March 04, 2019

Governor J.B. Pritzker’s first budget proposal for the State of Illinois faced major challenges, including an operating deficit that the new administration estimated at $3.2 billion. Closing the gap by implementing a graduated income tax—a centerpiece of the Governor’s election campaign—was off the table in fiscal year 2020 because of the lengthy process required to amend the Illinois Constitution.

Instead, the FY2020 recommended budget, which was issued on February 20, 2019, relies on $1.0 billion in additional revenues and $2.3 billion in net spending reductions to produce a modest general operating surplus of $155 million. The revenue increases stem mainly from an assortment of new taxes on recreational cannabis, sports betting, plastic bags and managed care organizations.

General Funds spending is reduced by lowering State pension contributions, shifting Medicaid expenditures to other State funds and delaying the repayment of interfund borrowing. But the recommended budget also contains hundreds of millions of dollars of spending increases for human services, education and public safety, in part to make up for shortfalls during the budget impasse in FY2016 and FY2017.

If proposed tax increases are not enacted, the administration said the alternative is a 4.0% across-the-board reduction to net agency spending. Those cuts would not affect debt service, which is boosted by the proposed sale of $1.5 billion in bonds to reduce late-payment interest penalties on the State’s massive backlog of unpaid bills.

Although the Civic Federation has not completed its analysis, there are concerns about the feasibility and long-term costs of the Governor’s budget proposal. The reduction in pension contributions, which is achieved primarily by a seven-year extension of the schedule for paying down pension debt, could further weaken the financial condition of the State’s severely underfunded retirement systems. The revenue projections depend partly on new, untested taxes that must be implemented in a tight timeframe, as well as on one-time revenue sources that will not be available in future years.

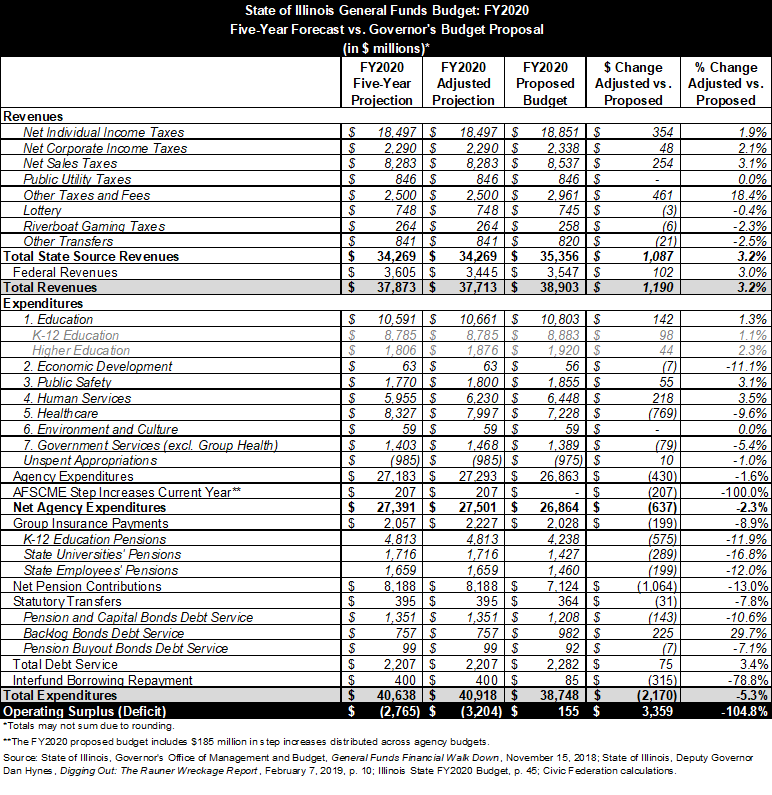

Governor Pritzker’s $3.2 billion deficit estimate for FY2020 is based on a modification of a five- year forecast in November 2018 by former Governor Bruce Rauner. For the year that begins on July 1, 2019, the Rauner administration projected an operating deficit of $2.8 billion. Shortly after taking office, Governor Pritzker increased the projected gap to $3.2 billion by adding $440 million in spending pressures.

