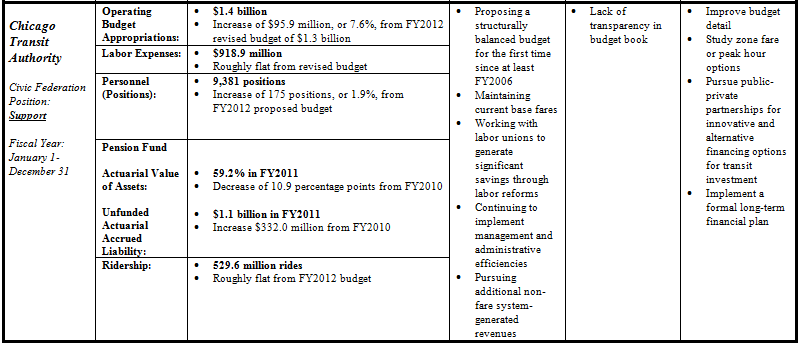

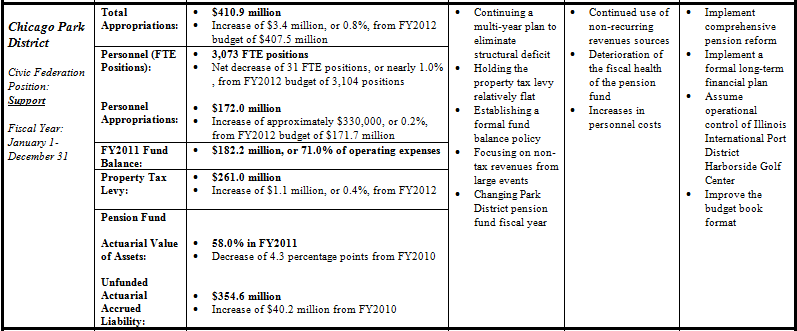

Last week marked the end of the budget season for the nine local governments monitored by the Civic Federation. These governments include: the City Colleges of Chicago, Chicago Public Schools (CPS), DuPage County, City of Chicago, Cook County, Chicago Transit Authority (CTA), Forest Preserve District of Cook County, Metropolitan Water Reclamation District of Greater Chicago (MWRD) and Chicago Park District. This blog provides a summary the proposed FY2013 budgets and how appropriations have changed from the prior year. Included is a chart that provides an overview of the Civic Federation’s findings and positions on each of the local government budgets.

Property Taxes

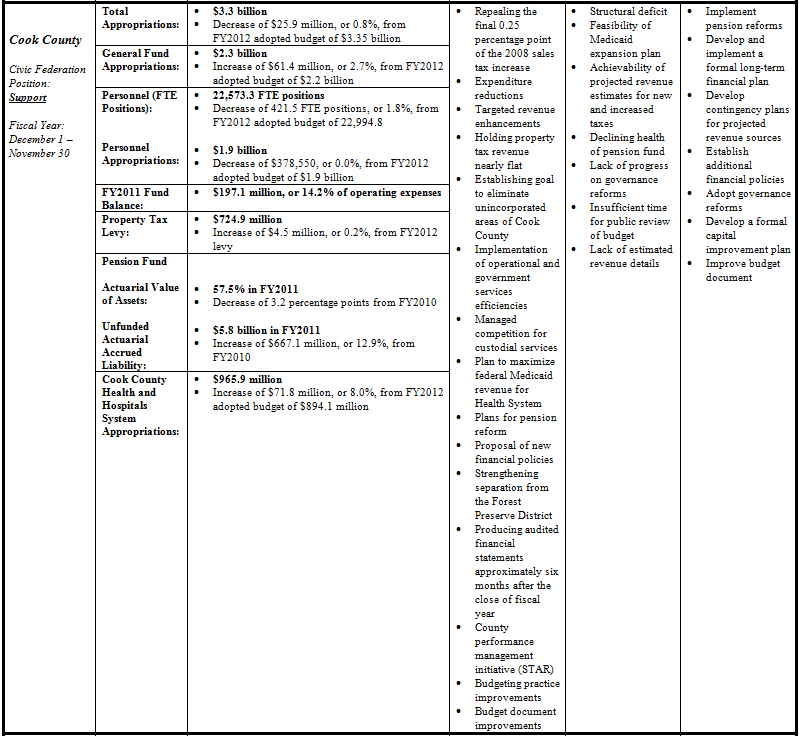

Six of the eight governments that levy property taxes held their levies flat or nearly flat for the FY2013 budget year. (The CTA does not levy a property tax). Like last year, the two exceptions are the Chicago Public Schools and Metropolitan Water Reclamation District. CPS raised its property tax levy by the maximum allowed - 1.5% this year - for the second year in a row. MWRD held the property tax levies for its tax-capped funds flat from FY2012, but raised its property tax levies for the other funds by 3.1%. Three governments – the City of Chicago, Chicago Park District and Cook County – raised their property tax levies to capture revenue from expiring and/or terminated Tax Increment Financing (TIF) districts. Although the levies for these governments are being raised, taxpayers will not be affected as explained below.

