March 23, 2015

The most recent legislative analysis of the State of Illinois’ annual revenues provides little hope for additional gains from economic growth to help solve the State’s ongoing budget crisis. This is in contrast to the last several budget years when the State has experienced revenue growth during the fiscal year that allowed for supplemental appropriations to plug budget holes and pay down bills.

The latest indications for FY2015 from the legislature’s joint fiscal research commission show the State ending the year far below the estimates used to develop the current budget.

Earlier this month, the Commission on Government Forecasting and Accountability (COGFA) published its annual economic forecast and revenue updates. The report includes an overview of the trends in the State’s economy and revenue updates for FY2015 based on year-to-date results as well as estimates for FY2016.

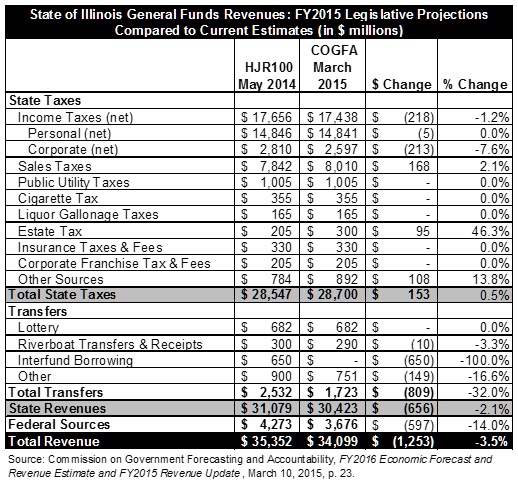

COGFA’s analysis shows projected General Fund revenues for FY2015 total $1.3 billion less than the estimates in House Joint Resolution 100, which was passed as the basis for spending in the current budget.

In both FY2014 and FY2013 the State was able to spend about $1.0 billion of additional revenue in the final months of the fiscal year due to resources exceeding the originally approved expenditures.

As discussed here, at the end of FY2014 the State approved supplemental appropriations of $974 million due to revenues exceeding the amount appropriated in the original FY2014 budget. However, $600 million of that appropriation was used to prop up the FY2015 budget. The remaining amounts were used for other FY2014 costs.

In FY2013 the State used an unexpected surge of income tax revenues totaling $1.2 billion to pay down a large portion of its backlog of bills.

According to the COGFA report, total General Funds revenues for FY2015 are expected to decline to $34.1 billion from the enacted estimate of $35.4 billion. The lower revenue highlights the difficulties the State faces in closing the current year budget gap estimated at $1.6 billion by Governor Bruce Rauner.

The following table shows the General Funds revenue estimates in House Joint Resolution 100, compared to the most recent estimates from COGFA for FY2015.

The largest portion of the FY2015 revenue shortfall comes from Governor Bruce Rauner’s decision to forgo $650 million of interfund borrowing originally included in the FY2015 revenues. Interfund borrowing was one of the stop-gap measures passed as part of the FY2015 budget rather than addressing the income tax revenue decline from the reduction of rates that took place halfway through the fiscal year.

A bill has been introduced to allow for fund sweeps totaling $580 million to replace some of the interfund borrowing. It has been reported that the measure may be amended to allow for up to $1 billion in sweeps but the changes have not been formally introduced.

Fund sweeps allow balances from the State’s Special Funds to be transferred to the State’s General Funds to pay for operations. Unlike interfund borrowing, fund sweeps do not have to be repaid within 18 months.

The second largest revenue reduction in the COGFA report is the expectation that federal revenues will be at least $597 million less than originally projected. According to COGFA federal revenues are down due a focus on reimbursable Medicaid spending outside the General Funds and lower overall liabilities of the Medicaid program.

Income taxes are also down by a combined net total of $218 million. This is led by an underperformance of corporate income tax revenues that are currently $220 million under the year-to-date estimates but are expected to meet expectations for the remainder of the year.

The Governor and General Assembly have yet to publicly agree on a full plan for fixing the FY2015 budget.

Much of the budget negotiations for FY2016 will depend on reconciliation of the FY2015 budget. The COGFA report shows that in FY2016 the State faces the loss of an additional $2.0 billion in General Funds revenues that are expected to total $32.1 billion as the State absorbs the impact of the first full year of the lower income tax rates that began halfway through FY2015.