June 02, 2020

When Illinois lawmakers met in Springfield to pass a budget for the upcoming fiscal year, the main issue they confronted was the tax shortfall caused by COVID-19. They did not want to include revenue from a proposed graduated income tax, which will only be available if voters approve the plan in November 2020.

Instead, the $43 billion budget passed on May 24 depends on $5 billion in borrowing through a new Federal Reserve program and about $1.2 billion in other debt. While the federal loans have been widely discussed, the additional borrowing has escaped notice because it was authorized in 2019 as a way to reduce the State’s backlog of unpaid bills and did not require action during this legislative session.

The only budget legislation signed so far by Governor JB Pritzker is a bill authorizing participation in the Federal Reserve program. But the Governor has argued that all of the borrowing could be avoided if Congress provides Illinois and other states with sufficient grants to cover pandemic-related revenue losses. A bill that would give states $500 billion in direct aid was passed by the U.S. House of Representatives earlier this month, but it has faced obstacles in the U.S. Senate. Additionally, amending the Illinois Constitution to permit graduated income tax rates is now expected to bring in nearly $1.2 billion in FY2021—about the same amount of revenue as the backlog borrowing.

Without those resources, borrowing closes a gap between General Funds revenues of $36.5 billion and expenditures of $43.0 billion, according to a budget summary by the Illinois Senate Democratic staff. Spending in FY2021, which begins on July 1, includes repayment of $1.6 billion in borrowing to cover revenue shortfalls in FY2020. The budget was passed along party lines, with minority Republican lawmakers criticizing the lack of spending cuts and the Governor’s authority over the distribution of federal funds to cover pandemic expenses. Democratic legislative leaders said they were opposed to reduced spending at a time of high unemployment and increasing social needs.

Before the four-day special session in May, the General Assembly had not met since March 5. The legislature could have convened earlier as an essential operation under Governor Pritzker’s stay-at-home order but chose not to for safety reasons. The Governor and legislative leaders interpreted a State law to require in-person meetings, which prevented the kind of remote meetings being conducted by the City of Chicago, Cook County and some other states. An attempt to change the statute failed to pass in the House and was not considered in the Senate, although the Senate subsequently approved rules allowing remote participation in Senate committee meetings, as well as limited remote participation in Senate floor sessions if a quorum is physically present.

During the brief May session, in addition to the bill on federal loans, the General Assembly approved legislation covering FY2021 operating appropriations and capital appropriations, statutory changes required to implement the budget and a new hospital assessment program to bring in additional federal funding for the State’s Medicaid program. Lawmakers also passed a gaming bill designed to pave the way for a Chicago casino. Because the budget legislation comprises thousands of pages and was not filed until the session began, the following analysis of the operating budget should be regarded as preliminary.

FY2021 Borrowing

The General Assembly’s FY2021 budget authorizes borrowing of up to $5 billion through the Federal Reserve’s Municipal Liquidity Facility (MLF) or a similar federal program. As explained here, the MLF was created as a short-term borrowing program to help states and large local governments deal with temporary cash flow problems generated by the negative impact of the pandemic on government revenues. Interest rates in the MLF program are based on governments’ credit ratings. Because Illinois has the lowest credit rating of any state, it would pay a relatively high interest rate on the loans—but not as high as the rates currently demanded by investors.

Loans through the MLF were initially limited to one year but were recently extended to 36 months. The General Assembly authorized Illinois to borrow through the program for up to ten years. That term reflects a provision in the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, the federal relief bill that passed the U.S. House but has stalled in the Senate.

To balance the FY2021 budget, the General Assembly also included about $1.2 billion from the sale of backlog bonds. The State previously sold $6 billion of backlog bonds in October 2017 to pay down the record $16.7 backlog of unpaid bills accumulated during the two-year budget impasse. Last year the legislature authorized the sale of an additional $1.2 billion in backlog bonds to further reduce the amount of unpaid bills, which currently stands at $6.9 billion. The additional bonds, which have not yet been issued, may be used to pay down bills more than 90 past due. While proceeds from the initial bonds reduced the existing backlog, the General Assembly’s FY2021 budget uses the additional bond proceeds to offset current expenses.

In addition, the General Assembly increased by $300 million—to $1.5 billion from $1.2 billion—permitted borrowing from other State accounts to support General Funds. The borrowing period was extended for a year, through FY2021, and the interfund borrowing must be repaid in 48 months.

