February 23, 2021

Click here to read the full report.

SUMMARY

The multiplicity of local units of government, many of which are funded predominantly by property taxes, is often cited as a reason for high property tax rates in Illinois. Local government consolidation, cooperation and dissolution has therefore become a focus for many government leaders and civic groups as a way to reduce duplication and the cost of government. This is particularly true at a time when local governments are facing severe revenue shortfalls as a result of the coronavirus pandemic.

According to the United States Census of Governments, the State of Illinois has by far the highest number of local governments in any state, at 6,918. However, a Civic Federation analysis of multiple sources found the number of local governments in Illinois to be 8,923.

A possible barrier to the consolidation and/or dissolution of duplicative and anachronistic local governments in Illinois is a lack of aggregated information about them. Different federal, state and local agencies collect information about the number and type of local governments in Illinois and their finances. Information about their operations is also in state statute and in several other places.

The purpose of this report is to compile information on this topic in one clearinghouse in order to facilitate future efforts by local government officials, state legislators, civic groups and other interested parties to streamline local government and reduce the tax burden on property owners.

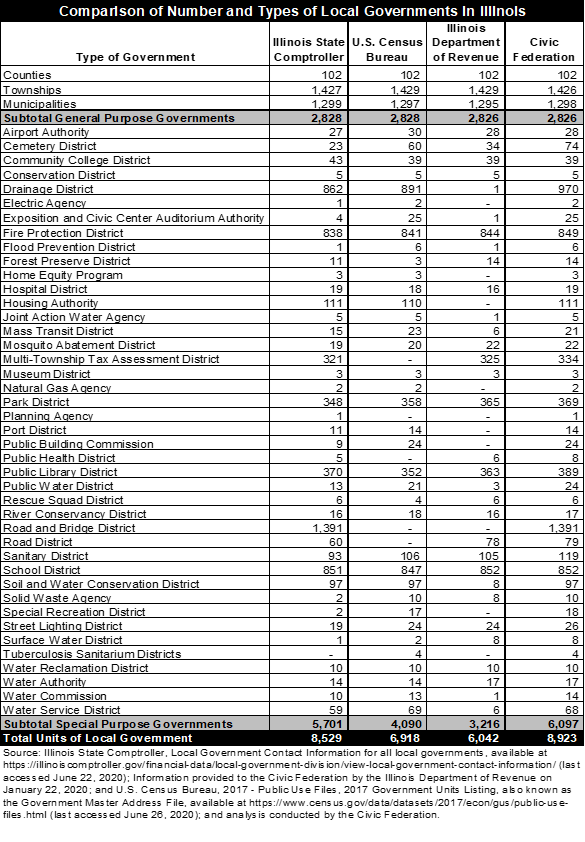

The Civic Federation uses three primary sources of information to produce the most comprehensive list of local governments in Illinois. These are the Government Master Address File (GMAF) from the U.S. Census Bureau’s 2017 Census of Governments, the Illinois State Comptroller’s registry of local governments and information provided to the Civic Federation by the Illinois Department of Revenue.

These reporting agencies all list a different number of local governments. For example, the U.S. Census Bureau’s 2017 Census of Governments reports 6,918 units, the Illinois Department of Revenue reports 6,042 units, and the Illinois State Comptroller reports 8,529 units. These differences are due to how each agency defines local governments and the methodology used for collecting information on local governments, among other criteria.

While the number of local governments varies by each reporting agency and each are not without their own limitations in identifying all of the various types of local governments in Illinois, individually they all serve as a valuable resource to lawmakers and the public. For example, the U.S. Census Bureau’s Census of Governments data serves as a useful tool for state-to-state comparisons, while the Illinois State Comptroller’s Office provides a registry of local governments that is helpful in identifying the local governments specific to Illinois. The Illinois Department of Revenue data provides useful information on the local governments in Illinois that are authorized to levy property taxes. In order to create the most comprehensive and inclusive list possible, there were no exclusions of local governments unless they could be further verified as being dissolved or improperly classified as a unit of local government in Illinois.

