June 12, 2013

Due to its large backlog of outstanding bills, the State of Illinois has permanently extended its annual deadline for paying old bills to December 31—six months after the end of the fiscal year.

The extension was enacted without fanfare in August 2012 as an amendment to the State Finance Act. Beginning in FY2013, the General Assembly gave the Comptroller’s Office six months after the fiscal year ends on June 30 to make the required payments.

Permanently extending the deadline is a reflection of the State’s ongoing fiscal crisis. Using this year’s money to pay last year’s bills strains the current budget because those revenues are not available to meet current expenses. Extending the deadline also means that vendors, social service agencies and local governments must wait longer to be paid by the State.

As discussed here, the time during which the State is allowed to pay the past fiscal year’s bills with current fiscal year revenues is called the lapse period. The State Finance Act generally requires the State to pay bills from a given fiscal year with that year’s appropriations. The Act has allowed two additional months after the end of the fiscal year—until August 31—to make the payments.

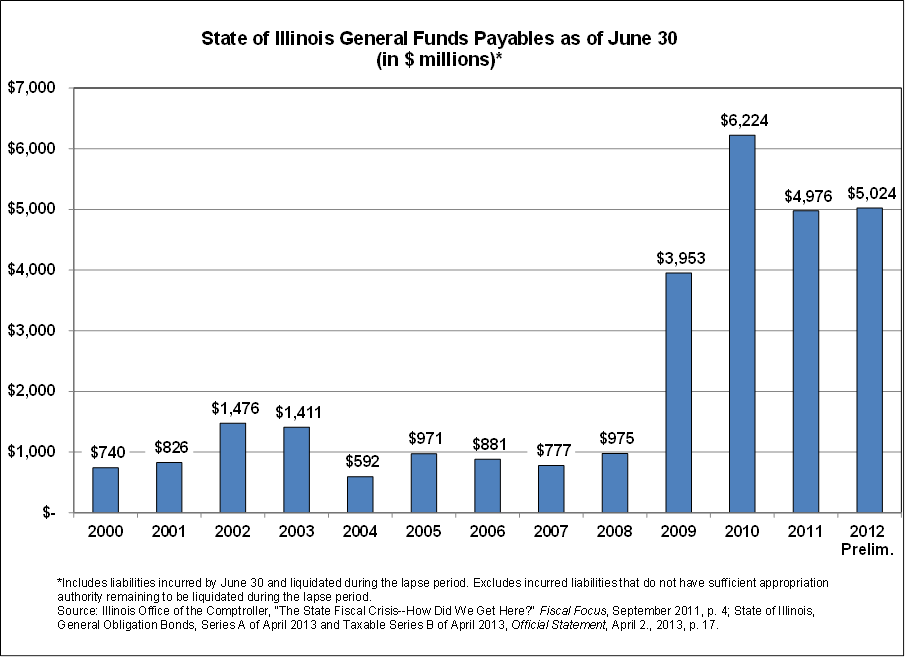

Faced with dramatic declines in revenue during the recession, the State was unable to pay its bills by the end of the normal lapse period. The legislature passed laws extending the lapse period to six months for FY2010, FY2011 and FY2012. General Funds payables increased from $975 million at the end of FY2008 to approximately $4.0 billion at the end of FY2009 and peaked at $6.2 billion at the end of FY2010. After a temporary income tax increase was enacted in mid-FY2011, payables declined to approximately $5.0 billion in FY2011 and FY2012.

The following chart shows actual fiscal year-end General Funds payables from 2000 to 2011 and preliminary results for 2012. Payables include unpaid bills, payments owed to school districts and universities and transfers due to local governments and other State funds. These obligations are paid off during the lapse period. Numbers in the chart do not include Section 25 liabilities (mostly Medicaid and group health insurance bills) and other obligations that are allowed to be deferred to future years due to inadequate appropriations. (Click to enlarge.)

Officials at the Comptroller’s Office said that the permanent extension of the lapse period was requested in response to a recommendation in March 2010 by the Illinois Auditor General. An audit of the Comptroller’s Office for FY2009 found that $478.2 million of checks were issued after the end of the lapse period on August 31, 2009 due to lack of available cash. The Auditor General recommended that the Comptroller seek legislative authority to pay outstanding liabilities after August 31, as long as requests for payments were submitted during the two-month lapse period.

Public Act 97-0932, signed by Governor Pat Quinn on August 10, 2012, states that the Comptroller must issue payments as soon “as practical” against bills incurred by June 30 and received by August 31; no payment may be issued more than four months after August 31, however, without the signed authorization of the Comptroller and the Governor.

As discussed here, the Comptroller’s Office was able to reduce the State’s backlog of unpaid General Funds bills from $6.9 billion on December 31, 2012 to $3.1 billion on April 30, 2013, due to an unexpected surge in income tax receipts. This surge, widely referred to as the April Surprise, is being attributed to accelerated payment of individual and corporate income taxes in 2012 to avoid higher federal tax rates in 2013.

As a result of the revenue increase, the Comptroller’s Office recently estimated that General Funds obligations at the end of FY2013 would total more than $6 billion, including both payables at the Comptroller’s Office and other obligations such as Section 25 liabilities. That is a decrease from the backlog estimate of $7.5 billion in the Governor’s FY2014 recommended budget, which was issued on March 6, 2013, before the April Surprise.