The administration previously announced several borrowing initiatives to close the virus-related budget gap in FY2020, including the sale of $1.2 billion in short-term debt. That sale, originally scheduled for May 6, was put on hold due to steep interest rate penalties on Illinois bonds. Officials said recently that the State is applying to sell the bonds through the MLF. The General Assembly’s FY2021 budget changed a provision in the Short Term Borrowing Act to allow the bonds to be sold through a negotiated process, rather than by sealed bid. The State Treasurer also agreed to the extension until FY2021 of $400 million of investments with the Illinois Comptroller that were scheduled to be repaid in FY2020. These two initiatives will require repayment of $1.6 billion, plus interest, in FY2021. Additionally, interfund borrowing in FY2020 is now expected to total $473 million, $323 million above initial projections.

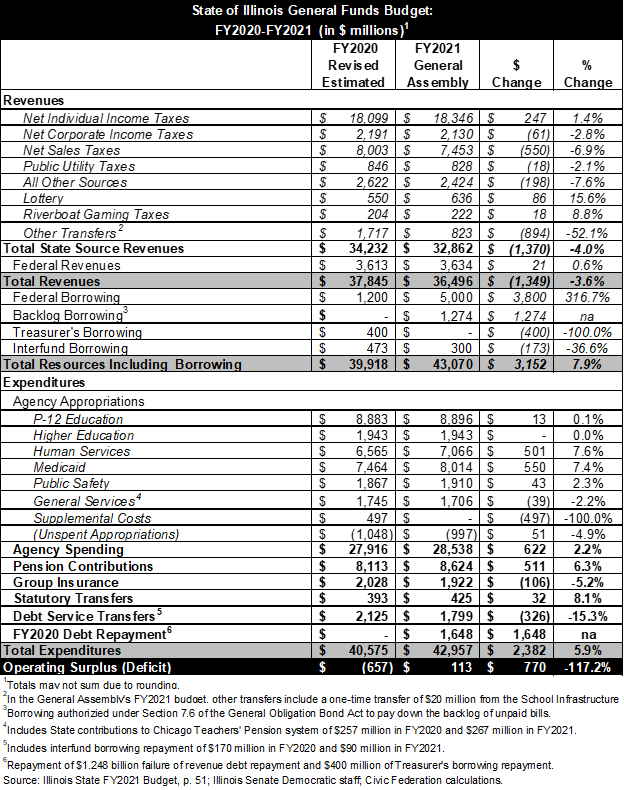

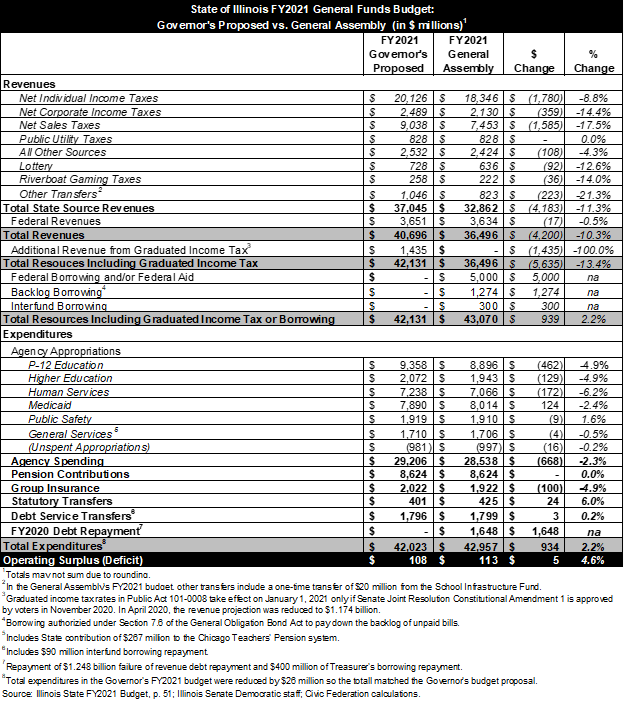

The table below shows the backlog borrowing amount as $1.274 billion, instead of $1.2 billion, to reflect the possibility that revenue from graduated tax rates could be used in place of the borrowing. Before the pandemic shutdown, the Governor’s Office of Management and Budget (GOMB) estimated that the new rate structure would bring in $1.435 billion beginning in January 2021, midway through the 2021 fiscal year. In April GOMB reduced its projection to $1.174 billion, but that number was net of a supplemental pension contribution of $100 million.

FY2021 Operating Revenues

The General Assembly’s estimate of operating revenue is similar to projections issued in April and May by GOMB and the General Assembly’s Commission on Government Forecasting and Accountability. Total General Funds revenues before borrowing of $36.5 billion are $1.3 billion, or 3.6%, below revised estimated FY2020 revenues of $37.8 billion. The current FY2021 projection is $4.2 billion, or 10.3%, below the $40.7 billion (not including graduated income tax revenue) in the Governor’s FY2021 budget proposal in February. Lawmakers emphasized that the potential impact of the pandemic-related economic shutdown on revenue collections remains unclear, increasing the likelihood that the budget may have to be adjusted as more is known.