Capturing Revenue from Expired and Terminated TIF Districts

Three governments will raise their tax levies to capture revenue from expiring and/or terminated TIF districts. This maneuver, which has been used by the City of Chicago for the past two years and by Cook County and the Chicago Park District this year, allows the governments to capture property tax revenues from expiring and terminated TIF districts without increasing the amount of money taxpayers will owe in property taxes. This is because taxpayers were previously paying the additional amounts for TIF district expenses, which are not reported in the operating budgets, and now will pay the same amounts as part of the property tax levy, which is reported in the budgets. The City of Chicago is raising its levy by $3.3 million, Cook County is raising its levy by $4.5 million and the Chicago Park District is raising its levy by $1.1 million.

Major Findings for FY2013

Major findings in changes from prior year budget appropriations include:

• Property tax levy:

• Six of eight governments held their property tax levies flat or relatively flat.

• One government increased its levy to the maximum amount allowable.

• One government held its tax-capped levies flat but increased its non-tax-capped levies.

• General Fund budget appropriations:

• Six of the nine governments increased their operating budget appropriations.

• Three of the nine governments decreased their operating budget appropriations.

• Personnel Position Count:

• Four of the eight governments increased their workforce (City Colleges, City of Chicago, Chicago Transit Authority and Forest Preserve District).[1]

• Personnel Expenses:

• Three of nine governments increased their appropriations for personnel expenses.

• Five of nine governments reduced their appropriations for personnel expenses.[2]

• One of nine governments held appropriations for personnel expenses flat.

• Fund Balance:

• Four of eight governments met the Government Finance Officers Association’s recommendation for maintaining a General Fund fund balance of at least 17% of operating expenditures.[3]

• Pension Fund:

• Funded ratios for government employee pension funds declined for the seven governments with their own pension funds.[4]

