May 19, 2016

With the current year’s budget still incomplete, the State of Illinois is now facing the prospect of starting another year without a financial plan.

Due to a political dispute between Illinois’ Republican Governor and Democratic legislators who control the General Assembly, the State does not have a comprehensive budget for fiscal year 2016, which ends on June 30. Despite recent efforts by lawmakers, there are no clear signs of progress on a budget for FY2017, which begins on July 1.

Since 1995, the deadline for annual State budgets has been regarded as May 31. After the end of May, the Illinois Constitution as amended in 1994 requires a three-fifths vote of both the House and Senate, instead of a simple majority, for laws to take effect before June 1 of the next calendar year. The provision has encouraged the General Assembly to end its regular spring session by May 31.

But this deadline has recently become less important. In late May 2015, the General Assembly approved a spending plan for FY2016 with an acknowledged operating deficit of $3 billion. Governor Bruce Rauner vetoed the plan—except for an appropriation bill for elementary and secondary education. The General Assembly did not override the Governor’s vetoes, which would have required a three-fifths vote of each chamber, and continued to meet intermittently through calendar year 2015 until the regular session began in January 2016.

Democratic leaders have pushed for a bipartisan agreement on additional revenues to help close the budget gap caused by the partial rollback of temporary income tax rate increases in January 2015. The Governor has said he would only agree to new revenue in conjunction with passage of key elements of his Turnaround Agenda, which is intended to make Illinois more appealing to businesses.

At a meeting on May 17 between Governor Rauner and legislative leaders, House Speaker Michael Madigan agreed to appoint delegates to a working group to negotiate on several items on the Governor’s agenda. However, the Speaker also issued a statement after the meeting that criticized Governor Rauner for continuing to insist on the agenda as a condition for enacting a budget.

The rare meeting came after a group of lawmakers drafted a budget framework for FY2017 that reportedly included $5.4 billion in new revenue and $2.4 billion in spending cuts. Speaker Madigan said many Democrats will consider the scope of government services in the proposal to be inadequate.

Governor Rauner’s proposed FY2017 budget has an operating deficit of $3.5 billion. As discussed here, the Governor said lawmakers could close the gap by either accepting elements of the Turnaround Agenda, in which case spending could reach $36.3 billion, or granting him broad authority to make cuts, resulting in spending as low as $32.8 billion.

As explained here, despite the lack of a complete budget most State spending is continuing in FY2016 due to court orders, consent decrees, statutory requirements and the appropriation bill for education signed by Governor Rauner. The major areas that are not being paid are higher education, certain social services programs, group health insurance and operational expenses for State agencies.

A $600 million stopgap funding measure for higher education, signed by the Governor in April, was expected to allow public universities to keep their doors open through the summer. The appropriation was from the Education Assistance Fund, one of four accounts that make up the State’s General Funds. Deposits into the Education Assistance Fund may only be spent on education.