Individual income taxes, the State’s largest revenue source, increase slightly to $18.3 billion in the legislature’s FY2021 budget from $18.1 billion in FY2020 and are down by $1.8 billion, or 8.8% from $20.1 billion in the Governor’s budget. Corporate income taxes decline to $2.1 billion in FY2021 from $2.2 billion in FY2020 and are down by $359 million, or 14.4%, from $2.5 billion in the Governor’s budget. As explained here, income tax collections in FY2021 are inflated by more than $1 billion due to the three-month extension of the deadline for making final 2019 income tax payments. The new deadline, July 15, 2020, falls in the State’s 2021 fiscal year, and taxes received after June 30 are booked in FY2021 for budget purposes. In addition, the General Assembly’s budget includes a slight decrease in the share of income tax revenues set aside to pay tax refunds; that change increases revenues available to General Funds.

Sales taxes are forecast at $7.5 billion in the legislature’s FY2021 budget, a decrease of $550 million, or 6.9%, from $8.0 billion in FY2020 and $1.6 billion, or 17.5%, from $9.0 billion in the Governor’s proposal. Transfers from lottery sales are $636 million in the General Assembly’s budget, an increase of $86 million from the revised FY2020 forecast but a decrease of $92 million from the Governor’s budget. Other Transfers in the legislature’s FY2021 budget are down by $894 million from FY2020 and by $223 million from the Governor’s proposal, partly because of reduced transfers from the account that pays income tax refunds. The General Assembly’s FY2021 budget includes $20 million in transfers from the School Infrastructure Fund, an account used to pay for school improvements.

For the first time since FY2017, the General Assembly did not reduce the statutory share of State income taxes distributed to local governments in Illinois. The share was lowered by 10% in FY2018 and 5% in the following two years to provide additional money for State operations. However, local governments have not benefited from income tax rate increases in effect since 2011, and the actual amount of local distributions is likely to decline in FY2021 because of the significant reduction in State income tax collections. The General Assembly’s FY2021 budget continues to reduce the share of State sales taxes distributed to transit districts by 5% from the pre-FY2018 formula. An early version of the budget implementation bill (known as the BIMP) would have required the State’s Road Fund to cover $100 million more of the public transit distribution to relieve pressure on General Funds. However, this provision was not included in the final BIMP.

As discussed here, Illinois received a total of $4.9 billion under the federal Coronavirus Aid, Relief and Economic Security (CARES) Act passed in late March. Of that amount, $3.5 billion went to the State itself and $1.4 billion was divided among Illinois’ five largest counties and the City of Chicago. The money can only be used to cover new expenses from March 1 to December 30 of this year to combat COVID-19 and is not available to offset lost revenue due to the virus. The General Assembly allocated $250 million of the State’s $3.5 billion share to local governments outside of the Chicago area. None of these federal dollars are deposited into General Funds, although federal revenues included in General Funds reflect enhanced federal Medicaid reimbursements provided under the Families First Coronavirus Response Act.

Lawmakers also approved language for the proposed graduated income tax constitutional amendment on the November general election ballot. State law requires that the ballot language for an amendment, along with an explanation and arguments for and against, be sent to voters before the election. Last year the General Assembly approved the graduated income tax amendment and a new income tax rate structure that takes effect if the amendment is approved.

FY2021 Expenditures

The General Assembly’s FY2021 budget has $43.0 billion in total expenditures, which represents an increase of $2.4 billion, or 5.9%, from the revised FY2020 spending estimate of $40.6 billion. Total spending in the legislature’s budget is $934 million, or 2.2%, higher than the Governor’s proposed FY2021 spending of $42.0 billion. The increase from FY2020 and from the Governor’s budget partly reflects the repayment of borrowing in FY2020.

Like the Governor’s budget proposal, the legislature’s budget provides full payment of statutorily required contributions to the State’s five retirement systems in FY2021. The $8.6 billion in General Funds pension contributions represents an increase of $511 million, or 6.3%, from the prior year. Group insurance payments of $1.9 billion in the General Assembly’s budget are down by roughly $100 million from both the FY2020 budget and the Governor’s proposal. Debt service transfers and interfund borrowing repayments in the legislature’s budget are even with the Governor’s budget and $326 million below the prior year.

Agency spending—not including pension contributions, group insurance, debt service and statutory transfers—totals $28.5 billion in the General Assembly’s budget. That represents an increase of $622 million, or 2.2%, from $27.9 billion in FY2020. Agency spending declines by $668 million, or 2.3%, from $29.2 billion in the Governor’s budget. The legislature’s budget gives the Governor more discretion to move funds around within specific agencies.

- P-12 education: Funding is essentially flat from FY2020 at $8.9 billion. The Governor’s FY2021 budget proposed a $50 million increase for early childhood education and a $350 million increase for the State’s evidence-based funding formula for elementary and secondary education, the minimum target amount in the 2017 school funding reform law.