The following table shows how the Pritzker administration proposes to close the $3.2 billion deficit. The table compares the adjusted five-year projection for FY2020 with Governor Pritzker’s FY2020 proposed budget.

FY2020 Revenues

FY2020 proposed State-source revenues are increased from the five-year projection released in November by $1.1 billion to $35.4 billion. Part of the increase is due to a more optimistic forecast of baseline revenues. The projection had used a pessimistic forecast scenario for FY2020 that contemplated a recession from the fourth quarter of 2019 through the second quarter of 2020. According to Governor’s Office officials at a hearing on February 28, the proposed budget has replaced the pessimistic outlook with a baseline scenario. The decision to switch was based on strong job and wage growth and federal tax changes.

Personal income tax is projected to be higher than the five-year projection due to economic stimulus from federal tax changes. However, at the hearing the Governor’s Office reported that this impact is expected to end soon. An additional $25 million comes from higher earnings due to the recent increase in the minimum wage, net of tax credits provided to employers to ease the phase-in of the increase. Sales tax revenues are higher due to increased collections by online retailers due to the U.S. Supreme Court decision in South Dakota vs. Wayfair, Inc.

Subtracting the Governor’s proposed tax changes from the total increase suggests that the improved outlook is responsible for roughly $280 million in additional revenues, although Governor’s Office officials warned that such a subtraction may not fully reflect the interaction between the revised estimates and the proposed policy changes.

The remaining revenues are detailed in the budget as specific changes in the tax code, resulting in an expected $751 million in additional General Funds revenues. The Governor proposes limiting the private school scholarship tax credit enacted as part of the 2017 school funding reform bill, which would increase individual income tax revenues for General Funds by about $6 million. Decoupling from a new federal tax change that allows corporations to deduct foreign derived intangible income would increase corporate income tax revenue by $94 million. Sales tax revenues would be increased by $75 million by capping the retailers discount at $1,000 per month. (The Civic Federation endorsed a cap of $200 per month in its FY2018 Roadmap.)

In addition to these changes, the Governor proposes several new revenue sources. A tax on plastic shopping bags is projected to produce $19 to $23 million for General Funds. The Governor also proposes to legalize and tax recreational cannabis and sports betting to produce $170 million and $212 million, respectively. As with all new sources, the amount of revenue produced is more speculative than with established sources, and State will need to successfully implement them within the fiscal year.

In addition to these concerns, the proposed structure of the licenses to provide recreational cannabis and sports betting effectively makes most of this revenue a one-time source. In both cases, the State will sell costly license fees up front, then allow the license holders to claim credits to defray the cost of the license in the next several years of tax returns.

Another proposed revenue source similarly accelerates future years’ revenue into FY2020: a delinquent tax payment incentive program is expected to bring in $175 million from all revenue sources, most of which would have eventually been collected by the Illinois Department of Revenue.

In addition to the revenues produced for General Funds, some of the Governor’s proposals provide revenues for other State funds. The cap on the retailers discount would result in an additional $58 million for the Local Government Distributive Fund. Additionally, the Governor proposes to maintain the diversions of income and sales taxes to local government and transit funds at 95% of the pre-FY2018 statutory formulas, as they were in FY2019. A restructuring of the cost of video gaming licenses that would make larger vendors pay higher fees is projected to provide the Capital Projects Fund with an additional $89 million. Managed care organizations would pay $867 million in new taxes into a Medicaid account called the Healthcare Provider Relief Fund (HPRF). Finally, a new tax on e-cigarettes and an increase in the tax on traditional cigarettes will together produce $65 million for HPRF. This in turn will be used to reduce the General Funds contribution for Medicaid, as discussed below.

FY2020 Expenditures

Proposed FY2020 General Funds spending of $38.7 billion represents a decrease of $2.2 billion, or 5.3%, from the previous projection of $40.9 billion.

Pensions

General Funds contributions to the State’s five retirement systems are reduced by $1.1 billion, or 13.0%, to $7.1 billion from $8.2 billion under existing law. Most of the savings—$878 million—comes from delaying the date to reach 90% funding to FY2052 from FY2045. The funds had total unfunded liabilities of $133.7 billion at the end of FY2018, based on the actuarial value of assets, and a combined funded ratio of 40.1%. Under the Governor’s proposal, the systems would be 65% funded in FY2045 instead of 90%.

