July 05, 2018

Since Illinois passed its budget for the current fiscal year, many questions have been raised about the $445 million in savings expected from enacted pension changes. What is the basis for the savings estimate and how accurate is it likely to be?

The assumed reductions in State pension contributions are the result of three provisions in the FY2019 budget legislation. The most important is a voluntary buyout plan that offers certain employees who are about to retire upfront cash payments—in exchange for delayed and lower automatic annual increases in their benefits. The plan accounts for $382 million, or 86%, of the total budgeted State pension savings for the fiscal year that began on July 1, 2018.[1]

Public records show that the $382 million figure comes from actuarial reviews of a different pension buyout plan. As a result, it is not clear whether the savings estimate applies to the enacted measure. Even if the savings estimate is relevant, it remains to be seen whether the assumed participation rate of 25% is realistic.

The $382 million savings estimate is based on actuarial reviews of House Bill 5472. The measure has not come up for a vote in the General Assembly, but the actuarial studies were prepared by the pension funds at the legislature’s request in advance of a public hearing last February. There was no public hearing on the enacted pension measure.

Like the enacted buyout plan, House Bill 5472 affects the State’s three largest pension funds: the Teachers’ Retirement System (TRS), State Universities Retirement System (SURS) and State Employees’ Retirement System (SERS). The actuarial reviews were obtained through public records requests to the pension funds and can be accessed from the following links for TRS, SERS and SURS.

The enacted buyout and House Bill 5472 have several similarities. Both apply to Tier 1 pension fund members: employees hired before January 2011 who receive the most generous pension benefits. Upon retirement with full benefits at age 60, Tier 1 members receive automatic compounded annual increases of 3%. More recently hired Tier 2 members, who retire with full benefits at age 67, receive annual increases of 3% or one half the rate of inflation, whichever is less, calculated on a simple-interest basis.

In both buyout plans, retiring members who opt to participate get a lump sum payment equal to 70% of the difference between the present value of their benefits with the current Tier 1 annual increase and with a lower simple interest annual increase starting at age 67. The annual increase in House Bill 5472 is the Tier 2 formula, while the enacted plan provides for a flat, simple 1.5% yearly increase. In both cases, the upfront payments must be deposited into another retirement account to avoid being taxed.

There are other differences. The enacted buyout plan lasts for three years, until June 30, 2021. House Bill 5472 has no set ending date.

Another difference relates to how the upfront payments are funded. The enacted buyout will be financed by selling up to $1 billion in bonds through FY2021.[2] House Bill 5472 does not specify how the payments would be funded; the actuarial analyses for TRS and SERS assumed that the cash for the buyout would come from pension assets, while the SURS study assumed that an unspecified funding source other than pension assets would be used. Bond financing is expected to reduce net State costs because the pension funds’ assumed rates of return on investment of 6.75% to 7% are higher than the expected interest rate paid on the bonds.

In evaluating House Bill 5472, the funds’ actuaries were asked to consider participation rates of 25%, 50% and 75%. The budgeted savings of $382 million were based on a 25% participation rate.[3] The actuaries did not provide their own assessment of how many fund members would choose the buyout or consider the potential cost of adverse selection, in which individuals in poor health choose the buyout while healthy members keep their lifetime pension payments.

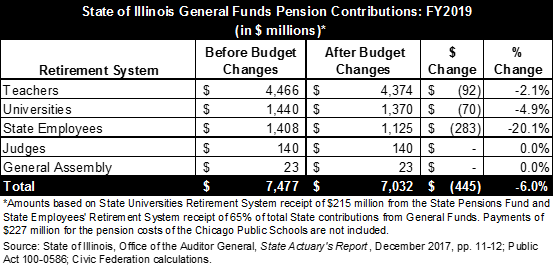

The following table compares FY2019 General Funds pension contributions before and after the changes in the FY2019 budget. The table has contributions to all five State pension funds, including the smaller Judges’ and General Assembly Retirement Systems, which are not affected by the new measures. It should be noted that the savings shown in the table total $445 million rather than $382 million because they reflect all three measures in the FY2019 budget (see footnote 1 for more details).

For reasons that have not been explained by State budget officials, most of the pension savings are expected to come from SERS. Even through the assumed participation rate is the same for all the affected funds, budgeted contributions for SERS were reduced by 20.1%, compared to reductions of 2.1% for TRS and 4.9% for SURS. This mirrors the results of the actuarial reviews of House Bill 5472, which show savings of $279 million, $56.1 million and $46.8 million for SERS, TRS and SURS, respectively.

In all, General Funds pension contributions are estimated to decline by 6.0% from $7.48 billion to $7.03 billion in FY2019 after the budgeted changes. With the assumed savings, pension contributions will account for 18.3% of budgeted General Funds expenditures of $38.51 billion. Total pension costs, including $1.25 billion of debt service payments on previously issued pension bonds, is estimated at $8.28 billion, or 21.5% of General Funds spending.[4]

The budget legislation directs the pension funds to implement the buyout plan “as soon as practical,” so it is not clear when it will take effect. However, the retirement systems will not receive their last monthly payments from the State until their trustees officially recalculate required contribution amounts in light of the newly enacted pension measures.

If the savings fall short of the estimated amount, the State would have to make up the difference due to continuing appropriation requirements, which statutorily authorize spending without any specific action by the General Assembly. Although the assumed savings are small compared with the overall General Funds budget, the budget is already precariously balanced with an operating surplus of $11 million.

The Civic Federation believes that significant changes to pension benefits should not be enacted without detailed actuarial impact studies that are made available to the public. Such actuarial analyses could indicate whether the changes will have the intended budgetary effects and show the long-term effects on the pension funds. Given the uncertainties inherent in actuarial projections, budget officials who are relying on the savings to balance the budget should also outline contingency plans in the event that the assumed savings do not materialize.

[1] Another provision gives inactive employees who have left their State pension-eligible jobs the chance to receive 60% of the current value of their benefits as a lump sum payment. A third shifts additional pension costs due to salary increases above 3% per year—rather than 6% under current law—to school districts, universities and community colleges. These changes are expected to save $41 million and $22 million, respectively.

[2] A portion of the bonds will be used to finance the buyout plan for inactive pension fund members.

[3] The savings estimate of $41 million for the inactive buyout plan is based on a participation rate of 22%, which is reportedly the rate experienced for a similar plan in Missouri.

[4] These numbers do not include $227 million for certain pension costs of the Chicago Public Schools.