By compiling and analyzing the data from these various reporting agencies, the Civic Federation has identified a total of 8,923 units of local government in Illinois as of 2019. The 8,923 units of local government include 2,826 general purpose governments, which include counties, townships and municipalities, and 6,097 special purpose governments, which include school districts, fire protection districts, street lighting districts, public library districts and other limited purpose governments. This list is purposefully as inclusive as possible so as to provide a comprehensive view of the totality of local governments in Illinois. The choice to be as inclusive as possible does not mean the other lists are wrong, they simply use different methodologies. See page 10 for more about the Civic Federation’s methodology.

In addition to providing a comprehensive list of local governments in Illinois, this report provides the reader with an overview of the different types of local governments and their reliance on property taxes and other sources of revenue to fund operations. This report also provides population characteristics of local governments as well as a comparison of the number of local governments in Illinois to other selected states. The four appendices in this report provide:

- A list of local governments that were delinquent in filing their annual financial reports with the Illinois Comptroller;

- Entries included in any of the three reporting agencies listings, but excluded from the Civic Federation’s unique list of local governments and why they were excluded;

- Detailed information on the differences in governance structures of local governments; and

- Statutory procedures for annexing, consolidating and dissolving units of local government in Illinois.

Differences Among Reporting Agencies

Through the compilation and analysis of local government listings from the Office of the Illinois State Comptroller, the Illinois Department of Revenue and the U.S. Census Bureau, the Civic Federation finds that Illinois has a total of 8,923 units of local government as of 2019. This includes 2,826 general purpose governments and 6,097 special purpose governments. The 2,826 general purpose governments include 102 counties, 1,426 townships and 1,298 municipalities. The majority of local governments are special purpose districts—6,097, or 68%, of all local governments. The Civic Federation’s total count of 8,923 local governments in Illinois is greater than the number of local governments reported by the Illinois State Comptroller (8,529), the U.S. Census Bureau (6,918) and the Illinois Department of Revenue (6,042), due to the methodology and the compilation of all three listings to create a composite count.

The differences in the total number of general-purpose governments by each reporting agency is minimal and due to the inclusion of townships and municipalities that are no longer in existence or how they are classified. For example, the U.S. Census Bureau and Illinois Department of Revenue include Belleville Township, while the Illinois Comptroller no longer lists Belleville Township since it was dissolved in 2017. Also, the Illinois Comptroller’s listing of local governments was the only reporting agency that still included the Village of Whiteash in Williamson County, which voters dissolved in 2014. As another example, the U.S. Census Bureau includes South Fillmore Township in Montgomery County separately even though it merged with Fillmore Township to create Fillmore Consolidated Township. Also, the Illinois Department of Revenue classifies the Town of Cicero in Cook County as a township, while the Illinois Comptroller and U.S. Census Bureau classify it as a municipality.

To further understand the differences in the total number of special purpose districts reported by each reporting agency it is important to understand the methodology used by each agency to collect information on the number and types of local governments. All three reporting agencies are required by law to collect information on local governments — albeit for different purposes. For example, the Illinois Department of Revenue only counts “taxing districts,” excluding governments that lack the authority to levy property taxes. This results in IDOR having the lowest count of local governments among the three government reporting agencies. Other differences among the reporting agencies are almost entirely due to criteria used to define local governments.

The U.S. Census Bureau excludes governments that lack several characteristics, namely fiscal and administrative autonomy. As result, road and bridge districts, which are frequently classified as divisions of townships, are not included in the Census Bureau’s listing of local governments or the Illinois Department of Revenue’s listing. However, the Illinois Comptroller’s registry of local governments recognizes road and bridge districts as a separate type of local government. For the purposes of this report, the Civic Federation also lists road and bridge districts separately from townships because not all townships have road districts and/or road and bridge districts. There are several types of road districts allowed under Illinois state law. Certain road districts are consolidated districts that include two or more townships. There are also municipal road districts that are solely within the boundaries of a municipality and unit road districts that are typically governed by the county board. The 2017 Census of Governments listing also does not include multi-township tax assessment districts, which accounts for approximately 325 additional units of local government. Multi-township tax assessment districts are responsible for the assessment of real property in townships with a population less than 1,000 residents and other townships electing to use these provisions.