Additional assumed savings of about $125 million are tied to making two pension buyout plans permanent that were scheduled to expire in FY2021. As discussed here, the buyouts allow members of the State’s largest retirement systems to give up future benefits in exchange for an immediate payment from the State. The buyouts were passed as part of the FY2019 enacted budget, which was balanced with the help of $445 million in assumed pension savings. Implementation of the plans has taken many months, and the proposed FY2020 budget assumes no pension savings in FY2019.

The FY2020 budget also proposes issuing $2 billion in pension obligation bonds to improve the systems’ funding levels. The borrowing is not expected to affect required contributions in FY2020 but could ultimately add to State costs if debt expenses exceed investment returns.

The pension-related measures are part of a five-point pension plan announced by the Pritzker administration in the week prior to the release of the FY2020 budget. The plan lays out two additional steps that are not reflected in the FY2020 budget: dedicating $200 million per year from a future graduated income tax to supplement statutorily required State contributions and transferring State assets to the pension funds. The Governor has created a task force to identify potential assets to shift to the funds’ books.

The administration has not yet provided actuarial reviews of the proposed pension changes.

Medicaid

General Funds appropriations for Medicaid (shown as Healthcare in the table) decline by $769 million, or 9.6%, to $7.2 billion from the adjusted projection of $8.0 billion. However, total funding for Medicaid actually rises in the proposed FY2020 budget because the decrease in general operating funds is more than offset by other resources.

The main source of new funding is the proposed assessment on healthcare managed care organizations (MCOs) designed to bring in additional reimbursements from the federal government. Of the $867 million total assessment, $390 million would replace a deposit into HPRF that would otherwise have come from General Funds. The remaining $477 million would go into the Medicaid program and, when paired with federal reimbursements, is expected to support nearly $1.2 billion in additional Medicaid spending. While the new spending would benefit MCOs that are paid by the State to service Medicaid clients, all MCOs would have to pay the tax due to a federal requirement that such assessments be imposed uniformly.

In addition to the proposed MCO assessment, Medicaid’s reliance on General Funds is reduced by another $332 million due to the new and increased cigarette taxes and a shift in existing cigarette tax revenues directly into HPRF.

Other Areas

Total General Funds appropriations for education of $10.8 billion are $142 million, or 1.3%, above the adjusted projection of $10.7 billion. The increase consists of an additional $98 million, or 1.1%, for elementary and secondary schools and $44 million, or 2.3%, for higher education.

Human Services appropriations rise by $218 million, or 3.5%, to $6.4 billion from $6.2 billion in the adjusted projection. More than $107 million of the increase stems from higher wages for State-funded home care aides, following Governor Pritzer’s signing of legislation to increase the State’s minimum wage in February 2019. These costs could be offset by federal Medicaid reimbursements, according to the proposed budget. Salary step increases for members of the American Federation of State, County and Municipal Employees (AFSCME) are included in the FY2020 budget’s agency appropriations but shown as a separate line item in the FY2019 budget and FY2020 projection.

Group health insurance declines by $199 million, or 12.0%, to $2.0 billion from $2.2 billion in the adjusted projection. After the reduction, the appropriation is below the original November 2018 projection. The new administration had raised the original projection by $170 million, which contributed to the increase in the estimated deficit. Officials said $60 million of the subsequent reduction reflects lower late-payment interest penalty costs due to the proposed $1.5 billion issuance of bonds to pay down the bill backlog. The interest rate paid on the bonds is expected to be lower than the annual penalties of 9% or 12% paid on group health insurance bills and many other bills.

The new backlog bonds also result in a $75 million increase in transfers out of General Funds to pay for debt service to $2.3 billion in the proposed FY2020 budget from $2.2 billion in the adjusted projection. The increase is due to Governor Pritzker’s plan to issue $1.5 billion in bonds to shrink the unpaid bill backlog. This additional expense more than offsets a decrease in pension bond debt service resulting from the final expiration of bonds that were issued in 2011 to pay for the State’s annual pension contributions.

