April 14, 2022

This blog post presents an overview of the Chicago Transit Authority’s FY2022 operating budget, including a summary of how federal stimulus funds were used to balance the budget, and an update on its recent $350 million debt issuance.

The Chicago Transit Authority, like other transit agencies around the country, faces serious challenges to its future operations and fiscal solvency in the wake of the COVID-19 pandemic. Federal funds have been critical in maintaining transit service in the Chicago region. These funds will be exhausted in 2024. If revenues and ridership do not rebound by that time and funding rules aren’t changed, the CTA may be forced to make some difficult financial decisions, including service reductions and/or fare increases to maintain operations.

The CTA released a $3.5 billion, five year FY2022-FY2026 capital plan in October 2021. An overview of the capital plan is available here.

CTA FY2022 Operating Budget Totals $1.7 Billion

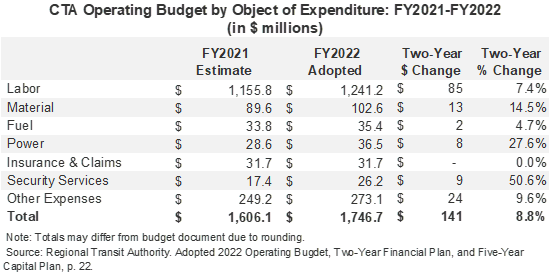

The Chicago Transit Authority FY2022 operating budget of $1.7 billion was approved by the Regional Transportation Authority (RTA) on December 16, 2021.[1] It had previously been approved by the CTA Board on November 17, 2021.[2] The budget is an 8.8% increase from the previous budget of $1.6 billion. Approximately 71.1% of the budget, or $1.2 billion, is earmarked for personnel related expenses. The next largest individual line item is for material, at $102.6 million. Other expenses, which aggregates a variety of line items such as utilities, legal fees, advertising, consulting services and debt service for outstanding debt, will be $273.1 million. Of that amount, $156 million will be used for pension obligation bond debt service.[3]

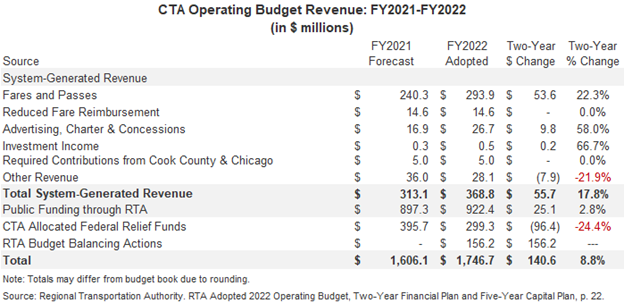

The FY2022 CTA budget is funded from four sources:

System generated revenues: Fare and pass revenue from CTA bus and train customers is the largest source of these revenues, with $293.9 million, or nearly 80.0% of the total amount of $368.8 million budgeted in FY2022. Smaller amounts will come from advertising, concessions, contributions from the City of Chicago and Cook County and other revenues.

Public funding through the Regional Transportation Authority: These revenues include funds from the regional sales tax authorized for transit in northeastern Illinois as well as real estate transfer tax revenues and public transportation funds. In FY2022 public funding will provide $922.4 million, an increase of 2.8% from the prior year.

Federal relief funds: These funds will provide $299.3 million for operations in FY2022.

Budget Balancing Actions: The RTA Board approved an allocation of $156.2 million from its allocation of American Rescue Plan funds to balance the CTA’s FY2022 budget.[4]

In FY2022 26.1% of the total budget, or $455.5 million, will be funded from federal stimulus funds (the Federal relief funds and the budget balancing actions). This is an increase from FY2021, when $395.7 million of these funds were used, which was 24.6% of the budget.

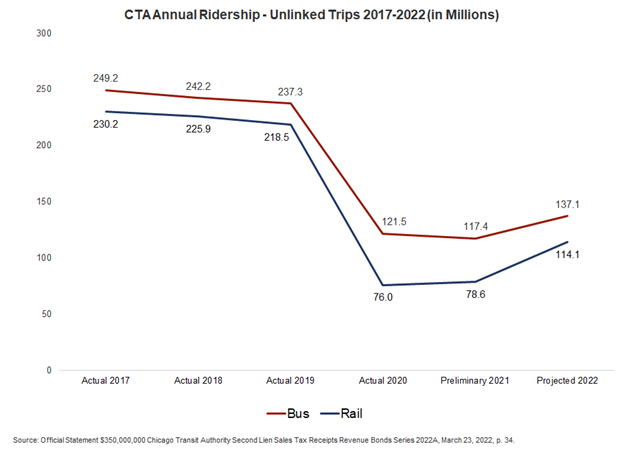

As noted above, CTA system generated revenues are derived primarily from bus and train fares. However, transit ridership has been severely impacted by the pandemic. While ridership is projected to increase in FY2022 to a total of 252.1 million unlinked rides, this is still a 47.6% decline from FY2017, a decrease of 228.2 million rides.