The U.S. Census Bureau’s exclusion of local governments that lack fiscal and administrative autonomy can also be seen in the higher count of public library districts and forest preserve districts by the Illinois Comptroller. As an example, because the governing boards of the Lake County Forest Preserve District and the Cook County Forest Preserve District are governed by the same board as their respective counties, the U.S. Census Bureau does not include them in their listing, even though they have independent taxing authority. The number of public library districts reported by the Comptroller are impacted by this as well as shown by the Comptroller including libraries that have separately elected boards but the budget and levy may be approved by the municipality that the library district is within, such as the La Grange Library in Cook County and Messenger Library in Kane County. Furthermore, the U.S. Census Bureau only includes local governments if they continue to operate; those that retain the “right to exist” are only counted by the U.S. Census Bureau if they still offer services. As a result, there are smaller special purpose governments included that are sometimes very small in geographical size that are still in existence and may still provide services, but the entire local government may be governed and operated by one person. These instances occurred primarily with drainage districts.

Other differences among the reporting agencies include the number of cemetery districts, exposition and civic center authorities, housing authorities, public building commissions, road districts, special recreation districts and smaller differences amongst other types of local governments. As previously noted, if the local government is not authorized to levy a property tax it is excluded from the Department of Revenue’s list. If it is not required to report to the Comptroller or is not properly reported to the Comptroller’s Office by the respective county clerk, it may not be included in their listing of local governments. If the local government does not meet the criteria for being an independent local government by the Census Bureau it may not be included in their listing. For the purposes of this report, the Civic Federation includes all of the local governments included in the lists by the three reporting agencies unless Federation staff could verify that certain entries by the reporting agency were not considered a local government under Illinois state law or they were consolidated, dissolved or eliminated by some other means, such as a ballot referendum.

Major Findings

The following findings were obtained from multiple sources of data. When comparing local governments in Illinois to other states U.S. Census Bureau data is used.

Counties

- There is a total of 102 counties in Illinois. Of the 102 counties, there are 15 counties that have a population of fewer than 10,000 residents and 36 counties that have a population of between 10,000 and 24,999 residents. Together these make up 50% of the total counties in Illinois;

- Cook County, which is the largest county in Illinois, has a population of approximately 5.2 million residents, followed by DuPage County with approximately 916,924 residents. Hardin County and Pope County are the least populous counties with 4,320 and 4,470 residents, respectively. Cook County and the collar counties compose nearly two-thirds of the State’s population with 8.3 million residents;

- Counties levied $2.0 billion, or 6.5%, of the $31.8 billion in property taxes levied statewide in 2018;

- Approximately 35.3% of county budgets are funded by property taxes; and

- Of the selected states used in this report, only Missouri and Texas have more counties than Illinois with 254 and 114, respectively.

Townships

- There are 1,426 townships in Illinois;

- The Illinois Constitution of 1848 granted voters the ability to adopt the township form of government in each county;

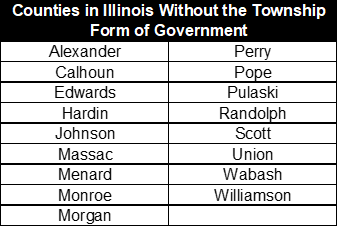

- 85 of the 102 counties in Illinois currently have the township form of government;

- Despite townships being the type of local government with the most units, townships are absent in 17 of the 102 counties in Illinois;

- The 17 counties in Illinois without the township form of government are:

- Townships (and road and bridge districts) make up $750.4 million, or 2.4%, of the $31.8 billion in total property taxes levied in Illinois in 2018;

