July 19, 2013

An increase in the cigarette tax increase designed to provide additional funding for the Illinois Medicaid program generated more revenues than expected despite a drop in sales and hoarding of tax stamps prior to the effective date of the tax increase.

As discussed here, the $1-per-pack increase was enacted as part of an overhaul of the Medicaid program that sought to eliminate a funding gap of $2.7 billion in FY2013. The State estimated that the increase would bring in an additional $350 million in cigarette tax revenue and provide a total of $700 million after federal reimbursements.

As enacted, the cigarette tax increase was combined with increased tax rates on other tobacco products in order to generate the target of $350 million in new State-source revenues.

Illinois collects the cigarette tax through stamps sold to distributors of tobacco products equal to the amount of the tax. The stamps are then affixed to cigarette packaging and the cost passed on to consumers. To prevent distributors from stockpiling the stamps, the Illinois Department of Revenue (IDOR) attempted to administratively limit their sale between May 2012, when the discussions regarding the proposal to increase the cigarette tax rate began, and when it took effect on June 24, 2012. However, distributors won a temporary restraining order against the department that prohibited them from restricting sales on June 14, 2012, the same day the Governor signed the bill into law. The court order led to a massive run on cigarette tax stamps at the lower rate and IDOR reduced its cigarette tax revenue estimate for FY2013 by $125.7 million.

For more on the new tax rates and initial post-hoarding estimates see this blog from September 2012.

Despite the negative start to the year, the measure netted $382.6 million in additional State-source revenues dedicated to Medicaid funding in FY2013, based on year-end revenue estimates reported by the IDOR and transfer data available on the Illinois Comptroller’s website.

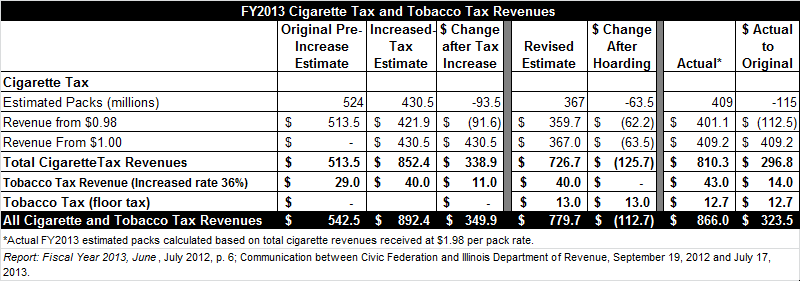

Total cigarette and tobacco tax revenues, including the original $0.98 per pack and other tobacco product taxes, totaled $866.0 million in FY2013, compared to an estimate of $542.5 million prior to the approval of the increased rates. The total is lower than the legislative estimate of $892.4 million that was presented during deliberations over the possibility of increasing the tax and slightly higher than the revised estimate of $779.7 million that was issued by IDOR in the wake of the hoarding of tax stamps that occurred prior to the laws effective date.

The following table compares the original FY2013 revenue estimates prior to the increase in cigarette and tobacco taxes to the year-end results. It also shows the initial legislative estimates and the revised estimates from early in the fiscal year. (click to enlarge)

As shown in the table above, the $1.00-per-pack increase brought in $409.2 million in FY2013 but the decline in total cigarette packs sold caused revenue from the original $0.98 tax to decrease by $112.5 million. Some of the revenue from the original tax was also dedicated to Medicaid funding.

Under the law, the original $0.98 tax is still split between the three funds. General Funds receive the first draw on the tax proceeds of approximately $350 million annually. Revenues received above the General Funds payment are then deposited to the School Infrastructure Fund totaling up to $60 million annually. The remainder is then deposited into the Long Term Care Provider Fund, a fund used to pay for Medicaid expenses. All of the additional $1.00 per pack from the rate increase is transferred into the Hospital Provider Fund to pay for previously underfunded Medicaid costs.

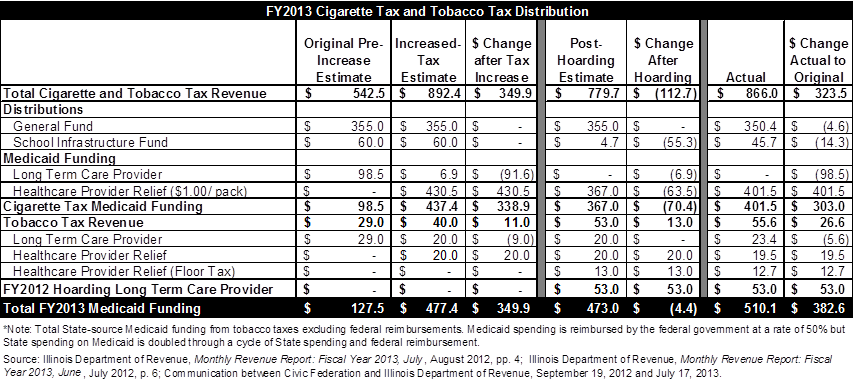

The following table shows the distribution of total cigarette and tobacco taxes in FY2013, compared to the original pretax estimates and revised estimates.

Total Medicaid funding provided through cigarette and tobacco taxes increased to $510.1 million from an initial pretax estimate of $127.5 million, leading to an additional $382.6 million in State-source revenue for Medicaid. After accounting for federal reimbursements, this increases the total fund by $765.2 million compared to the goal of $700 million.

The total tax revenues shown above includes $53 million in increased funding in FY2012 due to cigarette tax stamp hoarding by distributors before the increase went into effect.

Analysis from last fall showed that the School Infrastructure Fund, which pays for bonds sold to support school construction, was in danger of losing up to $55.3 million due to demand and hoarding effects on the original tax. As shown above, however, the Fund lost only $14.3 million.