January 16, 2020

On December 19, 2019 the Illinois Supreme Court struck down the City of Chicago’s ordinance imposing a tax on other tobacco products. The Supreme Court sided with the plaintiff that the City’s ordinance is preempted by the Illinois Municipal Code, which states home rule municipalities that have not imposed “a tax based on the number of units of cigarettes or tobacco products before July 1, 1993, shall not impose such a tax after that date.” While the City had a cigarette tax in 1993, it did not impose a tax on other tobacco products until 2016.

In March 2016 the City of Chicago adopted an ordinance imposing a tax on other tobacco products that was scheduled to go into effect July 1, 2016. The ordinance included taxes of $1.80 per ounce for both smoking tobacco and smokeless tobacco, $0.20 per cigar for both little and large cigars and $0.60 per ounce of pipe tobacco. However, a complaint was filed in the Circuit Court of Cook County challenging the City’s authority to impose a tax on these products and the July 1, 2016 implementation date was deferred until the matter was resolved by the courts.

On January 20, 2017, the Cook County Circuit Court ruled that the City’s tax on other tobacco products violated a state law that prohibited home rule municipalities in Illinois from imposing new taxes on other tobacco products after July 1, 1993.[1] Chicago had a cigarette tax in place but not a tax on other tobacco products before July 1, 1993. The City appealed in April 2017. The Illinois Appellate Court then overturned the Circuit Court decision on December 20, 2018 as too narrow a reading of State statute. The Appeals Court ruled that in the statute, cigarettes or tobacco products was meant to be a broad category and therefore, since the City imposed a tax on cigarettes before the deadline, the City may also impose a tax on other tobacco products.

The plaintiff appealed to the Illinois Supreme Court, and the Supreme Court issued a decision on December 19, 2019 striking down the City’s tax on other tobacco products. The Supreme Court agreed with the Circuit Court and the decision stated that the language in state law was intended to prohibit future municipal taxes on cigarettes or other tobacco products unless the tax was enacted before July 1, 1993. The ruling does not impact the tax on e-cigarettes, also known as liquid nicotine products, which are categorized differently than other tobacco products. Taxes on e-cigarettes were imposed by the City of Chicago and Cook County in 2016 and by the State of Illinois in 2019.

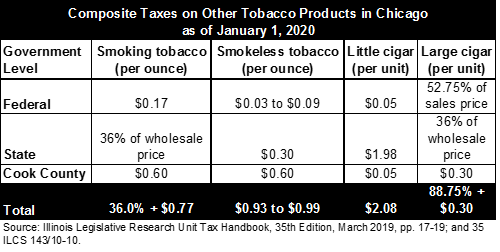

Federal, state and local governments have different taxes on other tobacco products The composite rates for a purchaser of other tobacco products in Cook County are shown in the following table and discussed further below. Other tobacco products are also subject to the sales tax on general merchandise.

The federal government taxes smoking tobacco at a rate of $0.17 per ounce and smokeless tobacco at a range from $0.03 to $0.09 per ounce depending on the type of smokeless tobacco. Large cigars are taxed by the federal government at 52.75% of the sale price, limited to approximately $0.40 per cigar.

The State of Illinois imposes a tax on the wholesale price for non-cigarette tobacco products. Effective July 1, 2012, the State tax on the wholesale price for non-cigarette tobacco products increased from 18.0% to 36.0%. Effective August 1, 2012, roll-your-own cigarette machine operators are required to pay an annual license fee of $250. While this fee is not a consumer tax, the additional cost may be passed onto consumers. Cigarettes sold by roll-your-own establishments are also subject to the State’s regular cigarette tax of $1.98 per pack. As of January 1, 2013, moist snuff tobacco products are taxed at $0.30 per ounce.

Cook County began taxing other tobacco products on March 1, 2012. As of January 1, 2013, County taxes on tobacco products include $0.60 per ounce of smoking tobacco and smokeless tobacco, $0.05 per little cigar and $0.30 per large cigar.

Relevant Links

Increases and Changes to Consumer Taxes in Chicago for 2020

Chicago’s Tax on Other Tobacco Products Struck Down by Cook County Circuit Court

City of Chicago FY2020 Proposed Budget: Analysis and Recommendations

[1] Iwan Ries & Co., et al. v. City of Chicago, Cook County Circuit Court Case No. 2016-L-050356.