December 14, 2012

If the U.S. Congress is unable to agree to an alternative to the automatic $491 billion in combined tax increases and spending cuts set to take place in January 2013, many are predicting dire national economic consequences. Additionally, Illinois and other states will also see a major decrease in available resources if the so called “fiscal cliff” comes to fruition.

According to the Illinois Department of Revenue (IDOR) the State could lose more than $1.0 billion in combined FY2013 and FY2014 revenues if no action is taken to avoid the cliff. The negative outlook comes on the heels of a positive early revenue projection for FY2014 that the State would otherwise see an increase in its largest revenue sources, income taxes and sales taxes, of roughly 2.4% or $640 million. These findings were presented to the Illinois House of Representatives’ Revenue and Finance Committee on November 26, 2012 by IDOR Research Director Natalie Davila.

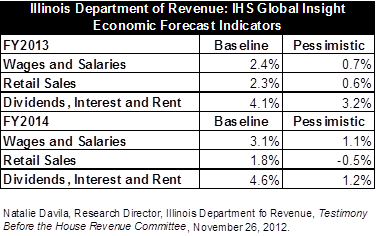

Revenue losses due to the fiscal cliff for the State of Illinois are based on IDOR shifting its economic outlook from baseline growth forecasts to pessimistic forecasts for FY2013 and FY2014. The State relies on economic indicators provided by consulting firm IHS Global Insight to develop its year-to-year revenue forecasts. The firm supplies an analysis of the elements of the economy that drive various revenue sources. IDOR then uses these growth rates along with statutory changes, state tax rates and other collection data to produce the State’s revenue forecasts. In order to project income taxes and sales taxes, IDOR looks closely at the expected growth rates in wages and salaries, retail sales and a combined rate for dividends, interest and rent. Combined, personal income tax, corporate income tax and sales taxes make up roughly 75% of the State’s annual General Funds revenues, which totaled $33.7 billion in FY2012.

The following chart shows the change in growth assumptions for FY2013 and FY2014 from the baseline view to the pessimistic view provided by IHS Global Insights for each major category.

In its October 2012 revenue report, IDOR included a special note that IHS Global Insights warned of a potential shift to the pessimistic indicators if federal policy makers are unable to avoid the fiscal cliff. The U.S. economy most likely would experience a recession leading to the economy shrinking at a rate of 1.3%, rather than the baseline growth projection of 1.9%, according to the consulting firm. In the presentation to the House Revenue Committee, IDOR staff showed how this change in outlook from baseline to pessimistic would affect expected income and sales tax revenues in FY2013 and FY2014.

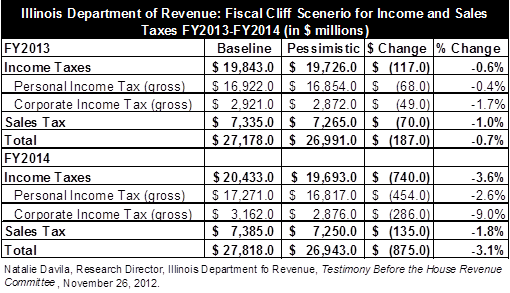

The losses in revenue in FY2013, according to the IDOR analysis, for income taxes and sales taxes would total $187 million from the current FY2013 estimates. A much larger decline would occur in FY2014 when the projections would fall by $875 million.

The following chart shows the change in revenue from personal income tax, corporate income tax and sales tax if the federal fiscal cliff is not averted.

The losses described in the chart above are based on the economic losses predicted to coincide with a recession caused by the economic policies that make up the fiscal cliff. However, the decline masks some increases in State tax rates that would also take place. Because Illinois links the amount of taxable personal and corporate income to the federal tax code, several deductions and tax credits that are eliminated in the fiscal cliff scenario would also no longer reduce the taxable income of Illinois taxpayers. A study by the Pew Center on the States details all of the eliminations under the fiscal cliff that will have an effect on states that are linked to the federal tax code. Using the information in the Pew report IDOR calculated that based on the reduction of the federal earned income tax credit, elimination of the deduction for student loan interest, elimination of tax-free employer tuition reimbursement, and reduction of business asset depreciation rates to 2001 levels, taxpayers would pay $45 million more in taxes in FY2014. This increase in revenue is not accounted for in the table above but does little to offset the magnitude of the economic losses to State revenues.

If the fiscal cliff is not mitigated and the pessimistic revenue projections presented by IDOR come to pass, the drop in revenue for FY2014 would further complicate the $964.7 million increase in the State’s annual pension payment and its multi-billion dollar backlog of unpaid bills expected at the end of FY2013.

Typically the State does not publish updated revenue estimates for current year revenues and projections for the next fiscal year until January, when at least 6 months of actual data for the year are available (the State’s fiscal year runs from July 1 to June 30). However, in order to explain the consequences of the fiscal cliff, early previews of the revenue trends were provided to the General Assembly. The next report on State revenues is expected in January 2013 as part of the Governor’s three-year budget forecast and should include a detailed analysis of all General Funds revenue sources from FY2013 to FY2016.