October 23, 2014

As previously discussed here, the enacted FY2015 budget for the State of Illinois includes several budgetary gimmicks intended to make up for the loss of revenues associated with the expiration of the temporary income tax increases halfway through the fiscal year.

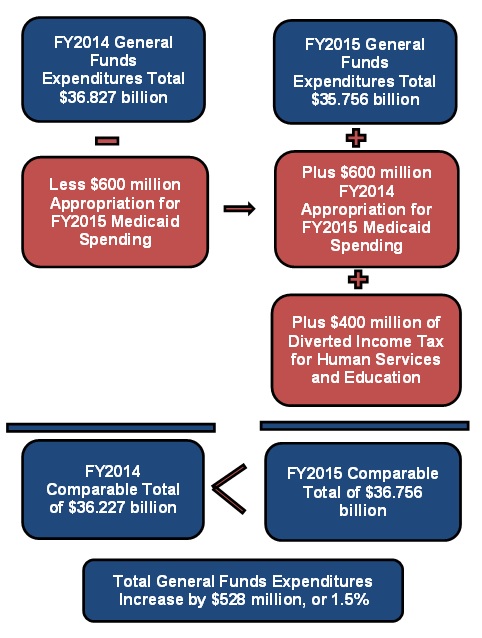

Two of these measures include shifting funds to pay for FY2015 General Funds expenses, which masks the growth in spending when comparing total operating costs for FY2015 and FY2014. An analysis of the FY2015 enacted budget published by the Civic Federation earlier this month showed that although year-to-year General Funds expenditures appear to decline on paper by $1.1 billion, the actual cost of the current budget will be $528 million more than the previous year.

According to a supplemental disclosure to the Official Statement that accompanied bonds issued by the State in May 2014, the enacted budget for FY2015 includes total General Funds spending of $35.8 billion compared to a preliminary year-end FY2014 total of $36.8 billion. This appears to be a year-to-year decline of 2.9%. However, as shown in the Civic Federation’s enacted budget report, the FY2014 budget is inflated by a $600 million supplemental appropriation that transferred surplus FY2014 funds to pay for FY2015 Medicaid expenses. This fund shift not only increased the FY2014 budget but also allowed the General Assembly to reduce the enacted FY2015 budget by eliminating a $600 million transfer that would have otherwise been paid for out of FY2015 General Funds resources. The supplemental bond disclosure from the State also discusses the effects of this fund shift.

In addition, $400 million of individual income tax revenues that would have been deposited into General Funds will be diverted to two new funds outside the General Funds and spent on education and human services in FY2015. As discussed here, these new transfers begin in FY2015 and were included in the legislation passed in 2011 that authorized the temporary income tax increases. These transfers are removed from the income tax receipts prior to deposit in the General Funds, then spent outside of the regular operating budget.

After accounting for the fund shifts discussed above, the modified spending associated with the enacted FY2015 budget totals $36.8 billion, an increase of $528 million compared to the modified total in FY2014 of $36.2 billion.

The following chart illustrates the shifting of funds and the adjustments necessary to calculate comparable totals for General Funds expenditures from FY2014 to FY2015.

The increase of $528 million represents only a 1.5% increase in spending. However, the State’s General Funds revenues are projected to decline by $1.7 billion, or 4.6%, to $35.1 billion from $36.8 billion. The enacted FY2015 budget additionally includes borrowing $650 million from other State funds to make up for some of the lost revenue. Interfund borrowing was also included in the Governor’s recommended FY2015 budget.