June 13, 2017

The State of Illinois has renegotiated the termination thresholds on four of its five interest rate swaps to help avoid termination fees if the State’s credit rating is downgraded further.

After the regular Illinois legislative session closed on May 31, 2017 with no budget being passed by both chambers of the General Assembly, two ratings agencies moved swiftly to downgrade the State. On June 1, both S&P and Moody’s lowered Illinois’ General Obligation bond rating by one notch, to BBB- and Baa3, respectively. Both of these ratings now stand one notch above junk status, and both companies have warned that failure to enact a budget by the end of the fiscal year on June 30 would result in further downgrades.

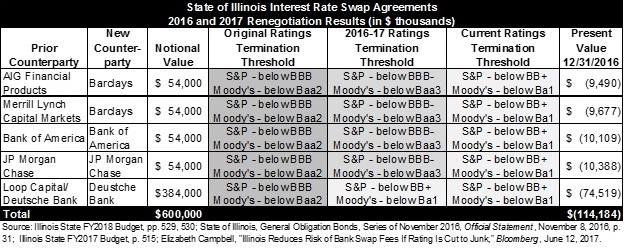

During 2016, due to the State’s deteriorating credit quality, the State entered negotiations with all counterparties. Two of the swaps were transferred to a new counterparty, and all of the swaps were given lower termination thresholds. If these negotiations had not taken place, then all five swaps would have been terminated with the June 1 downgrades.

However, the June 1 downgrades left the state within one notch of termination on four of the five swaps. If terminated, the State would face approximately $38 million in payments to the counterparties. Accordingly, the Governor’s Office of Management and Budget began negotiations with the counterparties. Although the terms of the agreements are not publicly available, the State was successful in lowering the termination thresholds by one notch. Now all swaps have a threshold of below BB+ or Ba1, two notches below current ratings. The following chart summarizes the results of the negotiations during 2016 and June 2017.

The lowered thresholds reduce the risk that the State will have to pay termination fees immediately after the fiscal year if it fails to pass a budget. However, with the thresholds for all swaps now at the same level, the State risks having to pay the market value of all swaps simultaneously if it receives a double downgrade. The Deutsche Bank swap already had a threshold of below BB+/Ba1 prior to this month’s negotiations, and its market value is approximately $70 million.

It remains to be seen whether any of the counterparties would be willing to lower the thresholds further or to negotiate lower or delayed payments by the State in the event of termination. It also remains to be seen whether the State can avoid downgrades by enacting a budget by the end of FY2017.