September 08, 2021

Unlike the State’s annual General Funds budget, which is intended to cover only the cost of operations for the current fiscal year, capital appropriations are reauthorized over multiple years as planning, engineering and construction of capital investments commence. Since 2005 the capital budget has been proposed in a separate document from the State’s operating budget and is not part of the annual General Funds expenditures. The current multi-year capital budget was initially approved in 2019 as the Rebuild Illinois capital plan; this action provides annual appropriation authority for capital project spending to proceed. Information about the Rebuild Illinois capital plan can be found here and here.

The Government Finance Officers Association (GFOA) and the National Advisory Council on State and Local Budgeting (NACSLB) both recommend as a best practice that governments develop a capital improvement plan.[2] However, the State of Illinois capital plan does not include a comprehensive statewide capital improvement plan (CIP) that establishes priorities to balance capital needs with available resources, pairs capital projects with funding sources, helps ensure orderly repair and maintenance of capital assets and provides an estimate of the size and timing of future debt issuance. Rather, it primarily includes a list of projects. Developing a CIP is an important financial accountability measure because capital projects are costly and must be paid for over a number of years that the funds are borrowed.[3]

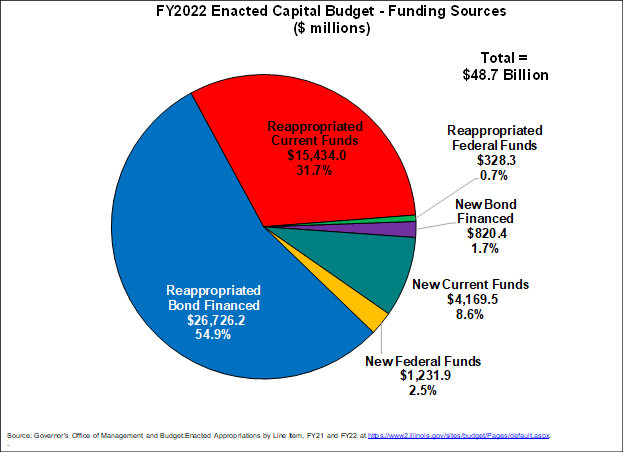

Types of Project Funding

The following chart shows the total FY2022 enacted capital budget by the type of project funding. Of the $42.5 billion in reappropriated funds, $26.7 billion will be reappropriated bond proceeds, $15.4 billion will be reappropriated current (pay-as-you-go) funds and $328.3 million will be from federal funds. Of the approximately $6.2 billion in new appropriations, $4.2 billion will come from current funds, $1.2 billion will be from federal funds and roughly $820.4 million will be from bond funds

Capital Budget Expenditures

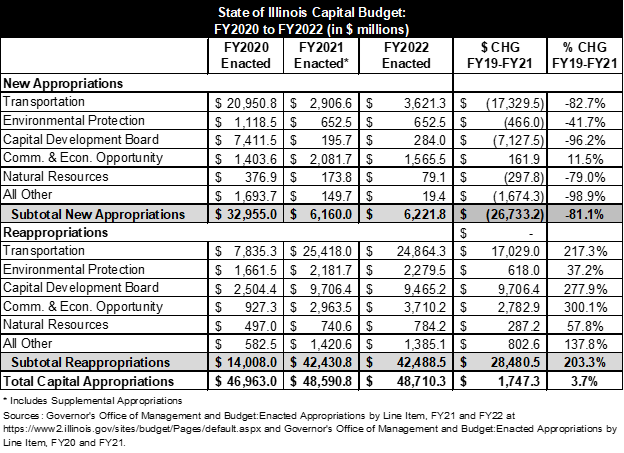

The following table compares total spending in the capital budget enacted by the General Assembly for FY2022 to the enacted capital budgets for FY2020 and FY2021 It breaks out new appropriations and reappropriations by major department.

Total capital appropriations will increase by 3.7% or $1.7 billion between FY2020 and FY2022. New appropriations during that three-year period will decrease by 81.1%, or $26.7 billion. The large decrease is due to the fact that capital spending authorized in FY2019 with the Rebuild Illinois Capital Plan is reappropriated each year until it is spent; smaller amounts of new spending are added to the plan each subsequent fiscal year. Reappropriations over that same period will increase by $28.5 billion or 203.3%.

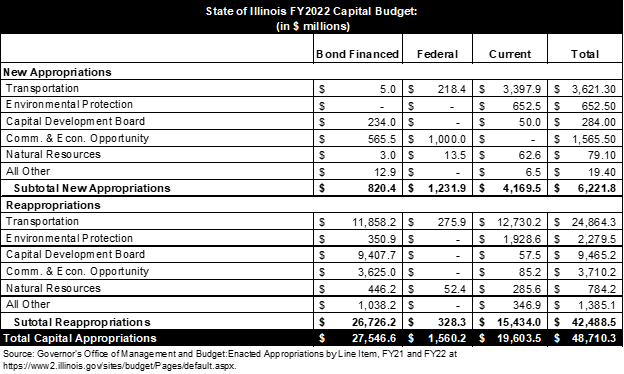

The next exhibit shows a breakdown of FY2022 capital budget spending by department and funding source.

