August 12, 2015

Although the State of Illinois in entering the second month of its new fiscal year without an operating budget, the Governor and General Assembly have agreed on a capital construction budget for fiscal year 2016.

Governor Bruce Rauner issued several line item vetoes to the capital appropriations bill, which primarily reauthorized ongoing spending from the Illinois Jobs Now! program that began in 2010. Following a proposal included in the Governor’s recommended FY2016 capital budget, additional renovations at the State Capitol Complex were eliminated from the bill. In all, the vetoes removed $68.4 million in reappropriated bond funds for the Capitol.

As previously discussed here, the recommended capital budget for FY2016 asked the General Assembly to eliminate the remaining Capitol Complex funding, which included an estimated $250 million in unspent previous appropriations, and allocate those funds to the Governor to be spent on other State owned capital facilities deemed to be more critical priorities. The Governor’s veto message reiterates the request to have the amounts reduced from the Capitol reallocated for critical deferred maintenance.

The legislature passed the capital budget with the remaining spending at the Capitol still intact but did not take action to overturn the Governor’s veto.

Controversy surrounded earlier Capitol renovations paid for with bonds issued as part of Illinois Jobs Now! after media reports surfaced on the extraordinary price for some of the items purchased for the building, including a set of copper doors that cost more than $600,000.

Most of the $65.0 million originally appropriated for the Capitol Building has been spent on historical restoration, building maintenance and replacement of the HVAC system.

The $68.4 million vetoed from the budget for FY2016 did not represent all of the reauthorized projects for the Capitol. The Governor approved $11.4 million mostly earmarked for additional HVAC upgrades and ADA compliance. Also untouched by the Governor’s veto are $1.4 million set aside for landscaping at the Capitol Complex and demolition of a building at 222 S. College Street – a former tavern named Play It Again Sam’s that also housed legislative offices after the business was closed.

The capital budget also authorizes a reappropriation of $51.1 million of an original $100 million for design and reconstruction of the Stratton Building, the offices adjacent to the Capitol that house executive and legislative offices.

Updated totals for all of the projects reapproved and any new projects added to the FY2016 capital budget are not yet available. Typically, the total reappropriations change significantly between the recommended budget and the enacted budget due to the amounts expended between March, when the proposed budget is issued, and June 30 when the fiscal year ends.

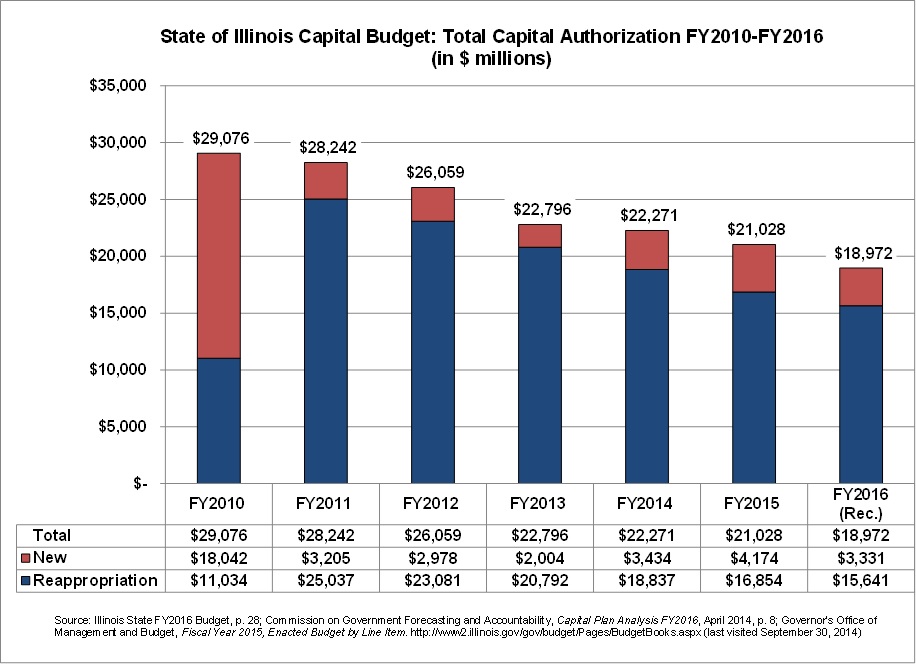

When it was first passed in FY2010 the capital budget authorizing Illinois Jobs Now! included $18.0 billion in new projects added to $11.0 billion of reappropriations from previous years. The Illinois Jobs Now! program is commonly referred to as a $31.0 billion spending plan due to an additional $3.0 billion of new capital spending approved prior to the FY2010 capital budget in the summer of 2009.

Including the proposed new spending in the Governor’s FY2016 capital budget, total new projects added since the initial Illinois Jobs Now! budget was first approved total $19.1 billion. The largest amount of new projects since FY2010 were approved in FY2015 totaling $4.2 billion. Reappropriations increased to $25.0 billion in FY2011 and then declined over the next five years to a total of $15.6 billion in FY2016.

The following chart shows the total capital appropriations approved by the State of Illinois from FY2010 through FY2016.

The State relies heavily on the sale of bonds to fund the capital budget. The original Illinois Jobs Now! capital program included approximately $16.2 billion of bond-funded expenditures.

As of December 31, 2014 the State had issued $11.4 billion in bonds to pay for capital projects since the capital program began. A package of dedicated revenue sources was authorized to pay for the additional debt service related to spending on Illinois Jobs Now! The new taxes and fees consist of the following:

- Statewide legalization and taxation of video poker;

- Expanded sales tax on candy, sweetened beverages and some hygiene products;

- Leasing a portion of state lottery operations;

- Increased per gallon tax on beer, wine and liquor; and

- Increased license and vehicle fees.

The proceeds from these sources are deposited in the Capital Projects Fund and used to pay for debt service on new capital bonds and some ongoing capital expenses. This is intended to limit the General Funds impact of the additional debt sold to pay for the new capital budget.

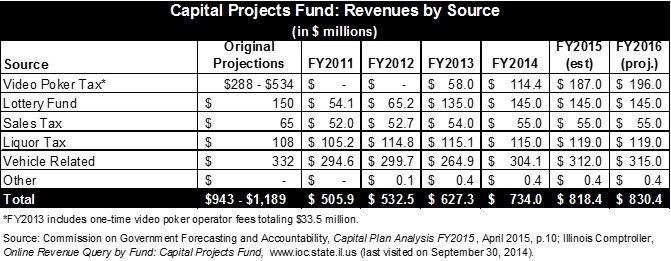

However, the taxes and fees have yet to produce the funding levels projected when Illinois Jobs Now! was originally approved. In FY2016 Capital Projects Fund revenues are projected to total $830.4 million compared to the estimated total of $818.4 million in FY2015. However, the legislative projections provided when the spending was approved in FY2010 anticipated $943 million to $1.2 billion annually.

The following table shows the revenues deposited into the Capital Projects Fund from FY2011 through FY2014, estimated revenues for FY2015 and projected FY2016 amounts. The original legislative projections are also included in the table for comparison.