June 06, 2013

Less than a week after the Illinois General Assembly adjourned its regular spring session without approving reform of the State’s underfunded retirement systems, two of the three major rating agencies have downgraded the State’s bond ratings. Both Fitch Ratings and Moody’s Investors Service cut the State’s rating one level, while Standard and Poor’s issued a statement calling the lack of pension reform, “another missed opportunity.”

The General Assembly closed the books on its regular session on May 31, 2013 without addressing its $96.8 billion unfunded pension liability and the unsustainable growth in its required annual contributions, despite urging from Governor Pat Quinn and consideration of several significant pieces of legislation in both chambers.

Specifically citing the inaction, Fitch Ratings lowered Illinois’ General Obligation (GO) bond rating to A- from A on June 3, 2013, the first business day following the end of the General Assembly’s regular session. On June 6, 2013, Moody’s Investors Service followed suit, reducing the State’s rating to A3 from A2, due to the State’s unresolved pension crisis. While critical of the legislature, S&P’s statement issued on June 6, 2013 explained that it had no plans to immediately downgrade the State any further, after downgrading the State’s rating on January 25, 2013 to A- from A.

Moody’s report accompanying the downgrade states that its analysis of the State’s financial condition not only takes into account the legislature’s failure to act on pension reform but also assumes that the General Assembly will not take action to resolve the problem anytime soon. The agency blames the “legislature’s political paralysis” when it comes to pension reform on the magnitude of the State’s unfunded liabilities as well as the legal and political hurdles any comprehensive reform measure would face.

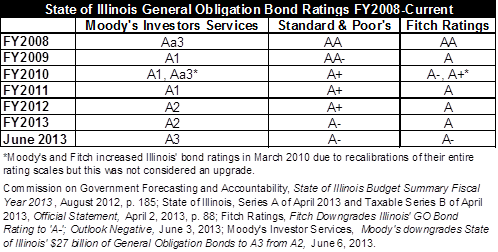

The following chart shows the current GO bond ratings from all three agencies compared to the FY2013 ratings prior to adjournment and for the last five fiscal years.

As discussed here, Illinois’ bond rating is the lowest of all 50 states, leading to dramatically higher borrowing costs than better-rated governments. However, as pointed out in a previous IIFS blog, despite the lowest rating among states, Illinois’ debt is still considered investment grade and now would need to be downgraded an additional four times by any one rating agency before falling into the speculative or junk category.

The latest downgrades put Illinois on the final step of the ‘A’ ratings for all three agencies before entering the ‘BBB” status. Fitch and S&P have downgraded Illinois’ rating six steps in the past five years, while Moody’s has reduced its level four times. All three agencies maintain a negative outlook on the State’s finances, indicating the possibility for further downgrades.

According to the statement issued by S&P, it is rare for any state to fall into the ‘BBB’ category. However, without pension reform, the State’s finances could be expected to deteriorate further, leading to additional downgrades, S&P stated. The statement also explained that despite the ongoing negative outlook, the agency was not joining the other two agencies in issuing an additional downgrade because the lack of action by the legislature was in line with its low expectations for the General Assembly when S&P issued its last downgrade of Illinois in January. That reduction came in advance of a planned $500 million GO bond sale by Illinois in February. The agency cited a lack of action on pension reform during the General Assembly’s brief January session as cause for the rating cut. The action by S&P preceded the cancellation of the February debt issuance, but Illinois returned to the market in April with a new bond sale totaling $800 million.

The reports this week from Fitch and Moody’s include references to the State’s lack of pension reform as the catalyst for the downgrades. However, the analysis from all three agencies point out the State’s precarious position as pension contributions continue to grow while the State struggles to cope with a multi-billion dollar backlog of unpaid bills and the fact that it is entering the final fiscal year (FY2014) prior to the scheduled rollback of the State’s income tax increases on January 1, 2015.

In reaction to the downgrades, Governor Pat Quinn issued a statement expressing frustration with the lack of action by the legislature and announcing he would convene a special session of the General Assembly on June 19, 2013, to address the issue. Approving a pension reform measure during special session faces an additional obstacle; any legislation that would take effect immediately requires the approval of a super majority (3/5ths) in each chamber.