December 17, 2014

For anyone who wants to understand the pension crisis facing the State of Illinois, a recent report for the State’s largest pension fund would be a good place to start.

The preliminary actuarial valuation report for the Teachers’ Retirement System (TRS) for the fiscal year ended on June 30, 2014 uses relatively plain language and reader-friendly charts to address a complex subject. The report’s new 24-page executive summary describes the pension valuation process and explains how the State’s pension funding policy has shortchanged the retirement system over many years.

TRS, which covers public school teachers outside Chicago, also posted on its website a presentation about the report that was delivered to its Board of Trustees on October 31.

The blunt conclusion to the presentation by Buck Consultants: “By funding based on Illinois Math instead of Actuarial Math, the State has put the retirement security for the 390,000 current and former educators in the State of Illinois at risk. Meaningful funding reform should be implemented now.”

“Illinois Math” is the term used by TRS since 2012 to distinguish Illinois’ pension funding plan from actuarially sound pension funding. In March 2012, the TRS Board determined that the State would not be able to afford the contributions required under the law and that action had to be taken to prevent the fund from becoming insolvent.

Illinois enacted major pension changes in December 2013 that reduced pension payments to retirees and employees and required the State to pay off its pension obligations more quickly and completely than under existing law. Public Act 98-0599 was put on hold pending legal challenges and Sangamon County Circuit Court Judge John Belz ruled in November 2014 that it violated the pension protection clause of the Illinois Constitution. The Illinois Supreme Court recently agreed to the State’s request to expedite the appeal process and is scheduled to hear oral arguments in the case in March 2015.

State contributions to TRS and the four other State-funded retirement systems are currently governed by a 50-year funding plan (Public Act 88-0593) that began in FY1996. After a 15-year phase-in period, the law requires the State to contribute a level percentage of payroll sufficient to bring the retirement systems’ funded ratios to 90% by FY2045.

Illinois’ pension funding has not met minimum financial reporting standards of the Governmental Accounting Standards Board (GASB). The plan and subsequently enacted changes deferred required contributions to later years, leading to significant growth in the unfunded liability (the amount of pension obligations not covered by pension assets).

As previously discussed on this blog, the FY2014 actuarial valuation report showed that TRS’ unfunded liability increased to $57.9 billion at the end of FY2014 from $54.0 billion at the end of FY2013, based on the market value of assets. Its funded ratio (the percentage of liabilities covered by assets) rose to 44.2% from 42.5%.

Since FY2009, State-funded retirement systems have been required to use asset smoothing, in which unexpected gains or losses in any fiscal year are recognized over five fiscal years. Based on asset smoothing, TRS’ unfunded liability increased to $61.6 billion at the end of FY2014 from $55.7 billion at the end of FY2013 and the funded ratio was unchanged at 40.6%. The State’s proposed contribution to TRS rises by $329.8 million, or 9.7%, in FY2016 to $3.7 billion from $3.4 billion in FY2015.