- Higher education: Funding is kept at the FY2020 level of $1.9 billion. The Governor had recommended a $129 million increase, including $50 million in additional Monetary Award Program tuition grants for low income college students and about $56 million in new funding for public universities.

- Human services: Funding of $7.1 billion represents an increase of $501 million from FY2020 and a decrease of $172 million from the Governor’s budget. The legislature’s budget has significant annual increases for the troubled Department of Children and Family Services and the Department on Aging’s Community Care Program; new funds to comply with a federal consent decree involving community services for individuals with developmental disabilities; and increases to support rate reimbursements for social service agencies to support minimum wage increases.

- Medicaid: General Funds appropriations for the State’s Medicaid program are $8.0 billion, an increase of $550 million from FY2020 and $124 million from the Governor’s budget. The legislature’s budget includes higher reimbursement rates for federally qualified health centers (FQHCs) and specialized mental health rehabilitation facilities (SMHRFs). It also authorizes the provision of Medicaid services to certain non-citizens over 65 who would not otherwise be eligible.

- Personnel: The budget does not break out the cost of wage increases negotiated with labor unions or the overall impact of minimum wage increases enacted in 2019 on State agency payrolls and reimbursements to social service providers. Although the budget does not specifically prohibit legislative pay raises, State officials have said that appropriated amounts do not cover raises for General Assembly members.

The next table compares the General Assembly’s FY2021 budget with the Governor’s proposed FY2021 budget.

Other Major Legislation Passed During the Session

In addition to the budget and borrowing legislation described above, the General Assembly also passed a gaming bill and property tax-related legislation.

Gaming Bill

The historic $45 billion Rebuild Illinois capital plan that was approved as part of the FY2020 budget relied heavily on an expansion of gaming to fund “vertical” non-transportation construction projects, such as state facilities and higher education. The expanded gaming included six new casinos, including a Chicago casino, as well as an increase in the number of gaming slots at existing casinos and other measures. Revenues to the City of Chicago from the casino were directed to pay for police and fire pensions. However, a feasibility study conducted in August 2019 by a consultant hired by the Illinois Gaming Board found that a Chicago casino at any one of five potential locations would not be feasible due to an onerous tax and fee structure.

In an effort to make the Chicago casino more attractive to potential developers, the Illinois General Assembly approved a gaming bill on a bipartisan vote during the special session that removed a 33.3% privilege tax that was singled out by the consultant as being particularly burdensome and adjusted the tax structure. The changes will result in less projected revenue to the State and City of Chicago. The bill also extended the timeframe over which the six new casinos must pay a reconciliation fee from two years to six years, made technical fixes to provisions allowing the Illinois Department of Agriculture to operate video gaming terminals at both state fairgrounds and provides a backup plan if a pending Danville casino application falls through (the “Danville Fix”), among other changes.

Property Tax Relief

On May 21, Cook County joined several other counties around the state in passing an ordinance to provide some relief to property taxpayers by making changes to penalty interest provisions or effective due dates for property tax bills. The Cook County ordinance will allow for the waiver of the 1.5% per month penalty interest on second installment property tax bills due on August 3, 2020 for 60 days. Cook County passed its ordinance based on Section 21-40(c) of the Property Tax Code, which allows counties to pass ordinances to waive interest and penalties or change due dates on properties that have been damaged or adversely affected by the disaster when there has been disaster declaration for the county by the President of the United States or Governor of Illinois.

The Illinois General Assembly passed legislation during the short session, Senate Bill 685, as amended, that allows counties other than Cook County to adopt ordinances or resolutions to waive interest penalties for tax bills on installments other than the final installment of 2019 tax bills (tax bills due in 2020). The waiver is allowed for up to 120 days after the effective date of the legislation or until the first day of the first month that there is no longer a statewide COVID-19 emergency declaration by the Governor. Other provisions of the bill allow for extensions of certain homestead exemptions on properties to tax year 2020 without application, delay the annual tax sales that would have been held in 2020 in Cook County and around the state and provides that a tax year may not be eligible for scavenger sale before it has been through the annual tax sale.

Major Budget, Tax and Capital Legislation

- SB264: FY2021 appropriations and FY2020 supplemental appropriations

- SB2099 (Public Act 101-0630): Authority to borrow through Federal Reserve’s Municipal Liquidity Facility or similar program

- HB357: Budget implementation bill

- HB64: FY2021 capital appropriations and re-appropriations

- SB516: Gaming bill that changes tax and fee structure for Chicago casino and other related gaming matters

- SB2541: New hospital assessment program

- SJR1 Special Session: Ballot language for constitutional amendment to permit graduated income tax rates

- SB685: Property tax relief bill