February 28, 2014

The Illinois House of Representatives has approved a revenue projection for the coming fiscal year that includes a $2.2 billion loss in operating resources for FY2015, after a holding series of committee meetings to deliberate varying estimates.

The General Funds revenue estimate totaling $34.5 billion was unanimously approved on February 25, 2014 in House Joint Resolution 80. The revenue projection represents a 6.1% drop from the current FY2014 estimate of $36.7 billion by the Illinois Department of Revenue (IDOR). Approving the resolution marks the first official step in the General Assembly’s budget process for FY2015, which begins on July 1, 2014. It also represents the legislature’s first attempt to define the decline in resources it will have to contend with due to the partial rollback of income tax rates scheduled for January 1, 2015. Under current law, the increased income tax rates passed in 2011 partially sunset to 3.75% from 5.0% for the individual income tax and to 5.25% from 7.0% for the corporate income tax halfway through FY2015.

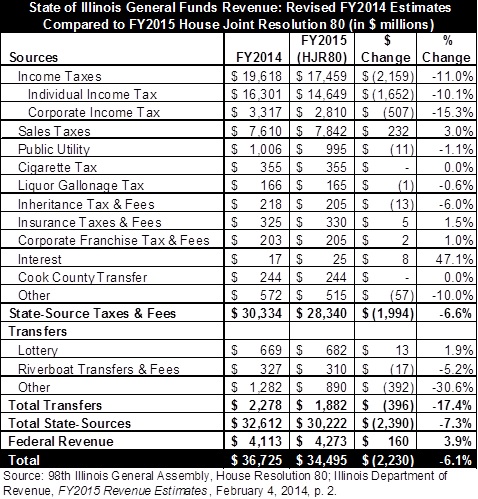

The following chart shows the revenue projection approved by the House compared to the latest estimates for FY2014 published by the Illinois Department of Revenue (IDOR).

The $2.2 billion fiscal cliff in FY2015, shown in the table above, is considerably higher than the $1.6 billion loss that IDOR projected earlier in the month. As discussed here, officials from the Revenue department presented a FY2015 revenue estimate of $35.2 billion in testimony before the House Revenue and Finance committee on February 4, 2014, which is $671 million above the amount approved in the House measure.

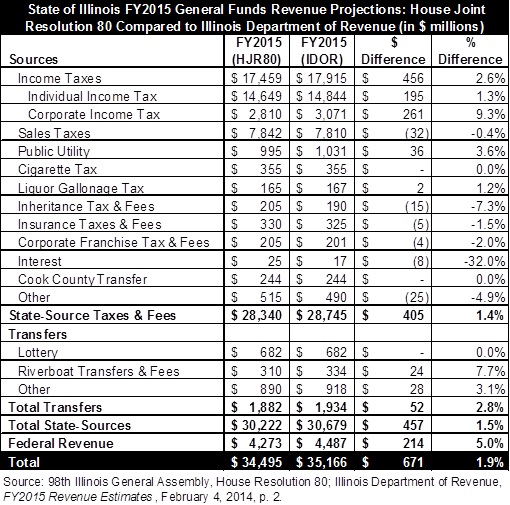

The largest divergence between the two estimates involves the amount of total income taxes that will be available in FY2015. The Revenue department includes $456 million more in total income taxes. IDOR’s projection for net individual income tax revenues is $195 million higher, totaling $14.8 billion compared to $14.6 billion in HJR80. IDOR’s corporate income tax projection is $261 million higher at $3.1 billion compared to $2.8 billion in the legislative resolution.

The following table compares the General Funds revenue projections approved in HJR80 to the IDOR projections.

The revenue projection in HJR80 is virtually identical to the projections presented to the House Revenue and Finance Committee by the General Assembly’s Commission on Government Forecasting and Accountability (COGFA), a joint legislative body. The legislatively approved total adds $56 million to the other revenue sources projection by COGFA due to a one-time escrow transfer from a capital projects account included in IDOR’s report that COGFA became aware of after the testimony on February 4.

For several years the General Assembly has based its budget on the revenue estimates approved by the House. The resolution also serves as a spending limit for the coming year, as it references the provisions of the Illinois Constitution that prohibit the General Assembly from approving appropriations that exceed its revenue estimates.

The approval of the resolution marks the second year in a row that the House has preempted the Governor’s budget by approving a spending limit prior to receiving the Governor’s budget recommendation. However, unlike FY2014 when the estimate was approved on the eve of the Governor’s budget address, the legislative estimate for FY2015 was approved a month prior to the Governor’s budget address on March 26, 2014. It remains to be seen if the General Assembly’s revenue projection will be incorporated into the Governor’s budget recommendation for FY2015.