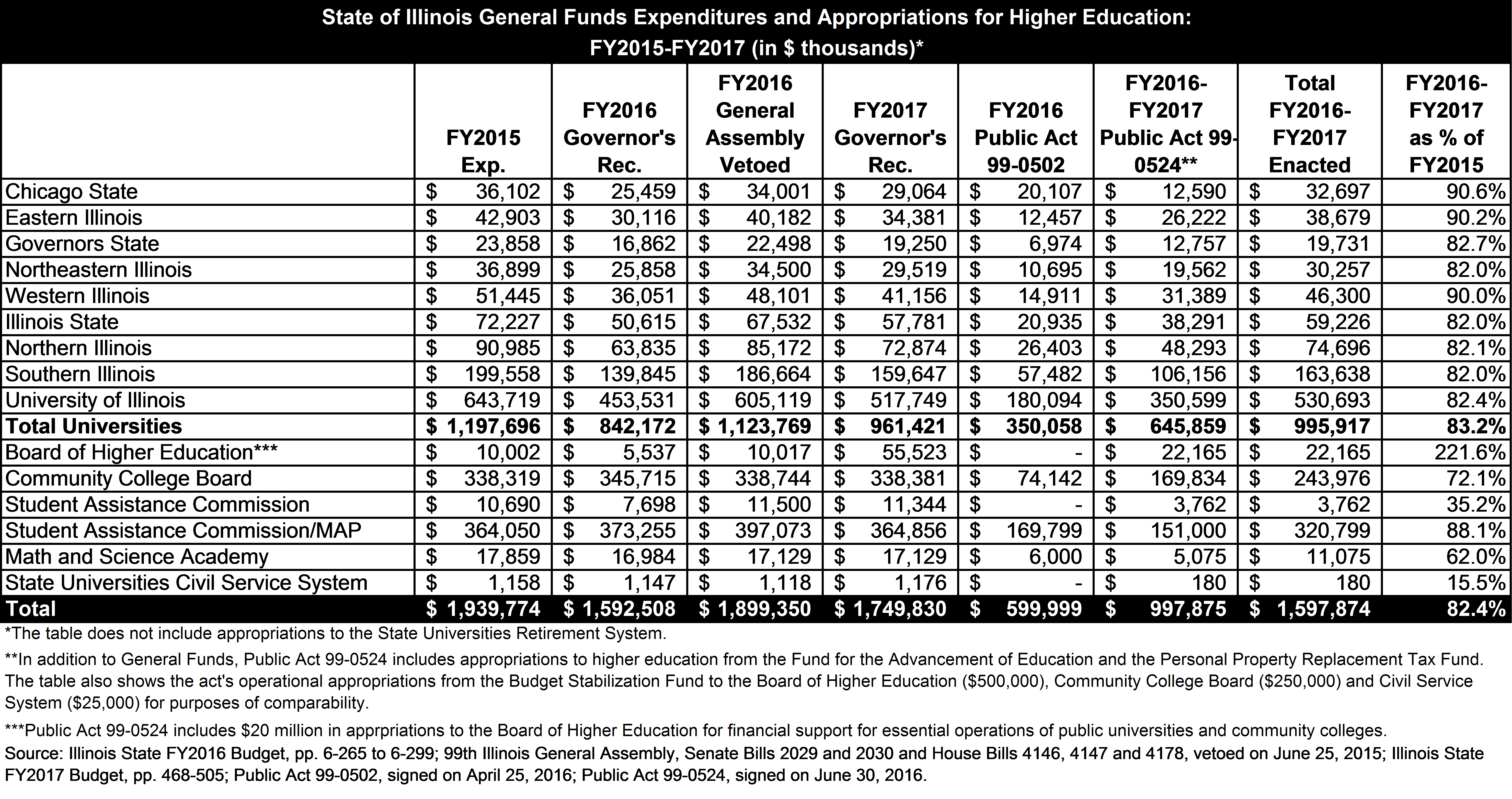

Public Act 99-0502 provided $350.1 million for public universities, which represents 29.2% of FY2015 State funding of $1.2 billion. Chicago State University, which depends more heavily on State funding than any other public university, was allocated $20.1 million, or 55.7% of its FY2015 funding. Chicago State had declared a financial crisis in February and pushed up the end of the spring semester to the end of April, saying it could not meet payroll after that date. Despite the additional funding, Chicago State subsequently announced that it was laying off 300 non-faculty workers, or about one-third of its staff.

The Illinois Student Assistance Commission received $169.8 million, or 45.3% of its FY2015 State funding of $374.7 million. The Commission administers the Monetary Award Program (MAP), which provides financial assistance to low income college students. Officials said the stopgap measure provided enough funding to cover MAP grants for the 2015 fall semester but not the 2016 spring term.

The following table compares FY2015 State expenditures on higher education with the Governor’s recommended appropriations for FY2016 and FY2017, the General Assembly’s FY2016 spending plan that was vetoed by the Governor and the stopgap measure enacted in April. The Governor proposed a funding reduction for public universities from FY2015 of $355.5 million, or 29.7%, in FY2016 and $236.3 million, or 19.7%, in FY2017.

On May 17, the House passed an additional $227.3 million appropriation for the Illinois Student Assistance Commission, which was intended to bring MAP grant funding to the level in the General Assembly’s FY2016 spending plan. The Senate approved the measure on May 19. Republican lawmakers (except Senator Sam McCann) opposed the bill because it lacked a source of funding.

The General Assembly gave bipartisan approval on May 12 to a stopgap funding measure for human services, including home and community care for the elderly, mental health counseling and addiction treatment services. The bill was passed after a coalition of 64 service providers sued the State in Cook County Circuit Court, alleging they were owed more than $100 million for work on contracts that dated back to the beginning of FY2016.

The measure appropriates more than $700 million, or approximately 46% of the funding in the General Assembly’s FY2016 spending plan. Funding would come from deposits into the Commitment to Human Services Fund and from other accounts outside of General Funds. The Commitment to Human Services Fund receives income tax revenues diverted from General Funds that must be spent on human services.

The bill was approved unanimously in both the House and Senate, except for three House members who voted present, and sent to Governor Rauner on May 18. However, it is not known whether the Governor will sign the measure as the administration has criticized a provision intended to prevent the funds from being used to pay operational expenses of State agencies. The Governor has 60 days to act on a bill after it is presented to him; if he takes no action, it becomes law without his signature.