To incent increases in ridership, the CTA is taking several steps to reduce costs for customers beginning in December 2021, including:

- Removing the $0.25 transfer for full fare Ventra Card payments and the $0.15 transfer fare for student fare Ventra Cards;

- Reducing Full Fare 30-day Pass prices from $105 to $75 and Reduced 30-day pass costs from $50 to $35;

- Extending 1-Day, 3-Day, and 7-Day pass promotions that significantly reduce fares to support the City’s “Open Chicago” initiative to bring back events, festivals, dining, and other indoor and outdoor activities.[5]

Use of Federal Stimulus Funding in CTA Budgets

The CTA relied on federal stimulus funding to offset declines in revenues in 2020 and 2021 and will continue to do so through 2024. The CTA notes that it cannot predict when its revenue stream will recover from the effects of the COVID-19 pandemic.[6]

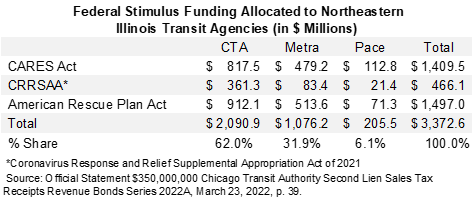

The table below shows the amount of federal funding provided to the RTA and allocated to CTA, Metra and PACE through three major Congressional COVID-129 pandemic relief acts to date: The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020, the Coronavirus Response and Relief Supplemental Appropriation (CRRSA) Act of 2021 and the American Rescue Plan Act (ARPA) of 2021. A total of $3.3 billion has been provided through these acts. Of that amount, the CTA received nearly $2.1 billion or 62.0% of the total.

In March 2022 the CTA was awarded was an additional $118.4 million in ARPA discretionary funds to cover additional expenses related to the COVID-19 pandemic. It was one of 35 transit agencies awarded this funding.

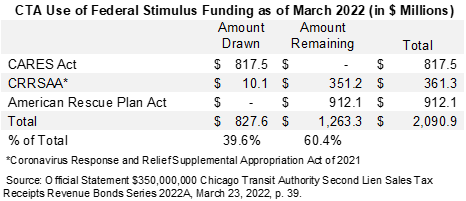

To date, the CTA has used $827.7 million of the total federal stimulus funding it has received, or 39.6% of the total. Approximately $1.2 billion remains. The CTA relied on federal stimulus funding to fund operations in 2021 and it will use $456 million in FY2022.

The Regional Transportation Authority has indicated that the $912.1 million allocated from ARPA funds should be sufficient to cover most of the CTA’s projected shortfalls through 2024. However, if CTA sales tax revenues are not adequate to cover any remaining gaps them service cuts or fare increases may be required.[7]

CTA Issues $350 Million in Revenue Bonds

The Chicago Transit Authority issued $350.0 million in Series 2022A second lien sales tax revenue bonds in March 2022. The bonds were issued with a $37.9 million premium, so the total funds available for CTA uses will be $387.9 million. This is the third bond issue for the CTA in three years. In June 2021, it issued $120.9 million in capital grant receipts refunding series bonds[8] and in 2020, the CTA issued a total of $901.9 million in revenue bonds.[9]

The 2022 revenue bonds will be used for three purposes:

- $212.5 million of the proceeds will be used for bus, rail and system-wide projects included in the CTA’s capital improvement plan;

- $126.8 million will be used to refund a portion of outstanding second lien sales tax receipts revenue capital improvement notes;

- $45.2 million will be deposited into the Series 2022A capitalized interest account to be sed to pay for scheduled interest payments on the bonds through December 2024; and

- $3.5 million will pay for bond issuance costs.[10]

S&P Global has assigned the bonds an A+ rating with a stable outlook, while Kroll has an AA- rating with a stable outlook rating. Standard and Poor’s has assigned an AA rating with a stable outlook based on the bond insurance policy issued by Build America Mutual (BAM) Assurance Company.[11]

[1] The CTA’s fiscal year is January 1 to December 31. Regional Transportation Authority, 2022 Regional Transit Operating Budget and Capital Program at https://www.rtachicago.org/finance-management/operating-capital.

[2] CTA President’s FY2022 Budget Recommendation, p. 84,

[3] CTA President’s FY2022 Budget Recommendation, p. 33.

[4] Regional Transportation Authority. RTA Adopted 2022 Operating Budget, Two-Year Financial Plan and Five-Year Capital Plan, p. 21.

[5] CTA President’s FY2022 Budget Recommendation, p. 35

[6] Official Statement, $350,000,000 Chicago Transit Authority Second Lien Sales Tax Receipts Revenue Bonds Series 2022A, March 23, 2022, p. 3.

[7] Regional Transportation Authority. RTA Adopted 2022 Operating Budget, Two-Year Financial Plan and Five-Year Capital Plan, p. 22.

[8] Chicago Transit Authority, Official Statement: $120,975,000 Capital Grants Receipts Revenue Bonds, June 2, 2021, p. 1 and CTA President’s FY2022 Budget Recommendations, p. 77.

[9] Chicago Transit Authority, Official Statement: $367,895,000 Second Lien Sales Tax Receipts Revenue Bonds Series 2020A, August 27, 2020, p. 1 and Chicago Transit Authority, Official Statement: $534,005,000 Sales Tax Receipts Revenue Refunding Bonds Series 2020B (Taxable), August 27, 2020, p. 1.

[10] Official Statement $350,000,000 Chicago Transit Authority Second Lien Sales Tax Receipts Revenue Bonds Series 2022A, March 23, 2022, pp. 4-5.

[11] Official Statement $350,000,000 Chicago Transit Authority Second Lien Sales Tax Receipts Revenue Bonds Series 2022A, March 23, 2022, p. 70.