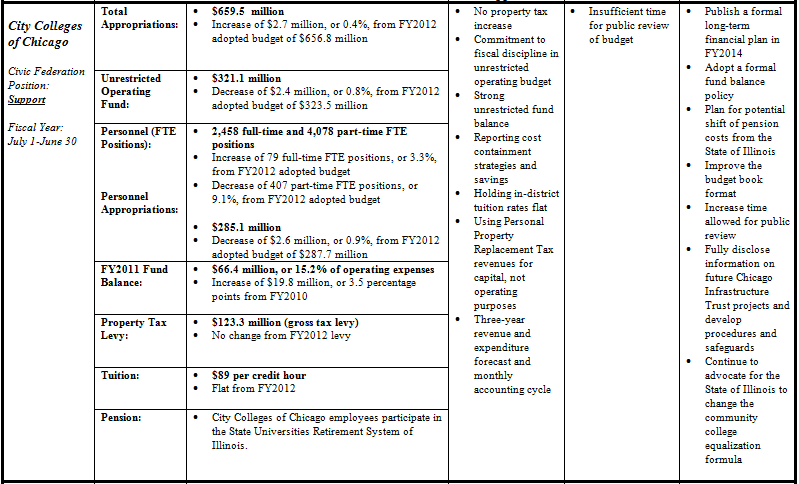

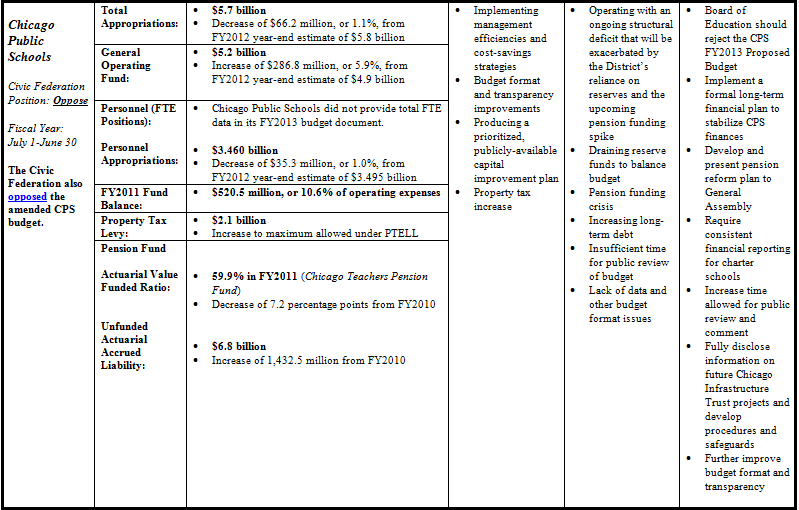

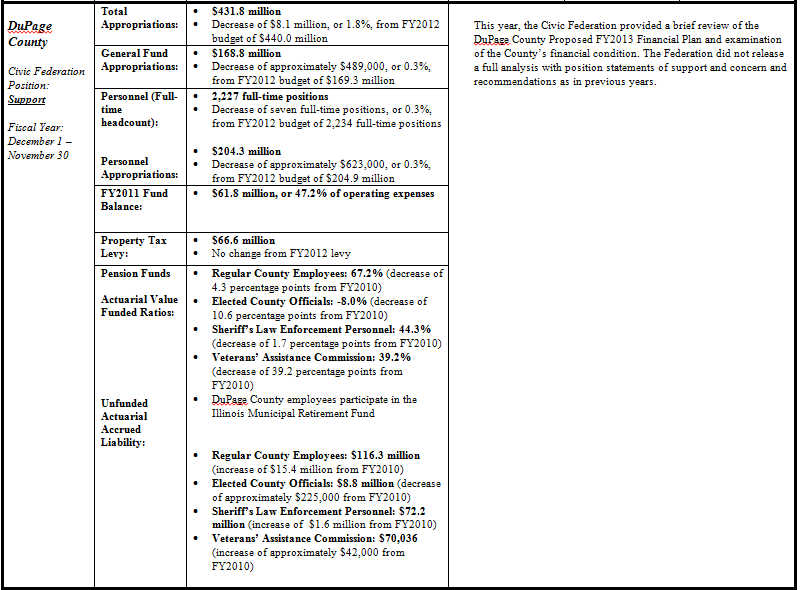

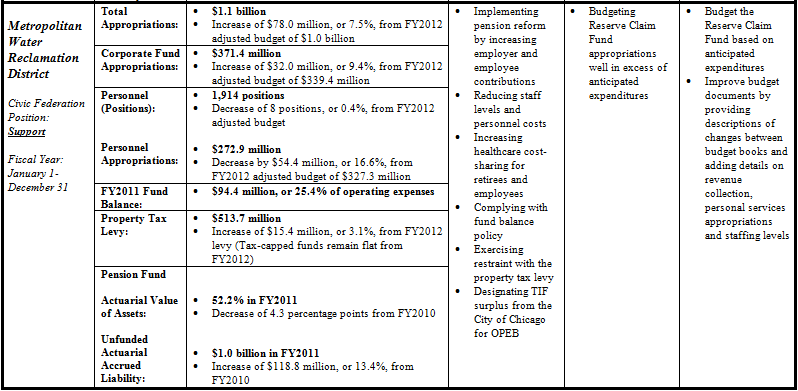

The exhibit below provides a summary of the budget analysis reports published by the Civic Federation following the release of each local government’s FY2013 proposed budget. The summary chart provides:

• Appropriation and financial data highlights;

• Changes from the previous year’s actual expenditures, year-end estimates or adjusted/adopted budgets;

• The Civic Federation’s positions; and

• The Civic Federation’s statements of support, concern and recommendation.

It should be noted that the figures below represent the data available at the time the Civic Federation’s analysis of each budget was published; appropriations and other financial data may have changed since the release of each report. Also, the Civic Federation’s individual analyses for some aspects of a government’s budget may not be comparable to the analyses of other governments, and therefore may not be included in the summary exhibit. Full analysis reports can be accessed at civicfed.org. For a full PDF of the following charts, click here.

![]()

[1] Chicago Public Schools did not provide total position data in its FY2013 budget documents.

[2] The Chicago Transit Authority does not provide personnel appropriation data.

[3] The Civic Federation does not conduct an analysis of fund balance for the Chicago Transit Authority.

[4] The City Colleges of Chicago employees participate in the State Universities Retirement System of Illinois and DuPage County Employees participate in the Illinois Municipal Retirement Fund.