April 21, 2023

The State of Illinois currently pays debt service on four major types of bonds: General Obligation (GO) bonds for capital projects, GO bonds for pension obligations, GO bonds to pay backlogged bills and Build Illinois revenue bonds. In previous years, the State has also issued short-term debt. The Illinois Constitution, the Short-Term Borrowing Act and the 2020 Coronavirus Urgent Remediation Emergency Borrowing (CURE) Act all authorize the issuance of short-term debt.

All GO bonds are guaranteed by a pledge of the full faith and credit of the State, which is a legally binding pledge to pay both principal and interest on these loans as required by the bond agreements prior to directing revenues to-any other use of State funds. The State is authorized under the General Obligation Bond Act to issue bonds to fund a variety of capital investments, including roads, schools, mass transit, environmental projects and other facilities.

Outstanding State of Illinois Debt

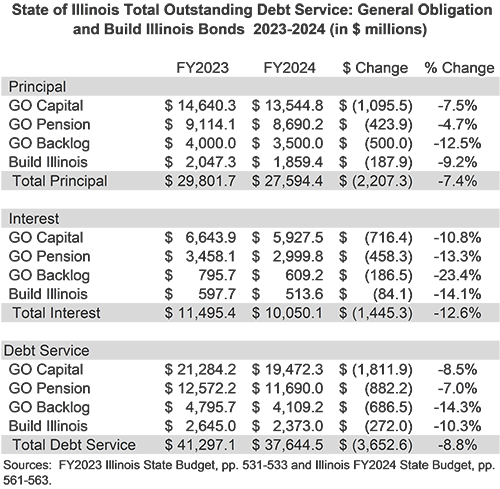

The following table shows the amount of debt service owed on each of the four major types of bonds, including principal, interest and total debt service (principal and interest combined) for the State of Illinois’ debt outstanding in FY2023 and FY2024.

Total outstanding principal on capital purpose GO bonds will decrease by $1.1 billion, from $14.6 billion in FY2023 to $13.5 billion in FY2024. The total debt service owed on all outstanding capital GO bonds will correspondingly decrease by $1.8 billion. The interest owed on these bonds will decrease by $716.4 million to $5.9 billion in FY2024.

The total principal owed on all outstanding pension (including pension acceleration) bonds in FY2024 will total nearly $8.7 billion, a decrease of $423.9 million from the total of $9.1 billion in the previous year. The outstanding interest owed on pension debt will decline by $458.3 million to $3 billion, from nearly $3.5 billion in the previous year. Total debt service, including both principal and interest, on the State’s pension bonds will total $11.7 billion in FY2024, compared to $12.6 billion in the previous year, a 7% or $882.2 million decrease.

The GO backlog bonds will decline by $500 million in principal and $186.5 million in interest between FY2023 and FY2024.

In FY2024, the principal on the outstanding Build Illinois Bonds will total nearly $1.9 billion compared to $2 billion in FY2023, a $187.9 million decrease. The interest owed on the loans through FY2048 will total $513.6 million as of FY2024, which will be a decrease of $84.1 million from FY2023. Total outstanding debt service on Build Illinois Bonds will decrease by $272 million to $2.4 billion as outstanding debt is retired.

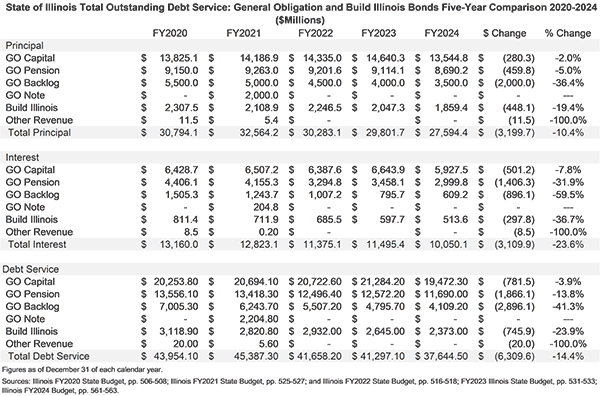

The next table compares the outstanding principal, interest and total debt service on all GO capital bonds, pension bonds, GO backlog bonds and Build Illinois Bonds over the five-year period from FY2020 to FY2024.

Between FY2020 and FY2024, the State of Illinois is expected to reduce the principal on outstanding bonds by 10.4% or $3.2 billion as outstanding bonds are retired. This is a decrease from $30.8 billion to nearly $27.6 billion.

Total interest owed on the State’s outstanding debt will decline by roughly $3.1 billion over this five-year period. Interest owed through FY2048 on pension bonds will be $1.4 billion less in FY2024 than it was in FY2020. Outstanding interest on capital GO bonds will decrease by $501.2 million over the five-year period; the State will owe $5.9 billion in interest on capital GO bonds for debt repaid through FY2048 compared to $6.4 billion in FY2020. The interest owed on outstanding Build Illinois Bond debt through FY2048 will fall by $297.8 million over five years, from $811.4 million in FY2020 to $513.6 million in FY2024.