FY2019-FY2020

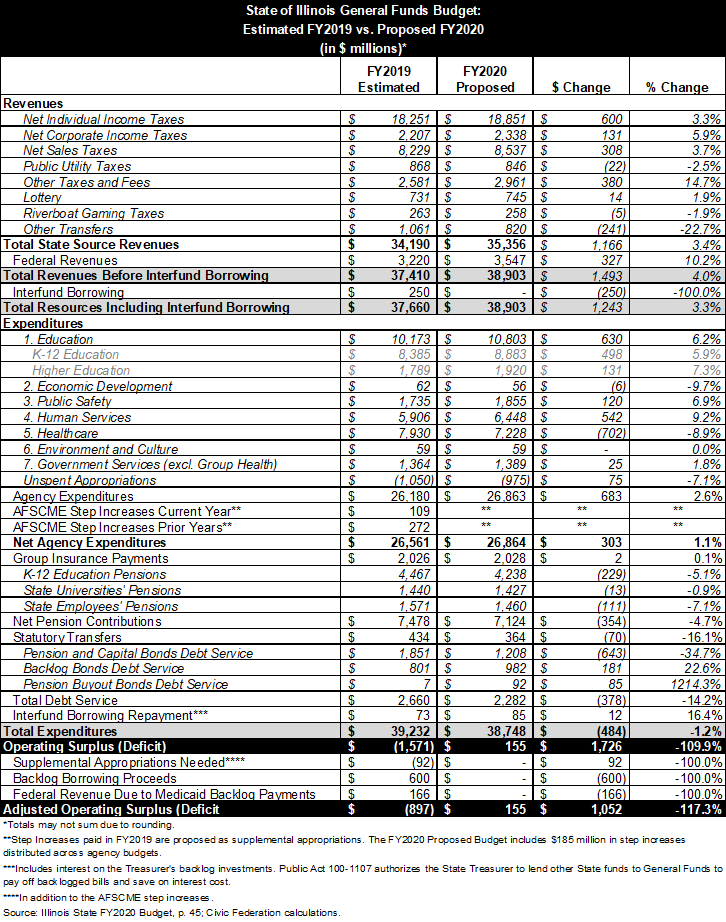

The next table compares estimated budget results in FY2019 with the Governor’s proposed FY2020 budget. General Funds revenues before interfund borrowing increase by $1.5 billion, or 4.0%, from $37.4 billion due to the proposed tax increases outlined above and Governor Pritzker’s more optimistic projection for economic growth in FY2020.

General Funds expenditures decline by $484 million, or 1.2%, from an estimated $39.2 billion in FY2019, due largely to the pension and Medicaid changes described above. Net debt service transfers decrease from FY2019 because of the expiration of the 2011 pension bonds.

Despite these decreases, spending for K-12 education increases by $498 million, fueled by a $375 million increase in the evidence-based funding formula—$25 million more than the annual target amount of $350 million—and a $100 million increase for early childhood programs. Higher education funding rises by $131 million, or 7.3%, with increases for public universities, community colleges and Monetary Award Program tuition grants for low income college students. Proposed human services spending increases come from expanding eligibility for child care subsidies and funding statutory wage increases and caseload growth in the Home Services Program for the physically disabled.

With the AFSCME step increases included, the expected revenues and expenditures for FY2019 will result in a deficit of $1.6 billion. This deficit would be widened by an additional $92 million in supplemental appropriations proposed by the Governor. However, he proposes to help narrow the gap by issuing an additional $1.5 billion of backlog bonds. Of these, $900 million would go to the Health Insurance Reserve Fund to pay health insurance bills and $600 million would be directed to General Funds. This would in turn generate an additional $166 million of federal reimbursements for payment of Medicaid bills. After these adjustments, the final expected deficit for FY2019 is about $900 million.

Backlog

On a budgetary basis, the unpaid bill backlog would be $8.4 billion at the end of FY2019. Despite the expected FY2019 deficit, this total is lower than the ending FY2018 backlog of $8.8 billion due to the proposed backlog bonds. If the FY2020 budget is implemented as proposed, the Governor’s Office forecasts an ending backlog of $7.9 billion.

Note: This blog post was modified on May 2, 2019 to reflect updated information.