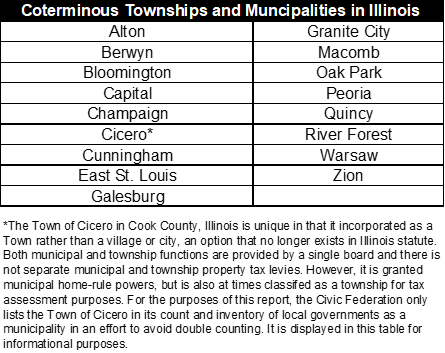

- There are a total of 17 coterminous townships and municipalities in Illinois, meaning the township and municipality share the same boundaries. The 17 coterminous townships in Illinois are:

- Nearly 50%, or 709 townships, have fewer than 1,000 residents;

- Of the selected states used in this report, Minnesota has the greatest number of townships at 1,780, followed by Pennsylvania with 1,546 and then Illinois with 1,429 townships;

- Counties without the township form of government operate under the precinct form of government. Precincts (or civil townships) are nonfunctioning, administrative units, with the county performing the administrative functions; and

- The City of Chicago’s residents voted to eliminate township government and transfer township functions to the City by referendum in 1902. Prior to 1902, multiple township governments existed within the City with each township government operating independently and electing its own officials.

Municipalities

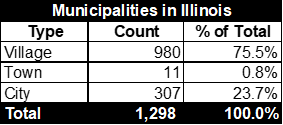

- There are 1,298 municipalities in Illinois;

- Illinois has the greatest number of municipalities in all 50 states. Texas and Pennsylvania have the second and third highest number of municipalities in all 50 states at 1,218 and 1,013, followed by Missouri and Iowa at 944 and 943, respectively; and

- A third of the municipalities in Illinois have fewer than 2,500 residents.

- The following table lists the number and type of municipalities in Illinois as of 2019.

School Districts

- There are 852 elementary and secondary public school districts in Illinois.

- Of the 852 school districts, 144 are located in Cook County. In Cook and the collar counties (DuPage, Lake, Kane, McHenry and Will) there are a total of 287 public school districts.

- Illinois has one of the lowest ratios of residents to school districts at an estimated 14,449 residents per district. On the other extreme, Florida has an estimated 220,888 residents per school district;

- Approximately two-thirds of the school districts in Illinois have fewer than 1,000 students enrolled in their districts;

- There are 26 school districts in Illinois with fewer than 100 students;

- Chicago Public Schools (Unit School District 299) is the only school district in Illinois with more than 100,000 students enrolled;

- School districts accounted for the largest share of property tax extensions throughout Illinois, even when the State is broken down into different regions;

- School districts accounted for $8.1 billion, or 53.7%, of total property taxes levied in Cook County;

- School districts and community college districts are the only type of non-municipal government found in every county;

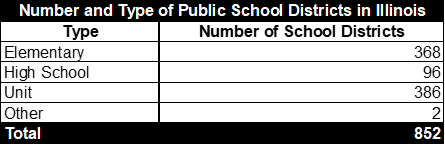

- The following table lists the number and type of public school districts in Illinois as of 2018.

Special Districts

- According to the U.S. Census Bureau, Illinois has the most special purpose governments in the entire country at 3,204; and

- Based on U.S. Census Bureau data, aside from Illinois, California, Texas and Colorado are the only three states that have more than 2,500 special purpose governments.

Additional Findings

The Civic Federation finds the following additional points of interest regarding local governments in Illinois:

- Other than Texas with 5,343 units of local government, Illinois is the only state in the U.S. with over 5,000 units of local government as of 2017;

- Cook County and the collar counties compose nearly two-thirds of the State’s population with 8.3 million residents;

- Unlike municipalities, townships do not overlap more than one county;

- In 2018, the Illinois Department of Revenue reported a total of $31.8 billion in property tax extensions by local governments in Illinois;

- Local governments in Cook County accounted for $15.0 billion, or 47.2%, of the total property taxes extended in Illinois;

- Local governments in the collar counties (DuPage, Kane, Lake, McHenry and Will) accounted for $9.4 billion, or 29.6% of the total property taxes extended in the state; and

- The 96 counties outside of Cook and the five collar counties accounted for $7.4 billion, or 23.1% of the property taxes extended statewide.

Click here to read the full report.

Click here to read the press release for this report.