October 15, 2014

Whether the State of Illinois has spent more or less on education in the last five years has recently been the subject of intense debate. This blog post examines various factors that affect the calculation of education spending trends and expands on the Civic Federation’s recent report on the State’s enacted budget for FY2015.

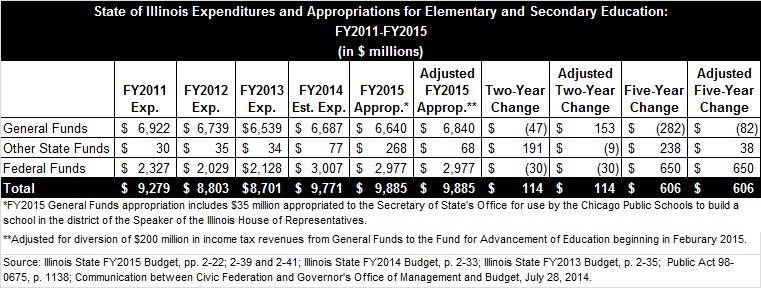

The Illinois State Board of Education provides resources for elementary and secondary education based on appropriations from the Illinois General Assembly. The following table shows actual spending by the Board of Education from FY2011 through FY2013, estimated spending in FY2014 and appropriations in FY2015. It should be noted that actual spending in FY2015 could be less than the spending authority granted through appropriations—or more, if supplemental appropriations are approved later in the year.

Total education spending grows by $606 million, from $9.3 billion in FY2011 to $9.9 billion in FY2015, mainly due to increases in federal funding. Total spending includes funding from all three types of State accounts: General Funds, which support the regular operating and administrative expenses of most agencies; Other State Funds, accounts funded by designated revenue sources that may only be used for specific purposes; and Federal Funds, which use federal revenues outside of the General Funds to support a variety of programs.

General Funds are the funds over which the State has the most control. General Funds spending on elementary and secondary education declines by $282 million from $6.9 billion in FY2011 to $6.6 billion in FY2015. The FY2015 number includes $35.0 million appropriated to the Secretary of State’s Office for a grant to the Chicago Public Schools to build a school in the legislative district of House Speaker Michael Madigan.

The FY2015 appropriation figure is adjusted in the table above to account for the diversion of income tax revenue from General Funds beginning in February 2015. As discussed here and here, an estimated $200 million of this revenue will be diverted to the newly created Fund for the Advancement of Education to help pay for General State Aid, the main State spending program for elementary and secondary education. After adjusting for this funding switch, General Funds spending on education increases to $6.8 billion in FY2015 and the decrease from FY2011 is reduced to $82 million.

When determining trends in education spending, the starting point of the analysis affects the results. The Civic Federation traditionally examines two- and five-year trends, but other analyses might look at longer trends.

For example, General Funds spending on education in FY2010 is shown in budget documents as $7.3 billion. But that number includes $790.8 million in federal stimulus funds from the American Recovery and Reinvestment Act of 2009. Some analysts might deduct that amount to maximize comparability, which would reduce the General Funds figure for FY2010 to $6.5 billion. Based on that calculation, General Funds spending on education increases by $358 million to $6.8 billion in FY2015. Similarly, budget documents in FY2009 show education spending at $7.4 billion, but that amount includes $1.0 billion of stimulus funding. Deducting that amount results in General Funds spending of $6.3 billion in FY2009 and an increase of $522 million to $6.8 billion in FY2015.

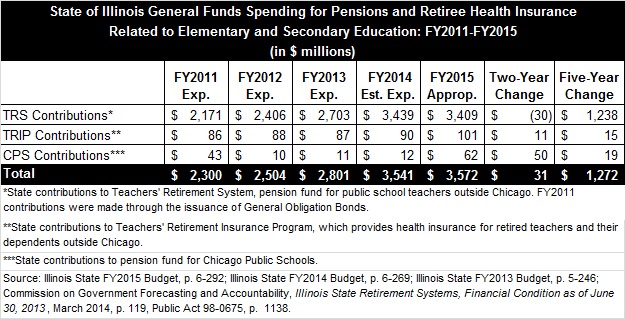

The major area of growth in State spending from FY2011 to FY2015 involves contributions to State pension funds. During this period, the State’s General Funds contributions to the Teachers’ Retirement System (TRS) increase by $1.2 billion, to $3.4 billion in FY2015 from $2.2 billion in FY2011. TRS, the largest State pension fund, covers teachers outside the City of Chicago.

The State also makes relatively modest General Funds contributions to the Public School Teachers’ Pension and Retirement Fund of Chicago, the pension fund for Chicago teachers. These contributions increase to $62 million in FY2015 from $43 million in FY2011. Another education-related General Funds contribution goes to the Teachers’ Retirement Insurance Program (TRIP), which provides health insurance for retired public school teachers and their dependents outside Chicago. General Funds contributions to TRIP increase to $101 million in FY2015 from $86 million in FY2011.

The next table shows the State’s education-related pension and retiree health insurance contributions from FY2011 to FY2015. The total grows by $1.3 billion to $3.6 billion in FY2015 from $2.3 billion in FY2011.

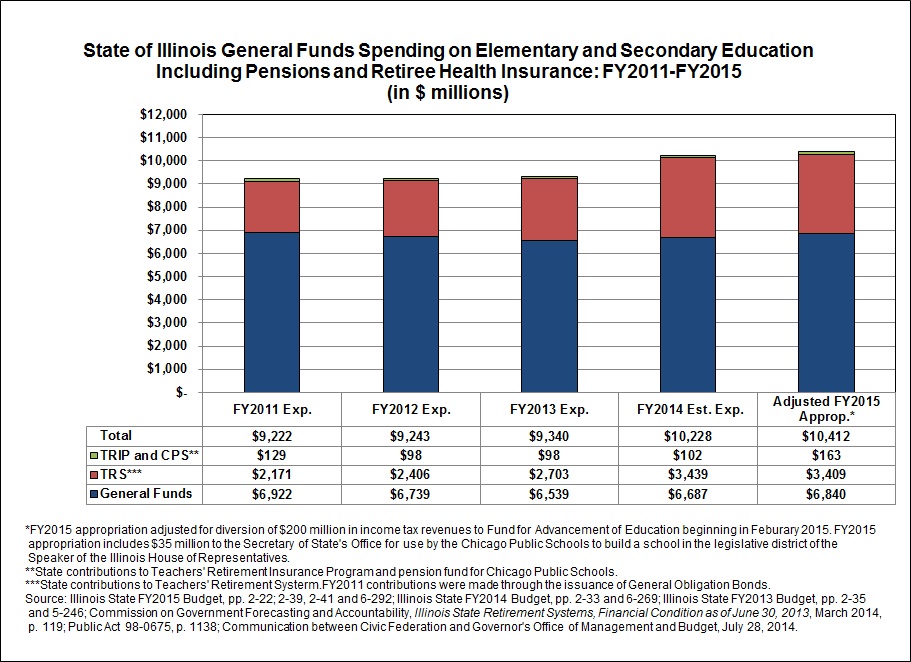

The following chart reflects the analysis above, showing General Funds spending on education (but not Other State Funds or Federal Funds) and adds in education-related State contributions to pensions and retiree health insurance from FY2011 to FY2015. With these components included, total education-related spending increases by $1.2 billion to $10.4 billion in FY2015 from $9.2 billion in FY2011.

The State also provides significant funding for higher education and capital improvements that is not included in the totals above.