July 10, 2013

Charged with finding a solution to the State of Illinois’ pension crisis, a legislative conference committee is considering a reform framework proposed by public university presidents.

The central feature of the university proposal is a compounded automatic annual benefit increase set at half of the percentage increase in the Consumer Price Index (CPI). Current Illinois retirees and employees hired before January 1, 2011 receive compounded increases of 3%.

If inflation averages 2.75% over the long term, as assumed in the university plan, then the proposal would substantially reduce State pension costs. Instead of receiving a compounded increase of 3%, retirees would receive 1.375%. If inflation exceeded 6%, however, retirees would be protected against reductions in their purchasing power but the State would be faced with increased pension obligations.

The General Assembly formed the conference committee after the House and Senate reached an impasse on pensions during the spring session that ended on May 31, 2013. As discussed here and here, the House passed a version of Senate Bill 1 backed by House Speaker Michael Madigan, while the Senate approved Senate President John Cullerton’s Senate Bill 2404 and rejected the House Speaker’s plan.

The legislature’s failure to pass pension reform led to the downgrading of the State’s credit rating by two rating firms. In response to the downgrades, Governor Pat Quinn called the General Assembly back to Springfield for a special session on June 19 to deal with pensions. When it appeared that the two chambers could not agree on either SB1 or SB2404, the Governor proposed the creation of a conference committee and set a deadline of July 9 for committee action.

The 10-member bipartisan committee has held three public meetings and heard testimony from a variety of interested parties, including the university presidents. At the last meeting, on July 8, committee members spent much of the time sparring with Jerry Stermer, the Governor’s budget director, over the Governor’s insistence on the July 9 deadline. Panel members said they were waiting for actuarial reviews that were not expected to be completed until July 17 at the earliest. Senator Kwame Raoul, the committee’s chairman, said actuaries for the State’s retirement systems have been asked by the committee to assess the savings of a proposal based on the university plan.

At a press conference on July 10, Governor Quinn announced that he had vetoed lawmakers’ pay for FY2014 due to the General Assembly’s failure to pass pension reform. The Governor said that he wants legislative salaries and stipends to be suspended until pension reform is passed. He also said he will not accept a paycheck himself until significant pension changes are enacted. The Governor’s line item vetoes were applied to House Bill 214, the only budget bill for FY2014 that had not yet been signed into law. The Governor’s salary is $177,500 a year; lawmakers receive base salaries of $67,836 and additional stipends for leadership positions.

The conference committee has not scheduled its next meeting or released any information about specific proposals that are being considered. The university plan, as contained in Senate Bill 2591 and Senate Bill 1687, only applies to one of the State’s five pension funds, the State Universities Retirement System (SURS), which covers universities and community colleges. The plan is based on a proposal published in March 2013 by the University of Illinois’ Institute on Government & Public Affairs.

Statements by conference committee members suggest that the university plan is regarded as a promising framework because it offers the potential for State savings in line with the House Speaker’s proposal while possibly following the legal approach favored by the Senate President.

Illinois’ retirement systems are in the worst financial condition of any state’s, with a total unfunded liability of $96.8 billion and a combined funded ratio of 39.0% as of June 30, 2012, based on the market value of assets. General Funds pension costs, including State pension contributions and payments on pension bonds, totaled an estimated $6.7 billion in FY2013, or roughly 21% of State-source General Funds revenues. As discussed here, actuarial studies have shown that SB1 would lead to a far bigger reduction in State pension obligations and greater savings on annual State pension contributions than SB2404.

The two bills take different approaches to the State’s constitutional protection of pension benefits. Speaker Madigan’s SB1 is based on the idea that Illinois’ dire financial condition requires that pension benefits be reduced to preserve the State’s five retirement systems while continuing to fund critical State services. Senate President Cullerton maintains that a reduction in pension benefits can withstand a legal challenge only if employees and retirees are given something valuable in exchange for forgone benefits.

At a conference committee hearing on July 3, supporters testified that the university proposal might be able to withstand legal scrutiny because it offers retirement system members something valuable: protection against inflation. Although the State’s costs would increase when inflation is high, proponents contend that the impact is mitigated by the higher state tax revenues that typically accompany increased inflation.

The major components of the university plan include the following:

- Annual automatic benefit increase for retirees and employees hired before January 1, 2011 (known as Tier 1 employees) set at half of the percentage increase in the CPI for urban consumers, calculated on a compounded basis.

- Contributions for Tier 1 employees increase by 2 percentage points over four years (half a percentage point a year).

- A new Tier 3 plan that would be mandatory for new employees and optional for Tier 2 employees (those hired on or after January 1, 2011 who receive reduced benefits under pension changes enacted in 2010). The new plan would be a hybrid plan, combining a defined benefit plan and a defined contribution plan.

- Defined benefit plan. Employees would contribute 5.35% of earnings. The automatic annual increase would be half of the percentage increase in the CPI, compounded. Pensionable salaries for benefits and contributions would be capped at the Social Security wage base. Pensions would be based on a retirement formula of 1.5% of salary per year of service credit (compared with 2.2% in Tier 1).

- Defined contribution plan. Employees would contribute 2.65% of earnings, and employees (universities and community colleges, rather than the State) would contribute at least 1%.

- Beginning in FY2015, employers would increase their share of normal cost (current service cost) by half of 1% of payroll each year.

- 100% funding would be achieved by FY2044, with State contributions based on a method of allocating costs that does not defer costs, and enforcement measures would ensure State and employer funding.

- Any benefit increases would require a three-fourths vote of the General Assembly and would be subject to review by SURS and each individual institution.

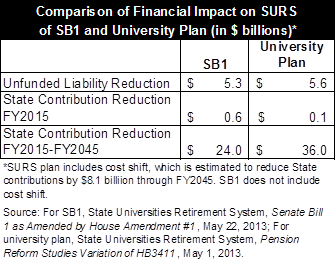

The table below compares the projected financial impact of the university plan and SB1. The actuarial review of SB1 is discussed here. The actuarial review of the university plan can be found here. This analysis only applies to SURS, which had an unfunded liability of $19.5 billion on June 30, 2012 and a statutorily required State contribution of $1.4 billion in FY2013.

It should be noted that the State contribution reductions for the university plan include the impact of shifting normal costs to universities and community colleges, estimated at $8.1 billion through FY2045. SB1 does not include the cost shift. Including the estimated impact of the cost shift would increase SB1 savings through FY2045 to $32.1 billion.