The GO Note debt service represents payments due for the $2 billion three-year short-term debt borrowed on December 17, 2020 from the federal Municipal Liquidity Facility to fund costs associated with the COVID-19 pandemic. This debt was retired by January 2022.

Total pension obligation debt service will decline by approximately $1.9 billion, from $13.6 billion to $11.7 billion between FY2020 and FY2024. This includes a drop of $459.8 million in pension debt principal expenses and $1.4 billion in pension debt interest expenses.

Total debt service between FY2020 and FY2024 will decline by 14.4%, or $6.3 billion, falling from $43.9 billion to $37.6 billion.

New General Obligation Debt Issues in FY2023 and FY2024

In the FY2024 Budget Book, the State announced that it would issue nearly $2.2 billion in new GO bonds to fund capital projects. This is an increase from the $1.8 billion planned for issuance in the current 2023 fiscal year. The bond issues over the five years from FY2020 through FY2024 will support projects in the State’s Rebuild Illinois capital plan approved in June 2019.

In March 2023, the State updated its initial bond issuance figure by indicating that it would be issuing approximately $2.5 billion in general obligation bonds in May. These bonds will be used to fund accelerated pension benefit payments, to finance Rebuild Illinois capital expenditures and to fund information technology projects under previous capital programs as well as the Rebuild Illinois program.

Bond Ratings

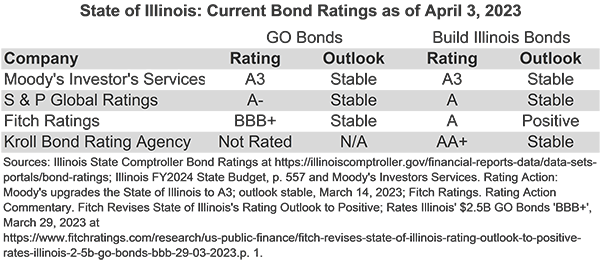

Bond ratings are one of the factors that weigh heavily in determining the interest rates the State must pay to issue debt. The following chart shows the current ratings for Illinois’ General Obligation Bonds and Build Illinois Bonds.

Recent Rating Agency Actions

In 2022 and 2023, three of the rating agencies – Moody’s Investors Services, Standard & Poor’s Global Ratings and Fitch Ratings – each upgraded the credit ratings for State of Illinois debt.

Moody’s Investors Services upgraded the State of Illinois’s issuer rating from Baa1 to A3 on March 14, 2023. Concurrently, it also increased the credit ratings of the State’s general obligation and Build Illinois sales tax bonds to A3 from Baa1. Moody’s cited continued improvement in the State’s financial situation for the upgraders, including expansion of fiscal reserves, increased payments toward outstanding liabilities such as the pension funds and improved governance processes. The rating agency warned, however, that Illinois continues to face large long-term liability pressures that constrain its fiscal flexibility.

On April 21, 2022, Moody’s had upgraded the rating of State of Illinois debt from Baa2 to Baa1 with a stable outlook. The rating agency cited the State’s steady revenue growth, which has allowed Illinois to increase its reserves and make additional payments towards pension liabilities as a key reason for the upgrade. At the same time, Moody’s also upgraded its rating for outstanding Build Illinois sales tax bonds from Baa2 to Baa1 with a stable outlook.

In March 2023, Fitch revised the State of Illinois’s rating outlook to positive from stable and assigned a BBB+ rating to the State’s $2.5 billion in general obligation bonds. The change reflected the State’s plans to increase its reserve fund contributions and its improved fiscal resilience.

In May 2022, Fitch Ratings made the following ratings upgrades:

- State of Illinois general obligation bonds were upgraded to BBB+ with a stable outlook from BBB-;

- Senior and Junior obligation Build Illinois sales tax revenue bonds were upgraded to A with a stable outlook from the previous BBB+ rating; and

- The issuer default rating was raised to BBB+ with a stable outlook from BBB-.

Fitch cited the State’s increased contributions to its reserves, the ending of certain pandemic-related non-recurring fiscal measures and the return to normal fiscal decision-making processes as the primary reasons for the upgrades.

In February 2023, Standard and Poor’s Global Ratings raised its credit rating to A- from BBB+ with a stable outlook on the State of Illinois’ outstanding long-term general obligation debt. It also raised the rating to A from A- on the State’s Build Illinois junior and senior lien sales tax bonds. The reasons given for the upgrade were the State’s increased repayment of its liabilities, increases in the Budget Stabilization Fund and a slowing of growth in statutorily required pension fund growth.

Standard and Poor’s Global Ratings previously raised its rating on State of Illinois general obligation debt to BBB+ from BBB with a stable outlook in May 2022. At that time, it also raised the rating on Build Illinois senior and junior lien sales tax bonds to A- from BBB+. The upgrade was due to the State’s increased financial flexibility, improved revenue reporting transparency, increased funding for the stabilization fund, additional contributions to the State’s pension funds, the elimination of the State’s bill backlog and the use of surplus revenues to reduce liabilities.