September 21, 2017

UPDATE: This blog was updated in March 2018 per revised data in the Illinois Department of Revenue 2015 Assessment-Sales Ratio Study.

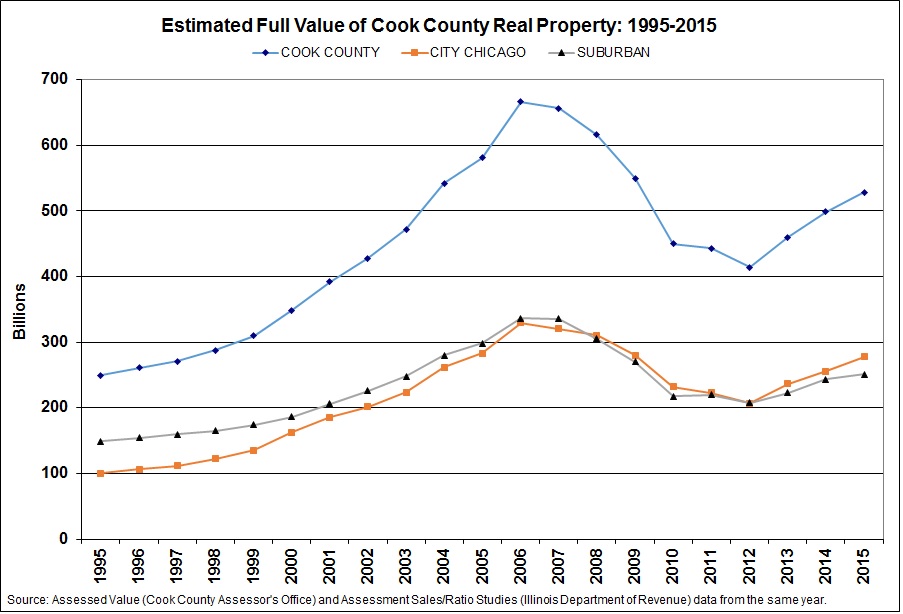

The Civic Federation released its annual estimate of the full value of real estate in Chicago and the Cook County suburbs yesterday. The full value report provides a snapshot of general trends in the property tax base in Cook County. After seven straight years of declines in estimated property values between 2007 and 2012, values have increased in Cook County as a whole, as well as in Chicago and the suburbs for the last three years for which data are available. This blog post will briefly explore the changes in the Civic Federation’s estimated full value of property in Cook County over the 20-year period of 1995-2015. While the 27.6% recovery in estimated full property value in Cook County in tax years 2013-2015 is a positive sign, it is important to put it into context.

The 2015 estimate of the full value of property in Cook County was $528.8 billion, an increase of 6.0% from the previous year. However, that full value is still 20.6% lower than the peak estimated value calculated by the Civic Federation in 2006 of $666.2 billion. In other words, the estimated full value of property in Cook County has not yet recovered to 2004 levels, let alone the 2006 peak in the market.

Prior to 2007, the estimated full value of real estate in the City of Chicago and the suburbs grew every year going back to at least 1995. The following graph shows the long increase in estimated full value since at least the mid-1990s to the mid-2000s, the precipitous drop that coincided with the housing bust and Great Recession and then the slow recovery of the most recent three years.

While the estimated full value of all real property in Cook County is still off its peak in 2006, the estimate for 2015 is 112.2% higher than estimated values in 1995. Between 1995 and the peak value in 2006, estimated values for the county as a whole had climbed by 167.3%.

This estimate is calculated using two data sources: the total assessed value of property as reported by the Cook County Assessor’s Office and the median level of assessment reported by the Illinois Department of Revenue. The estimate does not include railroad properties or properties that are exempt from real estate taxes.

The Illinois Department of Revenue collects data on property sales and calculates the ratio of assessed values to sales values. That data is used to compute the mean assessment-to-sales ratio, or the median level of assessment. The Department of Revenue figures for 2015 were released in the spring of 2017.

The Civic Federation estimates the full value of property by dividing the median level of assessment into the total assessed value of each class of property in Cook County. For those classes for which the Department of Revenue does not calculate a median level of assessment, the level set by County ordinance is used.