Nearly $4.2 billion in new current (pay-as-you-go) funding was primarily appropriated for five departments: Transportation, Environmental Protection, the Capital Development Board, Commerce and Economic Opportunity and Natural Resources.

Of the $15.4 billion in reappropriated current funding, 82.5%, or $12.7 billion, is earmarked for Department of Transportation projects. The largest amount of total reappropriations, $24.8 billion, is also reserved for Department of Transportation projects. The second largest amount of total reappropriations, or $9.5 billion, will be for Capital Development Board projects.

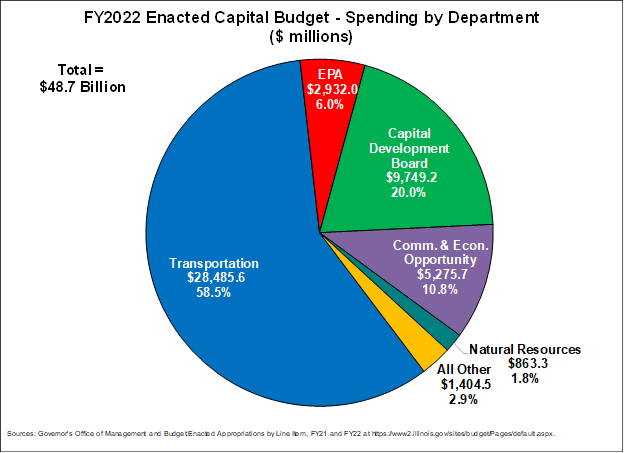

Total capital budget spending by major department for FY2022 is shown below. Funding for transportation, including statewide road and bridge construction, remains the largest portion of the State’s capital expenditures. The enacted FY2022 capital budget includes roughly $28.5 billion in total spending for the Illinois Department of Transportation, including the annual road program for ongoing surface transportation improvements (roads, bridges and mass transit). The second largest amount, or $9.7 billion, is earmarked for Capital Development Board projects. The Capital Development Board oversees the construction of new state facilities, including prisons, state parks, mental health institutions, and college and university projects. It is also responsible for the renovation of state-owned buildings.[4]

FY2022 Capital Budget Revenues

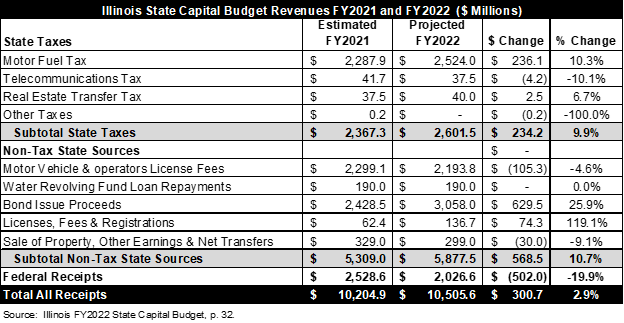

The state capital plan is supported by certain state taxes such as motor fuel taxes; non-tax state resources such as motor vehicle and operators license fees and bond issue proceeds; and federal receipts.

Much of the capital budget is supported by borrowed funds. Information about Illinois’ historic and current debt burden can be found here and an update on the State’s recent credit rating upgrades can be found here.

The FY2022 proposed State Capital Budget projects that total resources supporting the capital budget will rise by 2.9% in FY2022 from the previous fiscal year, increasing from $10.2 billion in FY021 to $10.5 billion. State tax revenues will increase by 9.9%, rising from $2.4 billion to $2.6 billion. Much of that increase is driven by a 10.3% increase in motor fuel taxes, which will rise from $2.3 billion to $2.5 billion. State non-tax resources will increase from $5.3 billion to nearly $5.9 billion. Finally, federal receipts will decrease by 19.9%, from $2.5 billion to $2.0 billion.[5]

[1] Governor’s Office of Management and Budget: Enacted Appropriations by Line Item, FY21 and FY22 at https://www2.illinois.gov/sites/budget/Pages/default.aspx.

[2] National Advisory Council on State and Local Budgeting. Recommended Budget Practices: A Framework For Improved State and Local Government Budgeting. Recommended Practi8ce 9.6 Develop a Capital Improvement Plan, p, 52.

[3] One prominent example of a best practice state CIP is the Virginia Department of Transportation’s SMART SCALE. Virginia statute requires the use of an objective, weighted scoring system for each proposed transportation project that takes into account the project’s impact on congestion, safety, accessibility, economic development, the environment and transportation-efficient land use. The resulting scores guide lawmakers’ allocation of funding resources. See Code of Virginia, § 33.2-214.1; Virginia Smart Scale, http://vasmartscale.org/.

[4] Illinois Capital Development Board at https://www2.illinois.gov/cdb/about/Pages/default.aspx.

[5] Illinois FY2022 State Capital Budget, p. 32.