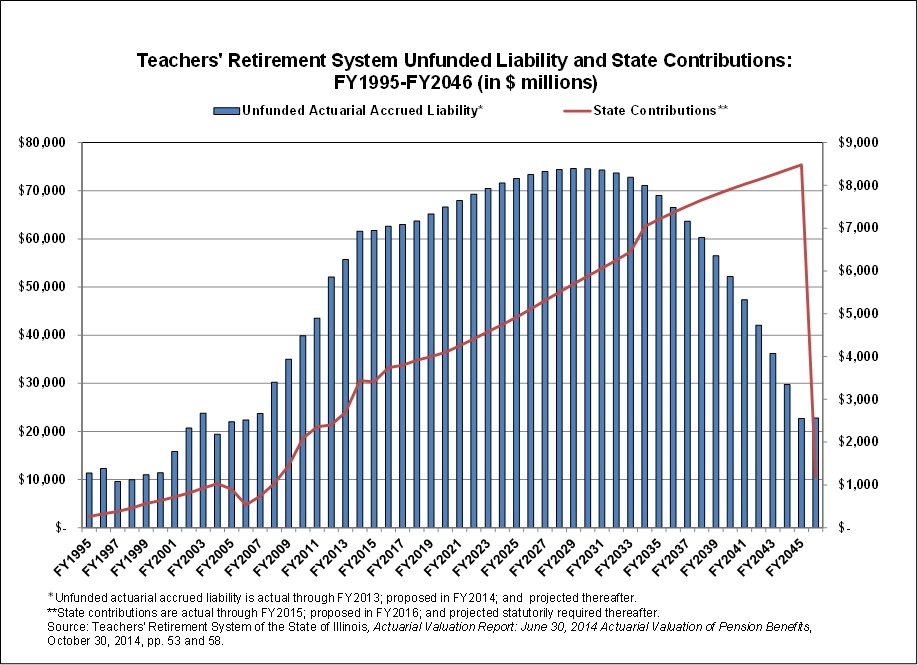

The following chart shows TRS’ unfunded actuarial accrued liability and State contributions from FY1995 to FY2046 based on the 50-year funding plan. The chart includes actual contributions through FY2015, the proposed contribution for FY2016 and projected statutorily required contributions thereafter. Under the current funding plan, the unfunded liability does not begin to decline until FY2030. The required State contribution for TRS alone is projected to rise to $8.5 billion in FY2045 and then decline dramatically after the target of 90% funding is achieved.

The proposed State contribution increases to $3.7 billion in FY2016 from $3.4 billion in FY2015 mainly because of a reduction from 8.0% to 7.5% in the fund’s assumed investment rate of return. The assumed rate of return is used to discount the present value of future benefit payments. Reducing the discount rate increases the present value of pension obligations and requires higher State pension contributions to compensate for lower investment returns. Before the investment rate of return was lowered, the FY2016 contribution was projected at $3.5 billion.

Actual investment returns were strong in FY2014 at more than 17%. However, the unfunded liability continued to grow because of the insufficient contributions required by State law and reductions in the assumed investment rate of return.

Tier 2 employees are paying more than the full cost of their benefits, effectively subsidizing the State by helping to pay down the unfunded liability, according to the TRS report. Tier 2 employees, hired on or after January 1, 2011, receive significantly lower pension benefits upon retirement under a law passed in April 2010 than Tier 1 employees, who were hired prior to that time.

Through FY2045, Tier 2 employees are projected to contribute $26.2 billion to fund their own benefits and $6.9 billion to pay for the unfunded liability. Tier 1 employees are projected to contribute $19.8 billion during the same period, all of which will be used to fund their own benefits.

The TRS report also includes information required by new financial reporting standards for public pension funds effective for fiscal years beginning after June 15, 2013. Among other changes, GASB Statement No. 67 requires a blended discount rate that was expected to be lower than the current rates used by substantially underfunded retirement systems like TRS.

For reporting purposes, the new standard allows the use of the assumed investment rate of return for years in which projected benefit payments are covered by net assets. When projections show that net assets will not cover benefit payments, the discount rate must be based on a high-grade municipal borrowing rate.

Because of strong investment returns in FY2014, TRS—like many other pension funds—did not have to use a lower discount rate under the new GASB standards. At the Board meeting in October, however, a TRS actuary warned trustees that a reduced rate could be required for the FY2015 valuation, depending on investment results.

Under the new GASB standard, the net pension liability (which is similar to the concept of unfunded actuarial accrued liability) is $60.9 billion at the end of FY2014. GASB 67 also requires a “sensitivity” projection, showing the impact of a one percentage point increase or decrease in the discount rate. An increase in the discount rate to 8.5% from 7.5% would reduce the net pension liability to $49.0 billion from $60.9 billion, while a decrease to 6.5% would increase the net pension liability to $75.2 billion.